[ad_1]

Photographer: Qilai Shen / Bloomberg

Photographer: Qilai Shen / Bloomberg

Asian stocks fell at the open Tuesday after US stocks fell on concerns about Coronavirus restrictions and prospects for economic stimulus. The dollar was stable after posting the biggest gain in three months.

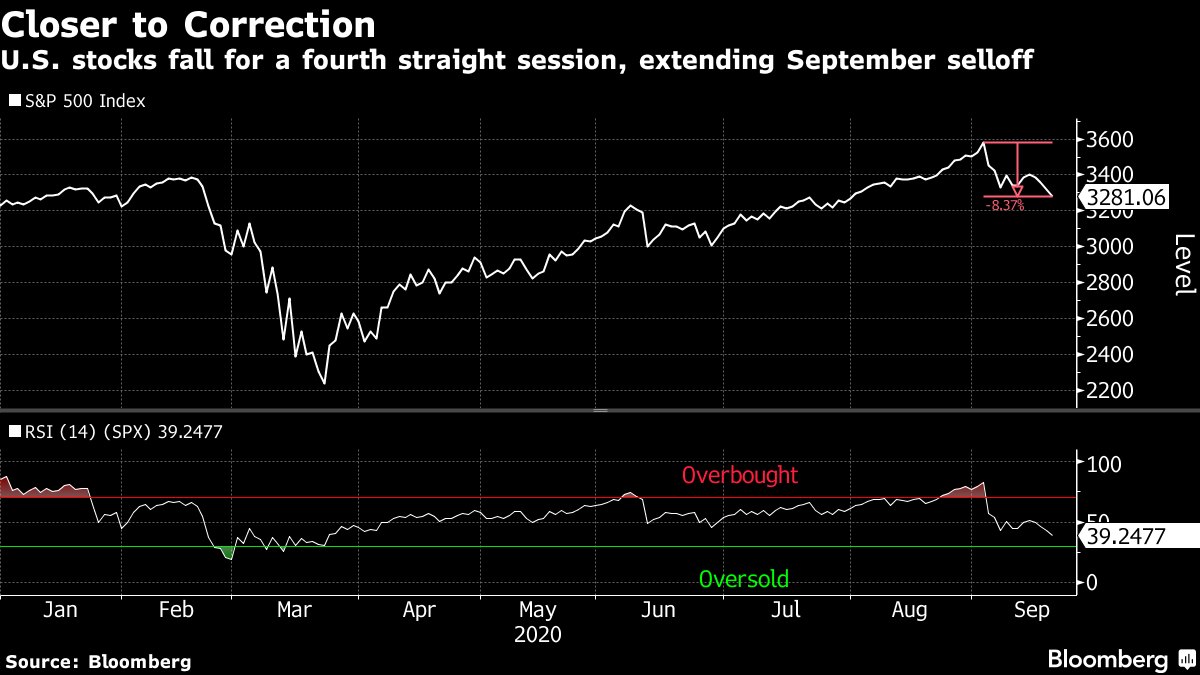

Benchmarks fell in Australia and South Korea, while S&P 500 futures rose. After approaching the threshold that many investors consider a market correction, the US benchmark broke out of session lows on Monday. The Nasdaq 100 rose. Japan is closed for the holidays and cash Treasuries will not trade until the London open.

Banks will be back in the spotlight after global lenders fell into a report on suspicious transactions around the world. Investors are also weighing the prospects for increased fiscal stimulus in the United States, increased Covid-19 cases in several countries, and the impending presidential election.

The outbreak of a partisan battle to replace Supreme Court Justice Ruth Bader Ginsburg hurt the already slim prospects for another round of spending. House Speaker Nancy Pelosi and House Democrats published an interim government funding bill without the support of the White House or Senate Republicans. Federal Reserve Chairman Jerome Powell He said the US economy is improving but has a long way to go before a full recovery from the pandemic.

“Valuations were getting more and more stretched and people looked the other way in the context of the undeniable support of the Fed and the view that the US government was going to top off the loss of revenue during the pandemic,” Macro Risk Advisers Founder and CEO Dean Curnutt said on Bloomberg Television. “There is concern that this uncertainty around the elections will stay with us for a period after the elections.”

On the front of the pandemic, former Food and Drug Administration Commissioner Scott Gottlieb has warned that the United States may experience “at least one more cycle” of the virus in the fall and winter. The UK will announce new restrictions on bars and restaurants.

Oil rebounded from its biggest drop in nearly two weeks on growing concerns about prolonged coronavirus restrictions and supply concerns.

Macro Risk Advisors Founder and CEO Dean Curnutt discusses the market sell-off in the US and Europe.

Here are some events to watch this week:

- Fed Chairman Jerome Powell appears before the House Select Subcommittee on Coronavirus to discuss the central bank’s response on Wednesday.

- New Zealand rate decision on Wednesday.

- Initial US jobless claims are due Thursday.

These are some of the main movements in the markets:

Stocks

- S&P 500 futures rose 0.4% at 10:19 am in Sydney. The S&P 500 fell 1.2%.

- Australia’s S & P / ASX 200 Index fell 0.7%.

- South Korea’s Kospi index fell 0.8%.

- Hong Kong’s Hang Seng Index futures lost 0.4% earlier.

Coins

- The yen was at 104.73 to the dollar.

- The offshore yuan was trading at 6.7898 to the dollar.

- The Bloomberg Dollar Spot Index was flat after rising 0.6%.

- The euro was trading at $ 1.1764 after sinking 0.7%.

Captivity

- The 10-year Treasury yield fell nearly three basis points to 0.67% on Monday.

Raw Materials

- West Texas Intermediate crude rose 0.9% to $ 39.67 a barrel. It fell 3.7% earlier.

- Gold rose 0.3% to $ 1,918.53 an ounce after depreciating 2%.

– With the assistance of Rita Nazareth and Claire Ballentine