[ad_1]

US dollar, analysis and news from the Fed

- USD on the defensive before the FOMC

- A change in future direction is expected as the Fed adjusts to the new mandate

As market participants await the Federal Reserve’s monetary policy decision, the US dollar has tumbled lower overnight with the dollar back below 93.00 with markets apparently bracing for a dovish rally.

It starts at:

Live now:

September, 17th

(16:09 GMT)

Join Day 3 of the DailyFX Summit by discussing the coins

DailyFX Education Summit: Trade Your Market – Day 3, Forex

As a reminder, at the Jackson Hole Symposium, President Powell had announced the Federal Reserve’s shift to average inflation targeting (AIT). This will mean that the Fed will allow inflation to exceed 2% for a period of time, rather than preemptively tightening monetary policy before inflation reaches its 2% target. As such, the policy is more geared to go down for longer.

What to watch out for

Forward orientation change: The expectation is that the Fed implements AIT within its statement. Alongside this, the Fed is likely to re-label its bond buying program as “accommodative” rather than “market performance,” given that the latter has largely returned to pre-Covid levels. This could be taken a bit further if the central bank set a timeline for QE or, in a more moderate scenario, increased the pace of QE.

Weighted average maturity: This essentially means the change in the weighted average maturity in the Fed’s bond portfolio. As the Treasury issued more debt at the longer end of the curve, there has been a growing expectation in the lead-up to the meeting. that the Fed could potentially increase the duration and target the longer end of the curve to provide accommodation.

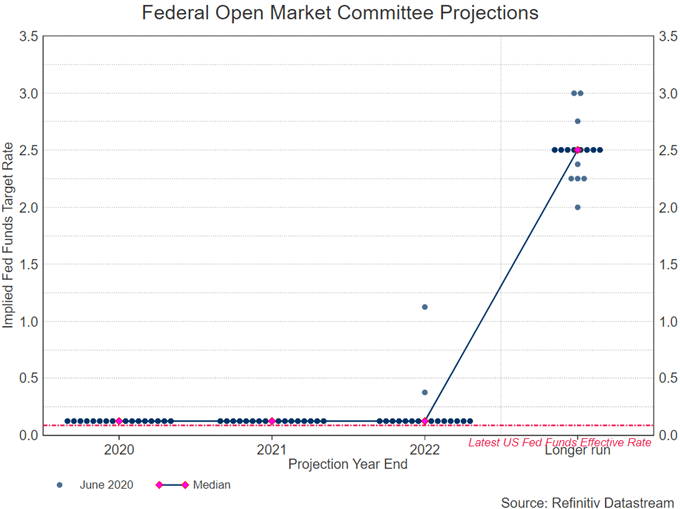

fed Dot plot: Given the new Fed mandate, the dot plot is unlikely to undergo a material change. That said, with the first look at the 2023 dot plot, the Fed is likely to suggest that no adjustments are expected.

US Dollar lower looking to 92.50-60 as we approach the Fed meeting. Failure to hold opens the door to a move below 92.00 and back to the low of September. That being said, the short-term bearish outlook will likely be reversed on a corrective move above 94.00.

The 10 most popular candlestick patterns

US Dollar Price Chart – Daily Time Frame

Source: IG

[ad_2]