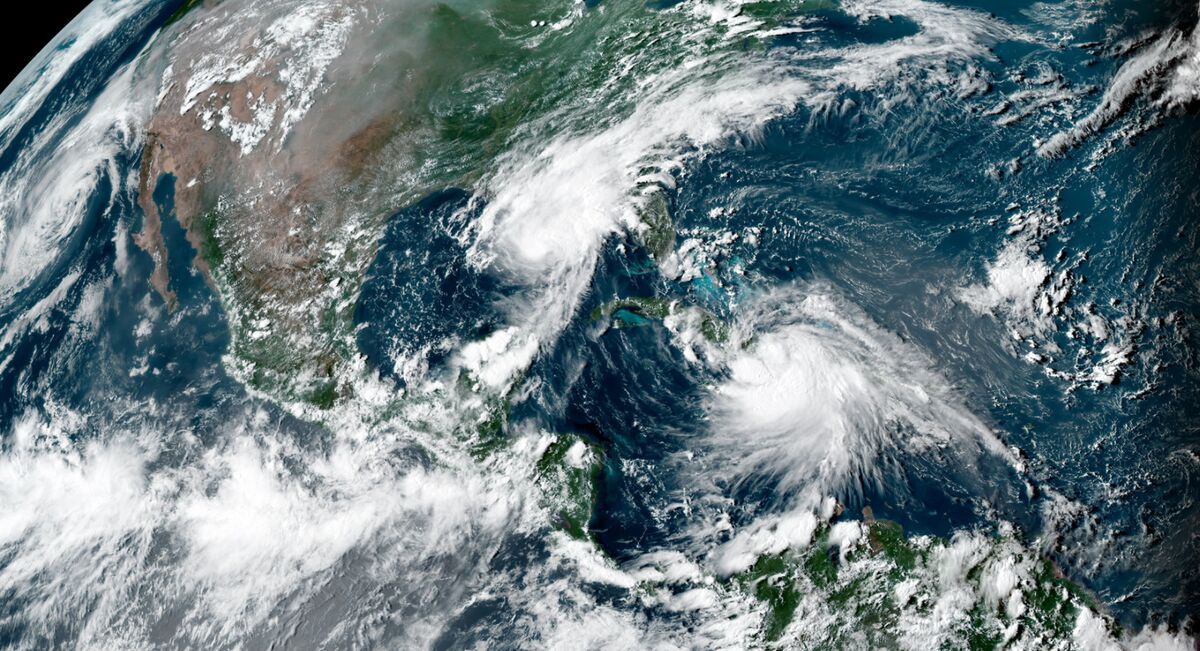

Tropical Storm Marco, left, and Laura on August 23rd.

Oil edge higher when production was disrupted by two storms approaching the U.S. Gulf Coast.

Futures rose 0.8% in New York. Nearly 58% of raw output, or more than 1 million barrels per day, in the Gulf of Mexico was closed by noon Sunday. The storms Marco and Laura – the last of which is predicted to become a hurricane – come from different directions and have the potential to cause billions of dollars in damage. The weather systems could force refineries to close and also raised the question of when they would land.

Raw, and other risk assets included shares, received an impetus on Monday amid a thief in US-China relations. President Donald Trump’s team was said to be privately seeking to trust American companies that they could still do business with the WeChat messaging app in China.

US benchmark crude futures are emerging – albeit very slowly – this month amid a slow decline in domestic crude and gasoline inventories, and tentative signs that demand is returning. That starts to stimulate the return of production, however, with drillers in the Permian Basin placing an extra 10 lines to work last week for the biggest jump in activity this year.

“The situation on the oil market in the next three days is likely to be determined in part by news from the Gulf of Mexico,” said Eugen Weinberg, head of commodities research at Commerzbank AG. “The psychological effect should not be underestimated,” Weinberg said of the impact of the two storms on refining activity and oil production in the US.

| Prices |

|---|

|

The shape of the oil-futures curve has suggested that concerns about oversupply have grown over the past week. On Friday, Brent futures traded for October on its biggest discount on the November contract since May, a structure known as contango. Speculators have also turned less Bullish on WTI, last week trimming their bet to the lowest since May.

| Other market drivers |

|---|

|

– With the help of James Thornhill

.