[ad_1]

There will be little change but a lot to discuss when the Reserve Bank publishes its latest monetary policy review on Wednesday (September 23).

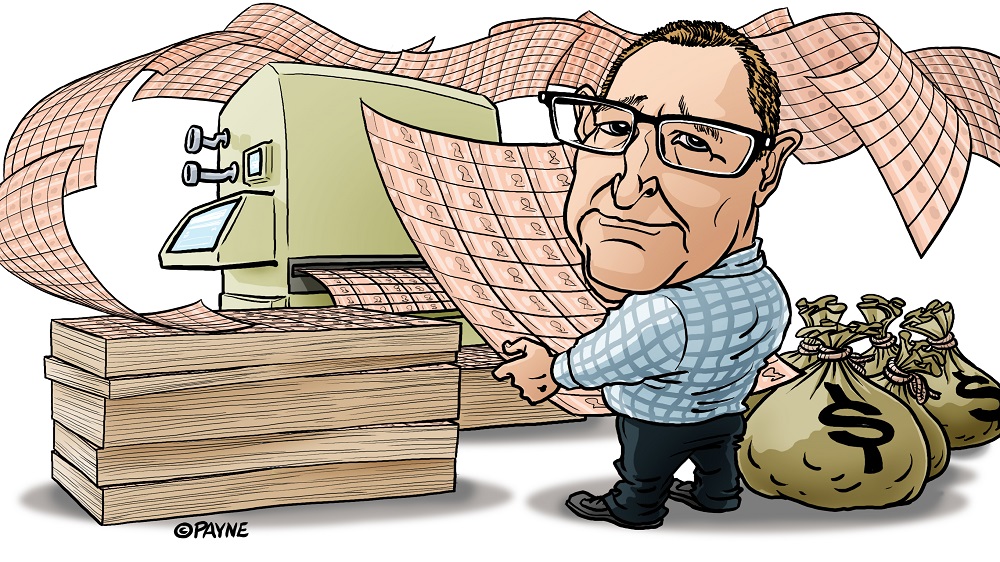

In its previous review on August 12 the RBNZ did a significant amount of heavy lifting; raise the size of its QE (money printing) program to $ 100 billion and more clearly signal a move next year toward negative interest rates. The August review was accompanied by a full Monetary Policy Statement. The central bank has shown a preference for making major policy changes during a review of the MPS, so that the reasons for the moves can be fully explained and described.

So with so much done in the review above, that leaves Wednesday’s statement as more than likely a ‘placeholder’, a reiteration of the key messages and overall direction. Although, having said that, it is fair to say that under this Governor, Adrian ‘shock and’ Orr, the RBNZ has tended to err on the side of adventure with its movements and statements.

It will be of great interest to the markets if there is any apparent evolution in this statement on thinking about negative interest rates. On August 12, Orr said the bank’s Monetary Policy Committee had expressed a preference for considering a package of a negative Official Cash Rate (OCR) and a ‘Loan Financing Program’ (FLP) in addition to the current Purchase Large Scale Assets (LSAP). program (QE). The Committee had tasked staff with preparing advice on designing a package for deployment if deemed necessary, taking into account the operational readiness of the financial system.

The RBNZ broke the OCR to a new all-time low of just 0.25% (from 1%) in March when the Covid crisis struck in earnest. At that time, the central bank promised to keep OCR at 0.25% for 12 months, that is, until next March. But with the RBNZ having consistently since not ruled out negative rates, and with the August statement saying so implicitly that the RBNZ was now bracing for negative rates, markets have been abuzz with speculation that the OCR decline will come sooner. .

ASB Senior Economist Mike Jones, in a preview of this week’s RBNZ review, said the key for market watchers will be whether the RBNZ sticks to its future guidance that OCR will be left where it is until March next year.

“The guidance was reiterated again in August: ‘the Official Cash Rate (OCR) remains at 0.25% according to the guidance issued on March 16.’ We expect this line to hold overall, Jones said.

The markets are playing with the idea

“But the risk, if there is one, is that the guidance could soften a bit. Markets are already toying with the idea. The price is now consistent with a better probability that even OCR will drop to zero in February (18 bp Any weakening in the Bank’s future direction would cause markets to move towards front-load OCR cuts even more, “he said.

Jones said the RBNZ was now busy consulting, researching and designing alternative monetary policy tools.

“Banks have been instructed to be prepared for negative OCR before the end of the year. If all this work yields a toolkit that is effective and operational, and there is no material improvement in the economic outlook, there is a possibility for the Bank to adopt additional policy easing measures before March next year. In other words, we think the market is right to assess the possibility of earlier easing.

“Adding to the possibility of an earlier move is the fact that the OCR announcement dates have changed, and the next OCR announcement scheduled after February MPS (February 24) will not arrive until April 14. In communications In recent times, the RBNZ has explicitly linked the prospect of negative OCR to a Loan Financing Program (FLP) that would cause the RBNZ to directly finance banks at the prevailing OCR rate. We remain of the view that a scheme FLP should be implemented before March. The timely success of such a plan is based in part on banks having a long enough lead time to include such a program in their financing plans. “

‘Slightly uncomfortable’

ANZ chief economist Sharon Zollner has a somewhat different take on the debate. She notes that the 12-month window that the RBNZ gave itself at the OCR is “a bit awkward,” as the compromise was made at an emergency MPC meeting between official review times.

“The [12 month] the deadline falls between a Monetary Policy Statement on February 24 and a Monetary Policy Review in mid-April, “he said.

“The market has therefore started to ponder whether ‘close enough’ could be ‘good enough’, putting February on the line, despite frequent reiteration of its guidance by the Reserve Bank of New Zealand.

“In a macroeconomic sense, a few weeks are neither here nor there. However, in a strategic sense, it matters. The RBNZ will be concerned that breaching its word, no matter how trivial, would undermine the power of future guidance in The future. As the recovery unfolds, convincing the market that they will not raise OCR for a period if hell or higher inflation will be important in keeping long-term interest rates low. The RBNZ has taken an approach of “The least they regret” in policymaking in recent years. Sometimes, we think they will come to the conclusion that they would regret damaging their credibility more than they would regret a few weeks of delay. “

‘Unyielding in need …’

But offering another perspective again are the Kiwibank economists, who said the RBNZ appears “inflexible in its need to go negative”, even if they made early and effective use of the FLP.

“We believe the RBNZ has seen enough to justify taking such a risk. Although we disagree, the RBNZ is likely to take the cash rate negative next year,” they said.

Kiwibank economists believe that if a central bank is to execute a negative interest rate strategy “it must be done with some bragging.”

“A cut of 75 bp [of the OCR] -0.5% is expected in February, and more likely than in April (or May), in our opinion. “

Westpac chief economist Dominick Stephens said he expected the RBNZ to simply state that design work on a negative interest rate package and FLP is ongoing.

‘There are tools …’

“The RBNZ will reiterate that if the economic situation warrants it, there are tools with which it could ease monetary policy. But there will be no signs that these tools are about to be implemented. As early as March, the RBNZ committed to maintaining OCR without changes. to 0.25% for one year; we strongly expect the Reserve Bank of New Zealand to issue a reminder of that commitment … “.

Stephens noted that the RBNZ’s new MPC structure for making monetary policy decisions has been in place for a year and a half, “and some clear patterns have emerged.”

“The MPC has a predilection for making big bold changes in monetary policy, less frequently. The gradual approach is not favored. When the need for a change in monetary policy has been identified, the MPC has tended to anticipate all change in a single big move (this is in contrast to previous RBNZ governors, who tended to partially move and point out that there was more to come.) Given that one big bold change was made to the August MPS, it seems less likely that the MPC will make another change now. “

Stephens said another pattern is that the MPC has never changed monetary policy in a review without a Monetary Policy Statement.

“Monetary policy has been altered in four of the six Monetary Policy Statements decided by the MPC, and there were two unscheduled changes during the most dramatic days of the Covid-19 epidemic. But of the four OCR reviews o [Monetary Policy Reviews], one was canceled and the other three have not presented changes in monetary policy. This makes a change in monetary policy next week seem even more unlikely.

‘No need to loosen’

“Finally, the recent period of increased [economic] The data means that the RBNZ will see no need for further easing of monetary policy at this stage. In normal times, a stronger data period could lead to a tightening of monetary policy, or at least a change in communications. But these are not normal times. The risks to the outlook are huge, flooding the importance of the most robust recent data. In addition, the RBNZ is pursuing a “least regrets” strategy: it is happy to take the risk that inflation and employment will hit the target, but wants to do everything it can to avoid major shortfalls on either target. That means it will happily store the strongest data news rather than react to it. “

ANZ’s Zollner said this week’s RBNZ policy review “is kind of a placeholder,” but that the RBNZ could expect to exert a bit of downward pressure on the long end of the yield curve. interest rate using a moderate tone and a reminder that you now have the ability. Take a more tactical approach to your weekly bond purchases.

“For the short ending [of the curve]Any weakening of the commitment to keep OCR unchanged through March would certainly cause a surge of enthusiasm, but this is not our expectation. “

Kiwibank economists say their preference would be to “unwrap” the negative interest rate “package” of the RBNZ and the FLP, the loan finance program.

“We recommend unpacking the deal and going with what works without (major) consequences. Focus on the FLP now and consider [negative rates] then. We’ve been hitting the drum on a FLP bench as the next best tool in the shed. The good thing about FLP is the timing. The RBNZ has committed to doing nothing with the OCR until March 2021. The FLP could start in November, to get the ball rolling. And if FLP is not enough … “