[ad_1]

Here’s what you need to know on Monday, December 21:

Market mood has soured and the US dollar is jumping as a new strain of coronavirus in the UK prompted flight bans and raised concerns. US lawmakers reached a $ 900 billion stimulus deal, boosting gold. The headlines on vaccines and Brexit are out there.

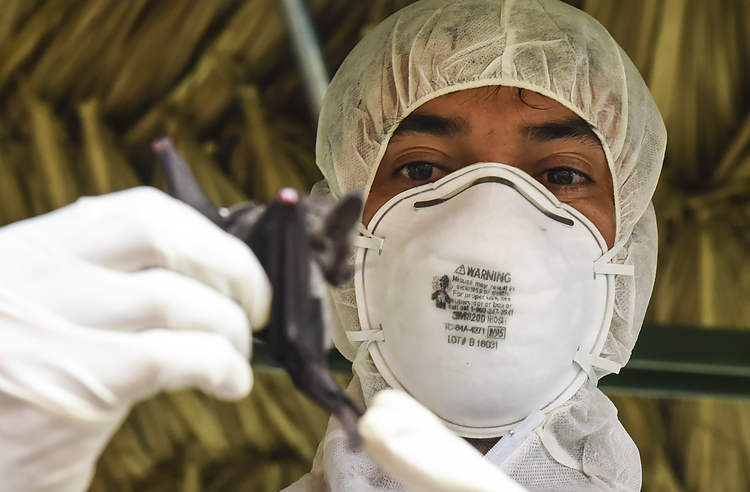

A new The COVID-19 strain is 70% more transmissible, increases the reproduction rate between 0.4 and 0.7 and is “out of control” according to the UK health secretary, Matt Hancock. The VIU-202012/01 variant is probably not more dangerous or resistant to vaccines.

The UK has done genetic sequencing more than other countries. Fear is driving the safe-haven dollar and more information on the tension is expected to emerge.

Great Britain announced a new level of restriction, Level 4, in London and the surrounding area and several countries canceled flights to Britain, which could cause problems in the supply chain before Christmas. Prime minister boris Johnson Convenes Cobra Cabinet Monday. GBP / USD is down more than 1%, also punished by the stalemate in the Brexit talks.

Brexi; The EU and UK continued to try to negotiate a trade deal over the weekend as well, and in recent reports, significant differences persist, especially in fisheries. A possible concession from the EU on this sensitive issue has angered the industry. The Brexit deliberations did not meet the Sunday deadline set by the European Parliament.

American stimulusSenate Majority Leader Mitch McConnell announced that Democrats and Republicans reached a $ 900 billion settlement, the second-largest in history after March’s CARES law. The deal includes checks for all Americans, unemployment benefits and help for small businesses.

A breakthrough was made possible after Senator Pat Toomey withdrew from lawsuits to curb the credit powers of the Federal Reserve. The news keeps US equity futures afloat despite concerns about the new chain. The final vote will take place later in the day. Gold has risen above $ 1,900 in response.

VaccineThe United States begins administering Moderna’s jab on Monday after the Food and Drug Administration approved it on Friday. The European Medical Agency will likely give the green light to the Pfizer / BioNTech vaccine.

ClosuresOntario, Canada’s most populous province, is poised to enter a significant shutdown, and the news is weighing on the Canadian. Several European countries are tightening their screws, including Italy, where a patient was diagnosed with the new variant of the virus.

Investors are also watching Russian trick in U.S. federal agencies and lawsuits against technology companies. The economic calendar is light on Monday, leaving room for political and virus headlines shaking the markets.

Oil prices have fallen amid concerns over falling demand with WTI crude oil falling below $ 48.

Bitcoin it has passed $ 24,000 over the weekend and remains at that level. Tesla’s Elon Musk flirted with investing in the granddaddy of crypto over the weekend.

More Can the dethroned King Dollar return? Santa’s market gifts are generous but not infinite