Last Tuesday (July 14), a study in the New England Journal of Medicine showed strong results for Moderna’s experimental mRNA-1273 (MRNA) vaccine against COVID-19. The MRNA stock gained almost 7% the next day.

However, as the always excellent Matt Levine pointed out Bloomberg, other names worked much better. Among the big winners on Wednesday:

- Royal Caribbean (RCL): + 21.2%

- Norwegian Cruise Lines (NCLH): + 20.7%

- Carnival (CCL): + 16.2%

- American Airlines (AAL): + 16.2%

- United Airlines (UAL): + 14.6%

Levine used the move to discuss the hypothetical legality of a Moderna insider call option on, say, RCL shares. But Wednesday’s moves go to an intriguing question about Moderna’s actions, which Levine also raised. Suppose an investor knew, with absolute certainty, that Moderna (MRNA) was going to successfully develop a vaccine against COVID-19. Should that investor buy MRNA shares?

The answer seems to be a blindingly obvious “yes”. And that is probably the simple and correct answer. But the more interesting question might be: can that investor find a best stocks to hold based on that information? The answer to that question is a little more complicated.

After all, there will be many companies that will benefit from a successful Modern vaccine. In fact, most companies will benefit. Presumably, the market as a whole would do the same.

And the profits are likely to be greater for those stocks that have been among the worst results in 2020, and therefore have the greatest room for improvement if any appearance of normality returns. There is certainly an argument that at least one, and perhaps several, of those names will outperform MRNA’s actions even if Moderna succeeds.

There is also the question of how much benefit Moderna will get from the vaccine. Political factors can put pressure on prices and profits. And while Moderna is more (and indeed much more) than a coronavirus game, its stocks have increased more than 400% since the company first revealed progress toward a vaccine in late February.

It is certainly fair to wonder if the rally has gone far enough at this point. And even if it doesn’t, there is a strong argument that even investors who believe Moderna will succeed should look elsewhere for that success.

Better options than MRNA stocks?

It’s worth noting that Wednesday’s move wasn’t the only jump that Moderna’s shares saw last week. MRNA gained 16% on Friday and 51% in one week. As for the names that were gathered on Wednesday, they were generally delayed. In fact, the US Global Jets ETF (JETS) was up less than 2%.

Of course, that rally in itself potentially increases the relative attractiveness of other plays on Moderna’s success. MRNA shares added about $ 13 billion in market value last week. Since February 25, the day after the company announced that it had shipped the first batch of mRNA-1273 for Phase 1 testing, Moderna’s market capitalization has increased by $ 30 billion to now come close. of $ 38 billion.

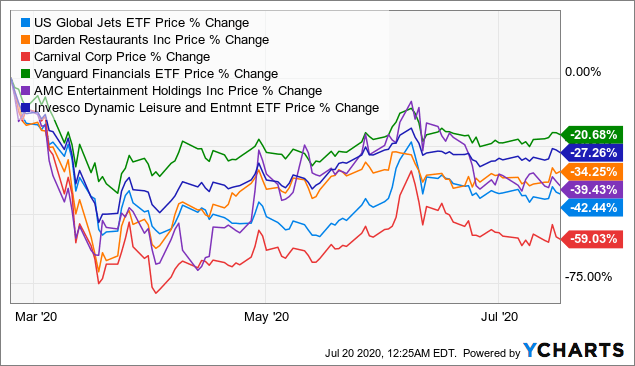

That optimism has certainly not bled out populations that would benefit from a vaccine:

Data by YCharts

Data by YChartsgraph since 02/24/20

As a result, there are games for which a successful vaccine would suggest a significant advantage. Major US airlines United and Delta Air Lines (DAL) have dropped at least 53% so far this year. A return to normality, assuming that companies recovered past values and even incorporating 2020 material losses, suggests in the range of more than 70% upward in those names.

Informal meals like Darden Restaurants (DRI) and Brinker International (EAT) could end up with a long-term benefit. Both companies have built their businesses to go: Brinker posted particularly strong results on that front during the worst crisis, which could fuel growth even when traffic returns. With a DRI of 29% YTD and EAT 42%, bulls could model gains of more than 70% on those names in an environment where coronavirus concerns are significantly mitigated.

To be sure, investors may disagree with any of these names or other pandemic losers. Airlines may have permanent headwinds (sorry for the pun) of lower business travel as Zoom Video (ZM) drives the adoption of video conferencing. Casual dining has faced secular pressure for years, and the mall’s traffic is getting lower. Cruise demand may have had a permanent impact. The problems these laggards face don’t all go away when and when a vaccine arrives.

Still, at least the options elsewhere in the space seem to create a fairly high bar for an investment in Moderna stocks. An investor has to believe not only that the company will be successful (an outcome that seems increasingly likely with each news item), but that it will also be significantly profitable as a result. You probably also have to believe that the benefits accruing at Moderna suggest (using certainly approximate figures) that stocks can increase at least 50% from here. Otherwise, it seems highly likely that you can find a stock that can increase at a faster rate if Moderna can stop the virus from spreading.

The profit problem

From here on, that suggests (again, broadly speaking) that the vaccine will likely have to generate at least $ 50 billion in value for Moderna. That is possibly too aggressive. Modern is not a one trick pony. Its IPO at the end of 2018 was the largest in biotechnology. It has a broad platform with a number of applications and partnerships with Merck (MRK) and AstraZeneca (AZN):

source: presentation of Moderna Q1

source: presentation of Moderna Q1

Success with COVID-19 would presumably read well on other company products, such as cancer and cytomegalovirus vaccines.

However, that alone cannot explain what a ~ $ 50 billion increase in the company’s market capitalization would be (again, based on the idea that MRNA needs another ~ 50% upside to be worth it. at this time). To justify concentration, Moderna needs to make significant gains from a successful vaccine, and probably needs to do it alone. It’s hard (though far from impossible) to imagine a pharmaceutical CEO taking on Moderna and, in the process, taking on the myriad regulatory and political headaches necessary to price the vaccine and market it.

Modern can probably reach that $ 50 billion ghost if it succeeds. CEO Stephane Bancel said in an interview in March that the company would not rate its product higher than other respiratory virus vaccines, but that is still around $ 800 per regimen. In May, Barron’s It highlighted two disparate (but much lower) estimates from Wall Street analysts. Morgan Stanley saw the price increase from $ 5- $ 10 per starting dose to $ 13- $ 30 thereafter. BMO, however, saw a path from a starting price of $ 125 to $ 200.

Of course, Moderna will face price pressures in developing countries. In developed nations outside the United States (especially Europe), price controls will be a problem even before political factors are taken into account.

There appears to be room for improvement in the MRNA stock, assuming the vaccine is successful. But the numbers also suggest that mere success at this point is not enough. Modern needs an effective price. If a competitor develops a vaccine of its own, according to my numbers, there are at least 15 companies that do it aggressively, the pricing power will have a substantial impact. Regulatory and public pressures must also be taken into account.

One more factor must be considered. As Levine pointed out in April, top investors are putting pressure on drug and biotech manufacturers like Moderna not only to collaborate on vaccines and treatments, but also to give up patenting. Those investors hold diversified portfolios, and the benefit to their non-MRNA holdings is likely to outweigh any concentrated profit that Moderna could generate.

Bancel is Moderna’s largest shareholder, so you will likely be incentivized to ignore those calls and boost price and competition. But as the CEO and other executives continue to sell stocks aggressively (and are likely to redeploy at least some of the capital to other parts of the stock market), even that incentive diminishes.

Meanwhile, other shareholders are not going to put pressure on the company on the price front. Therefore, it may be that the path of least resistance for the Moderna administration is to work with rivals and regulators, without squeezing every last dollar of potential profit. Given that we can reasonably estimate that the company may need to earn up to $ 50 billion from the vaccine to support the bull’s case here, that seems like a potential hurdle to a long position near $ 100.

The downside risk

The analysis so far assumes that Moderna is successful. Despite the anticipated promise, that is not guaranteed.

And if the company is not successful, the downside is substantial. Once again, the MRNA stock has recovered more than 400% since its coronavirus efforts gained increased attention. An elimination on the COVID-19 front could suggest a decline of up to 80%, assuming stocks return to pre-pandemic levels below $ 20.

That concern also adds to the questions surrounding the relative risk / reward at this point. An investor could reasonably refuse to hold UAL and AAL in debt due to downside risk. But Moderna is not a sure thing either. The development of biotechnology is always loaded, and Moderna is trying to develop a vaccine at an unprecedented rate. Even a modest stumble could cause MRNA shares to drop.

Names exposed to a pandemic would likely decrease in such a scenario, but not necessarily that far. And if a rival beats Moderna (or succeeds where the company doesn’t), those names could win even when Moderna’s stock falls.

None of this means that Moderna’s stock is short. That’s certainly not a trade that has worked well: Short sellers have lost approximately $ 1.5 billion in MRNA so far this year. Bulls could target Gilead (GILD), which entered 2020 with a business value in the $ 80 billion range on the back of its vaccine portfolio. Moderna will certainly not get Gilead’s prices, but its unit sales would be exponentially higher. From a rough perspective (again), a coronavirus vaccine leader might see a similar assessment, and that would imply that the MRNA stock doubles again from here.

Rather, it is an effort to highlight some of the challenges that Moderna’s actions face, even assuming success with the Moderna business. The story here is much more complicated than is usually the case with biotechnologies. In this case, development success does not necessarily guarantee financial success, or at least not the level of success valued at a 400% rebound. Given what that success would mean to the world at large, at this point, even Moderna bulls should at least consider looking for other potential winners.

Divulge: I / we have no positions in any mentioned action, and we have no plans to initiate any positions within the next 72 hours. I wrote this article myself and express my own opinions. I receive no compensation for it (other than Seeking Alpha). I have no business relationship with any company whose shares are mentioned in this article.