[ad_1]

GOLD AND CRUDE PETROLEUM BENCHMARKS:

- Crude oil and gold prices plunge as sentiment turns sour in global markets

- Covid cases improve, US fiscal stagnation and electoral concerns at stake

- Q3 US GDP data may disappoint, encouraging further sell-off

Crude oil prices plunged along with stocks as risk appetite soured on global financial markets. The benchmark WTI index suffered its biggest drop in a day in nearly two months. The S&P 500 stock index, a benchmark for general market sentiment, suffered the biggest setback since June.

A global spike in Covid-19 cases has clouded hopes for a lasting economic recovery even as political stagnation in the US has derailed the scope for a short-term fiscal boost. The reduction in polls before next week’s US presidential elections has raised the level of uncertainty around the result, further worrying markets.

Gold prices also fell as harsh sentiment fueled the sell-off, boosting the US dollar and undermining the appeal of anti-fiat alternatives personified by the yellow metal. The unmatched liquidity of the global reserve currency attenuates volatility, making it a frequent beneficiary in times of turmoil.

CRUDE OIL, GOLD MAY FALL MORE IF US GDP DATA DISAPPOINT

Looking ahead, he focuses on a first look at third quarter US GDP data. An annualized increase of 32 percent is expected, the highest on record. Critically, this would still put the annual rate of contraction from the pre-Covid peak of more than 7 percent. That’s just shy of the drop seen at the low point of the Great Recession of 2008.

The US economic news flow has deteriorated further and further relative to baseline forecasts since mid-July, warning that a disappointment could be on the way. Such a result could lead to another risk reduction push, driving crude oil and gold prices further down.

Ilya Spivak liked this

Get your free oil forecast

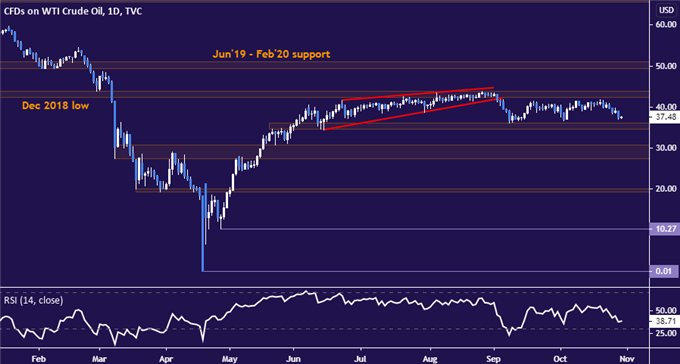

TECHNICAL ANALYSIS OF CRUDE

Crude oil prices are back in the range support at the 34.64-36.15 area. A daily close below that appears to expose the next 27.40-30.73 region. Resistance is at the 42.40-43.88 zone, with a pullback above that, putting the $ 50 / bbl figure back in the sights of buyers.

Crude oil price chart created with TradingView

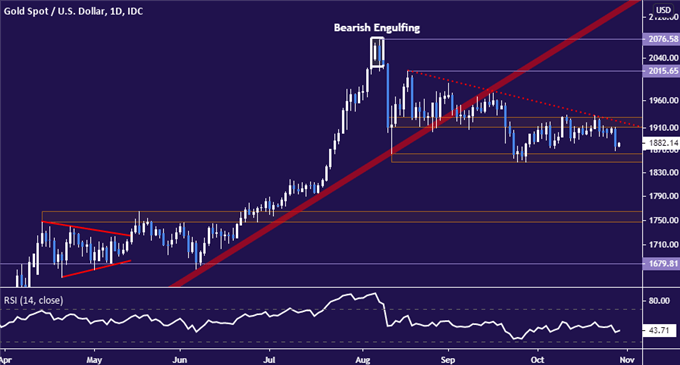

GOLD TECHNICAL ANALYSIS

Gold prices fell back to support in the 1848.66-63.27 zone. Breaking below this barrier on a daily close can set the stage for a drop below the $ 1800 / oz figure. Neutralizing the selling pressure requires regaining a foothold above resistance at the 1911.44-28.82 zone. That may put the $ 2000 / oz mark back in play.

Gold price chart created with TradingView

Ilya Spivak liked this

Get your free gold forecast

COMMODITY TRADING RESOURCES

— Written by Ilya Spivak, APAC Chief Strategist for DailyFX

To contact Ilya, use the comment section below or @IlyaSpivak in Twitter

[ad_2]