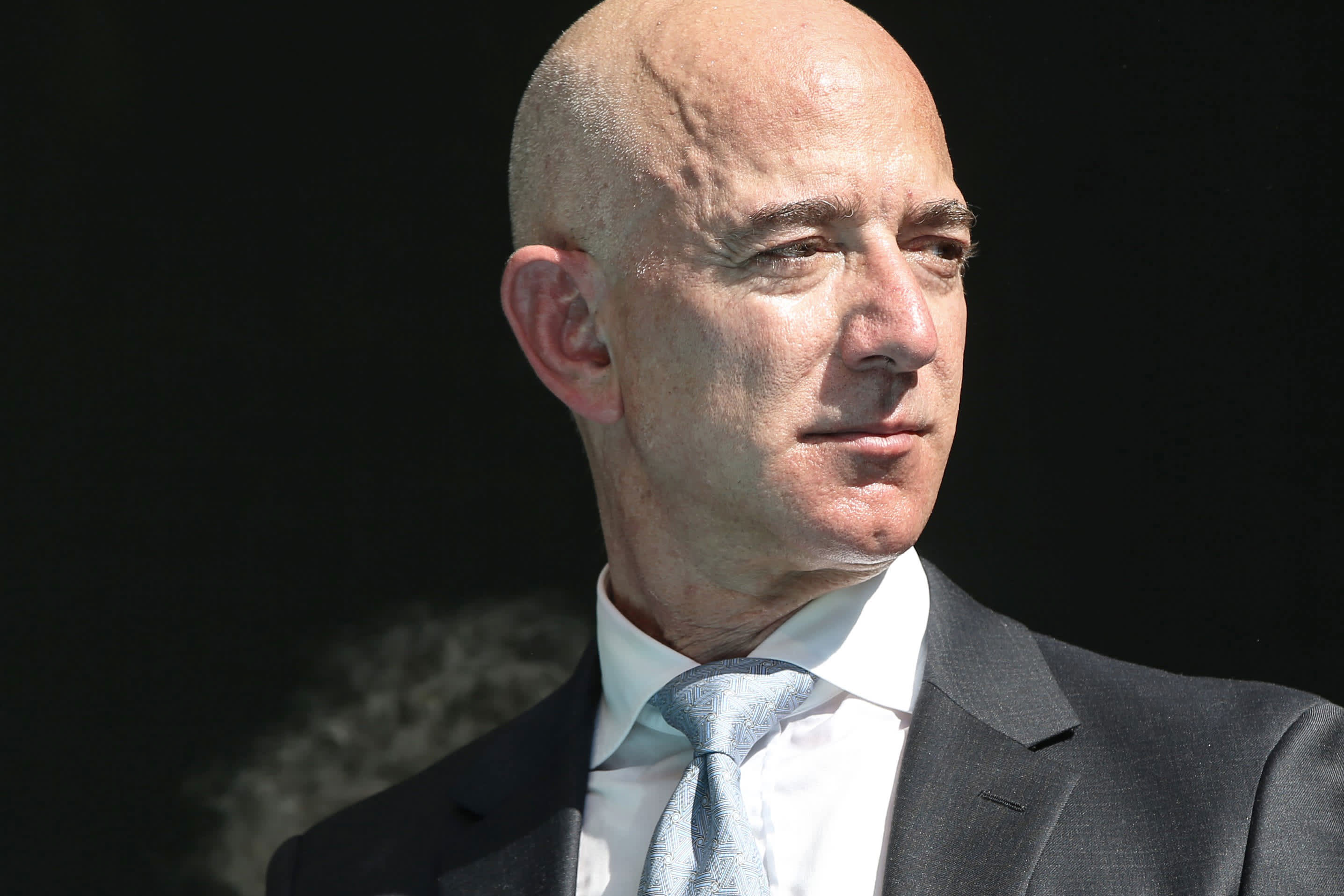

Amazon CEO Jeff Bezos on October 2, 2019.

Elif Ozturk | Anadolu Agency | fake pictures

Amazon CEO Jeff Bezos will finally come face to face with lawmakers seeking to question his company’s growing influence on Wednesday’s antitrust hearing.

The hearing before the House of Representatives’ Antimonopoly Subcommittee, which will be held via videoconference due to the coronavirus pandemic, will provide lawmakers with a rare opportunity to question the Amazon CEO directly about the market power and business practices of Amazon, along with other hot topics, such as its treatment of warehouse workers during the pandemic.

Apple, Google and Facebook CEOs, who will also appear on Wednesday, have previously attempted to make proposals with politicians who have questioned the power or policies of their companies, either by appearing on The Hill or, in the case of the Apple CEO, Tim Cook. , finding common ground with President Trump.

But Amazon has mainly featured other top executives in past antitrust hearings with lawmakers, allowing Bezos to stay away from the fray. Dave Clark, Amazon’s senior vice president of retail operations, Jeff Wilke, CEO of Amazon’s consumer business, and Jay Carney, Amazon’s chief spokesman and former press secretary to President Barack Obama, have exchanged comments with critics of the company. in press interviews and on Twitter. .

Meanwhile, President Trump, angered by critical reports from the Bezos-owned Washington Post, has repeatedly criticized the company, accusing it of everything from evading local taxes to unfairly exploiting the U.S. Postal Service. The conflict reached a new spike in January, when Amazon filed a formal complaint about the Department of Defense decision to award a $ 10 billion cloud computing contract to rival Microsoft. Amazon Web Services chief Andy Jassy told CNBC’s Jon Fortt at the time: “When you have a sitting president who is willing to be very vocal that they don’t like a company and the CEO of that company It makes it difficult for government agencies, including the Department of Defense, to make objective decisions without fear of retaliation. “

Wednesday’s hearing will mark Bezos’ first appearance before Congress. But he has been steadily increasing his presence in the nation’s capital for years.

After purchasing the Post in 2013, Bezos purchased a $ 23 million mansion in the Kalorama neighborhood of DC. Within a few years, Amazon selected the National Landing neighborhood of the Washington suburb of Arlington, Virginia, as the location of its second headquarters, HQ2. Amazon remains one of the top lobbyists among tech companies and has grown its public policy team in recent years.

Lawmakers pursue “easy goal”

Wednesday’s hearing is likely to draw new attention to the antitrust scrutiny surrounding Amazon, but people familiar with the company’s business practices remain skeptical about whether lawmakers will ask the right questions.

Amazon faces polls by the Federal Trade Commission, the Justice Department and state attorneys general, as well as possible antitrust charges in the EU for its treatment of third-party sellers, The Wall Street Journal reported in June.

Amazon’s relationships with third-party sellers have become a main topic of research. These sellers sell their products on the Amazon market, which represents more than half of the company’s annual revenue, and some have complained about inconsistent policies and unclear communication from the company over the years.

A WSJ report earlier this year found that Amazon employees used ungrouped or easily identifiable data from outside vendors to build their own competing products, and the House Antitrust Subcommittee pressured Amazon to get answers on the data it collects. from third-party vendor transactions, what Employees have access to transaction data, as well as how they determine who wins each sale and at what price.

The report’s findings appear to contradict the testimony given by Amazon general counsel Nate Sutton during a hearing in July 2019. Sutton said Amazon does not use data from third-party vendors to help develop its private-label products, but that it does analyze aggregated data. of the merchants

House of Representatives antitrust subcommittee chairman David Cicilline said the report raised suspicions that Amazon may have lied to the committee. The committee then asked Bezos to testify to address the matter.

Jason Boyce, a former Amazon seller who is now a third-party merchant consultant, says he experienced first-hand some of the strategies that regulators are now examining. Boyce said he began to question whether data from Amazon third-party sellers was being analyzed by other teams as early as 2007, according to information he obtained from meetings with Amazon executives. About a decade later, his concerns became more personal when Amazon released a private-label bocce ball set that looked surprisingly similar to his own, right down to the Boyce brand “unique color scheme.”

It is not uncommon for supermarkets and department stores to develop their own brands and promote them to customers. Additionally, Amazon says its private label products account for about 1% of its sales.

Boyce said Bezos will reach out to the audience prepared with statistics like these to try to downplay the importance of Amazon’s private label products on the platform, as well as concerns that they will be given preferential treatment over third-party products in the search and advertising ranking.

“Bezos will follow Amazon’s standard party line,” Boyce said. “They like to focus on the numerator rather than the denominator, in terms of where they are or what they are doing in the market.”

The ads and the ‘shopping box’

The more complicated issues affecting third-party vendors are likely to go unnoticed during Wednesday’s hearing, given time constraints and the fact that lawmakers may not have all the expertise necessary to understand all the nuances of certain technologies used in the market, Boyce said. For example, he said lawmakers may not know how to ask about the algorithms that power Amazon’s “shopping box,” which offers customers a one-click button to add a listed product to their shopping cart or buy it. It is a major sales driver, but not all third-party merchants qualify to get the box on their listings.

James Thomson, a former Amazon manager and now a partner at Buy Box Experts, said Amazon’s private label business is an “easy target” for lawmakers, but other problems, such as using Amazon’s customer data to guide Ads should be considered as well.

Thomson said that the targeted ads on Amazon have made it look like a “virtual grocery store, where only aisles are shown where you’ve shopped for products.” He admitted that it is not clear if this access to detailed customer data gives Amazon an advantage over other sellers in the market.

Still, he said, “It would be interesting to learn more about what Amazon’s proprietary marketing is that it provides itself, but does not provide anyone else, in terms of space, data access, email campaigns, ad placement. unpaid. “

Melissa Burdick, a 10-year-old Amazon veteran who now runs an Amazon ad buying technology provider, reiterated that researchers should not overlook Amazon’s advertising practices. “Amazon has become a payment platform because the game must appear on the first page of search results,” she added.

The House of Representatives antitrust subcommittee questioned Amazon last October about placing ads on the site, asking if its algorithms favor third-party merchants who have bought ads and other services, whether its private label business pays for ads. sponsored and if you make advertising space above the buy box available to third party sellers.

In its responses, Amazon said it does not reserve advertising space for private labels, adding that “it depends on many variables,” such as what buyers are looking for and the device they are browsing.

“Manufacturers will never publicly say they are upset with Amazon, but when Amazon suggests a private label product as a cheaper product, I think these are the questions,” Burdick said. “I think he’s looking at what’s fair and then making some consistent, standardized rules around him.”

.