[ad_1]

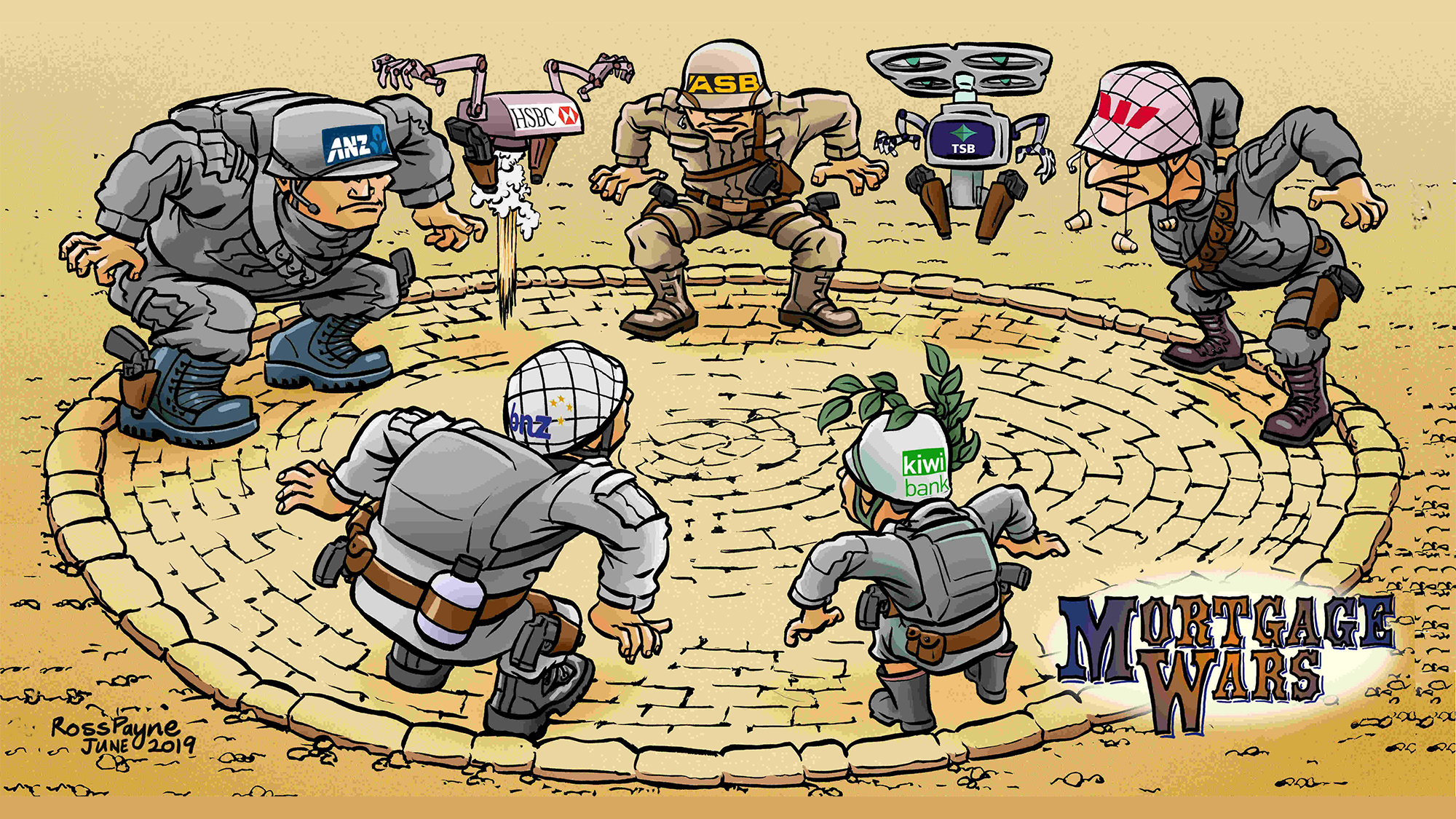

Now Westpac has announced a 2.99% rate for a fixed two-year ‘special’ home loan rate.

That coincides with ASB for a period of two years.

But Westpac has established a competitive position for fixed-term rates that are longer than two years, with the lowest fixed rates of any major bank for all terms up to five years.

In fact, Westpac’s five-year rate is massive -126 bps lower than the equivalent ANZ rate. And it’s -30bp lower than its closest rivals ASB and BNZ for a period of five years.

The Cooperative Bank has also adjusted today, and they have concentrated their fire on the short end. In fact, its new 6-month fixed rate of 3.09% is the market leader for this term. Borrowers who have decided that there are more reductions ahead may think that a six-month fixed rate right now is a good idea. The 2020 spring ‘specials’ may come as the most competitive market conditions emerge as real estate markets attempt their usual seasonal rebound, and the full effects of the acute phase of the economic crisis are evident (but, for Of course, new tribulations could also appear. The future is never resolved.)

Tuesday’s changes skyrocketed after Monday’s ANZ (2.99%) and TSB (2.89%) cuts, reactions in themselves to ASB and Kiwibank, who led the latest dip in the home loan rate.

Only BNZ has yet to launch a response in this round, even if it started at a competitive rate of 3.05% for 18 months, a level that now seems normal.

Of course, these top bank cuts are not the first banks to go below the 3% benchmark.

HSBC already offers rates as low as 2.95%. Heartland Bank offers a rate of 2.89%. And China Construction Bank has the lowest of all, at 2.80%.

All banks are reporting reduced net interest margins (NIMs) and with the cuts to the term deposit rate, banks show that they take margin protection seriously, and that savers are the group that pays the price for low interest rates from homeowners.

Despite the lower fixed rate offerings, there is still no suggestion from any bank that floating rates will be lowered, and it is floating rates that are the basis for SME loans. These borrowers go unnoticed.

The world is changing fast and now we need your support more than ever. Quality journalism is expensive and in these difficult times our advertising revenues are becoming very uncertain. We provide our free coverage to readers, and if you value that, we ask that you Become a supporter. The level of their support is up to you. Thank you. (If you are already a Supporter, you are a hero).

Wholesale exchange rates have fallen dramatically in the blockade, although the last daily shifts have seen the withdrawal end and a kind of floor has been found. See the pictures here.

Here’s the full snapshot of the lowest fixed-term fees offered at the major retail banks.

In addition to the table above, BNZ has a seven-year fixed single rate of 5.20%.