Welcome to the oil extraction edition of Oil Markets Daily!

Back in March / April when the Saudis declared a world oil price war, analysts and pundits began predicting how global oil inventories would reach tank tops. The reason was that, if demand dropped by ~ 30 mb / d and Saudi Arabia did not cut production, the stockpile would be full by May, and as a result, global oil prices would go to negative. Landlock and early trade of expulsions drove WTI to negative, but this never happened to Brent. Fast forward to today, oil stocks never came close to peak capacity, and we are about ~ 400 million bbls above the norm.

So, why think consensus again in a vacuum?

This time it has to do with the oil price forecast. For the sellside analysts, Goldman Sachs, Morgan Stanley, and others like HSBC have forecast oil price forecasts of $ 50 to $ 60 / bbl for 2021. Others like Energy Aspects (to their credit) turned their forecast back after prices went up gone) have price forecasts of $ 66 / bbl for 2021.

Of course, their forecasts are gradually increasing by $ 5 to $ 10 per year to reflect some sort of linear progress in recovery in oil prices.

History tells us that oil prices rarely return linearly. It is more than a bazooka on the way and a waterfall on the way. Linear oil price forecast is the same as trying to measure something with your fingers, it never works, and it will never work.

Instead, we ask readers to use a little imagination in the realm of oil price forecasting. Important questions to ask are:

- What are the drivers of global oil prices?

- What will happen to these drivers in the coming years?

For us, we think the No. 1 driver of global oil prices will be how U.S. shale oil responds to higher oil prices. We say this because the market is only looking to the US for any future supply growth. Although OPEC + has additional capacity today, it is limited and will only provide a safety net in the short term.

Instead, oil market will demand the price needed for US shale to pick up growth until demand completes. That, in our opinion, is the number one driver of global oil prices, and nothing else comes close.

For example, in today’s pandemic market environment, the market plays it safe by limiting all possible US shale responses to higher oil prices. By keeping prices at $ 40 / bbl, it has guaranteed low activity levels, while at the same time ensuring that stocks do not fall further through shut-ins.

This brings us to the topic we want to hammer in today’s article, and that is the misunderstanding of the US-scale consensus that emerges from this crisis. As a member of the board of an energy company, it has given me valuable insight into how operators think, make decisions and how they will respond to higher prices in the future. Even the board of an energy company also gave me great insight back in March that U.S. and Canadian oil production will fall off a cliff, thanks to shut-ins.

I think the information I get as an insider is what gives me so much more confidence this time around about how I think about US shale.

With all that said, U.S. oil production is responding exactly in line with how we think about the developments so far.

Source: EIA, HFI Research

After the collapse in May, US oil production shutdowns are back. But all this recovery is already high point. Despite producers reacting with the return of almost all final production in August, the associated gas production remains a lower trend.

This indicates to us that underlying decline is substantially more than one expects.

In fact, based on conversations I’ve had with other producers over the last few weeks, August is likely to be peak production before production falls slightly more into the year.

Our calculation that American shale loses about ~ 250k b / d per month was correct. In the last 5 months of inactivity, US shale has lost about ~ 1.25 mb / d of production. Some of the wells returning from encapsulation see an increase in initial production only to become tapered. This brings the production capacity of US shale oil close to ~ 11.1 mb / d today.

Now, for every month US shale producers do not respond with some kind of activity shift, we would set the declines from the basin at ~ 200k b / d to ~ 250k b / d. The decay rate is lower as the overall basic production rate decreases.

The key indicator we are looking at is the frac spread count, which tells us exactly how driving scaling activity is at the moment.

And with the frac spread at a stupid 76, the decline will continue unabated. We should count a V-shaped recovery time in frac spread back to 275 to prevent the decline coming forward.

By our calculation, US oil production will probably now drop to 10.7 mb / d by the end of the year against the old estimate of 11.1 mb / d.

Source: EIA, HFI Research

While this revision may not seem like much, keep in mind that an oil market with 400k b / d more deficit results in 146 million bbls less of oil produced in a year.

And if US oil production decline is confirmed by consensus, what will happen is that the market will push oil prices higher to see how US scales react. Based on our conversations and estimates about production cash flows, we will not see any activity response up to $ 60 + WTI. Manufacturers will start using too much FCF to pay for damaged balance points and build up cash reserves.

One lesson that many manufacturers are learning the hard way in this cycle is that banks no longer support E&P companies in general. Cash is king, and the idea that credit facilities serve as some sort of liquidity metric has been thrown out the window.

This means that not only does debt have to go down this time, but cash reserves have to go up.

In addition, it is not just the management teams that are starting to think this way. The Board of Directors is also whispered by the talks with the creditors during this pandemic. Many financial institutions took advantage of this pandemic by increasing the fees for the credit facilities by 200% to 300%. Many board members have already complained about how punitive the creditors are, and because beggars cannot be voters, they have no choice but to suck up the higher fees.

All of these expenditures contribute to the idea that many E & Ps want to run their businesses without moving forward. The idea that having a prudent balance is no longer the case and manufacturers now want to operate with no debt and especially no reserved based credit facilities.

Now consider that almost all E&Ps with mid-cap reserved reserved lending facilities have reserved, and you soon realize just how much more cautious producers will be when higher oil prices return.

As a result, the muted reaction will be a shocking revelation to the market. The market will then have to keep oil prices higher to see exactly where US shale producers begin to react again. Will it be $ 70? Will it be $ 80?

And our assumption is that it will be closer to $ 70.

Now that we’ve explained why the consensus linear extrapolation will not work, let’s dive deeper into the real bull thesis.

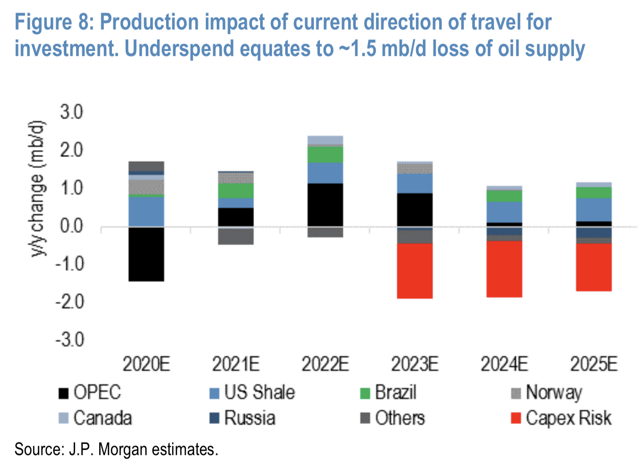

We have explained that the number 1 driver of oil prices will be US shale production. Markets will first want to test the US shale’s response to higher oil prices before giving it the benefit of the doubt. But a larger force is creeping up, and those are the non-OPEC conventional declines.

Outside Norway, Canada, the US, and Brazil, global oil production has been flat and declining over the last several years.

And because of COVID-19, capex cuts are rivaling again on that of 2016, which was the last time we saw a massive exodus of capital. The difference this time is that private equity is not on the verge of waiting to put capital back into the market.

And these charts are another reason why linear extrapolation does not work. If the market sees the incoming shortage, oil prices will not go up just to reflect the shortage, but it will rise to the point of destroying demand while stimulating supply at the same time. Well, this brings us to the ESG issue, and with global banks and investors wiping out the energy sector, exactly where will this stream of capital come from? Oil majors are already declaring that they want to be carbon neutral by 2035 as some sort, so will they really spend more money trying to increase production? Is the peak oil supply thread the inherent catalyst for peak oil supply?

These scenarios only guarantee that there will be no future linear extrapolation on the market. Prices will rise parabolically higher to reflect the changing landscapes, and because of the climate focus and investors doubling energy as a whole, prices would have to do all the heavy lifting for the wrong consensus sentiment.

And because this is a scenario we are considering, it is also not too far-fetched to say that we think oil prices could break the previous high by 2022 (seeing the cap and supply cliff on the horizon).

Conclusion

Linear extrapolation in the oil market has never worked. Because US shale response this time around is much more dampened at higher oil prices, the market will push the upper limit. All the while, an intense focus on ESG and investors / banks losing energy will ensure that the capex deficit continues. All of this simply means that oil prices must continue to push up demand or stimulate more supply. By this time, the market will not move linearly, it will move parabolically.

We are now definitely entering the bulging phase of the energy stock rally. With valuations still completely disconnected with oil brand foundations, we think investors should be positioned to take advantage of the oil bull market. We are now offering a free 2 week trial and if you would like to read our WCTWs this week, please see here.

Announcement: I / we have no positions in named shares, and no plans to initiate positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I do not receive compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose supply is mentioned in this article.