[ad_1]

GOLD PRICE PERSPECTIVES:

- Gold prices rose for the third day to $ 1,890 as traders counted down for the election.

- The price of precious metals was driven by improving market sentiment and a weaker US dollar

- 81% of the Retail gold merchants (inside IG)They are long net gold, in anticipation of a Democratic sweep

Gold prices recovered from a key support level of US $ 1,870 amid favorable market sentiment while merchants counted down for the American elections. As recent polls have suggested, many are anticipating a potential “Blue Wave”- a Democratic sweep – election result, likely to support risky assets and sink the US dollar. If Biden wins, Democrats may have the power to push through a larger tax bill at the expense of a larger deficit, which can lead to the US dollar falling. With a new viral wave of Covid-19 hitting the US and most of the EU, a aid packages seems necessary to cushion the impact of the pandemic.

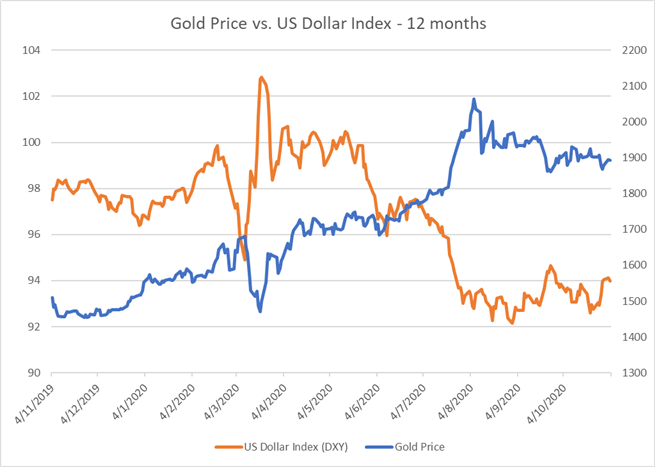

In view of a historical negative correlation Between gold and the US dollar (chart below), a “Biden-win” scenario is likely to sink the US dollar and push up precious metal prices. The opposite is true if Trump beats Biden, a less likely outcome that can result in a stronger US dollar and weaker gold prices.

Source: Bloomberg, DailyFX

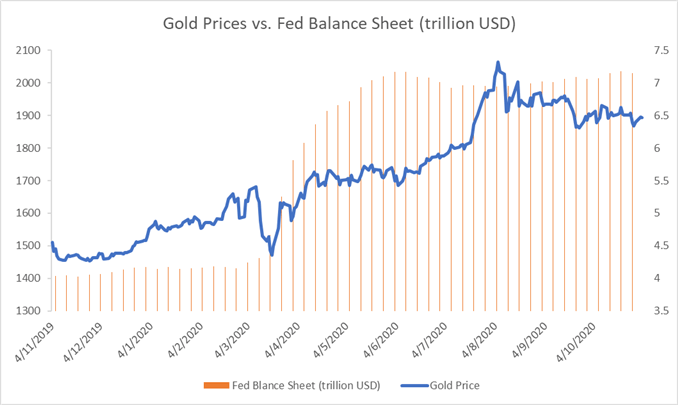

the medium-term perspectiveHowever, it appears biased to the upside as global central banks continue to expand their balance sheets. Systemically important central banks, including the Fed, the ECB, the RBA and the Bank of England, may lean towards the dovish side against the backdrop of a slower pace of economic growth in the fourth quarter as a second viral wave Covid-19 hits US and EU. Ample liquidity and an ultra-low interest rate environment could remain with us for a longer period of time, which could support precious metal prices.

the Federal Reserve Balance It hit a record $ 7.177 trillion at the end of October, and the trend showed no signs of reversing anytime soon (chart below).

Source: Bloomberg, DailyFX

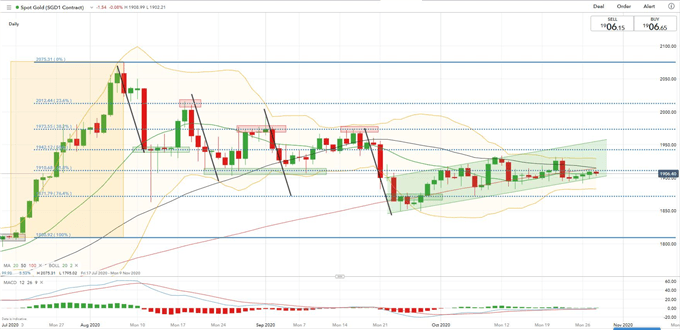

Technically, gold prices left the its highest point (US $ 2,075) in early August and have since entered a three-month setback. Prices are consolidating within a narrow range between $ 1,870 and $ 1,930 in the last four weeks (highlighted in the chart below). An immediate support level can be found at $ 1,870 (the 76.4% Fibonacci retracement), breaking below which may open room for further losses with an eye toward $ 1,810.

The overall trend appeared to have a bearish bias, with a “Death cross”It was probably formed recently. The 20 and 50-day SMA lines have crossed below the 100-day SMA, indicating that downside pressure could be prevailing. Immediate resistance levels can be found at $ 1,898 (20-day SMA), $ 1,910 (61.8% Fibonacci retracement), and then $ 1,930 (upper range ceiling).

Gold price – Diary Graphic

|

Switch in |

Long pants |

Shorts |

HI |

| Diary | -4% | 2% | -3% |

| Weekly | -5% | -14% | -7% |

I G Customer sentiment indicates that retail gold traders are leaning heavily to the long side, with 81% of net long positions, while 19% are net short. Traders cut long positions (-2%) and added short bets (+ 16%) overnight. Compared to a week ago, traders have reduced exposure to both long (-3%) and short (-10%).

Recommended by Margaret Yang, CFA

Don’t despair, make a game plan

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy On twitter

[ad_2]