[ad_1]

KUALA LUMPUR: The government’s decision to put the proposed vacancy tax on the back burner is good news for developers and also for the housing industry, say real estate consultants and economists.

Rahim and Co International research director Sulaiman Saheh said the proposal from Housing and Local Government Minister Zuraida Kamaruddin lacked clarity in the first place.

“While the intention was to prevent the residential salient situation from worsening, the implications of implementing the tax amid the difficult period we are in now could have other ramifications,” he said.

Sulaiman also said developers should be given “a preparation period of one to two years from the date of implementation of the tax to eliminate the existing excess.”

Sulaiman was responding to an announcement by Zuraida yesterday that the proposed tax would not be imposed on developers next year, as previously proposed.

“We are reviewing it and it is not our priority.

“Let’s let the developers manage it (the cantilever),” Zuraida told Bernama after launching Cagamas SRP Bhd’s Digital Skim Rumah Pertamaku (Digital SRP).

He also said the proposed tax was not an urgent matter for the ministry.

“The vacancy tax idea only came about when we thought about unsold high-end properties … it won’t be implemented in 2021, we have other mechanisms,” he said.

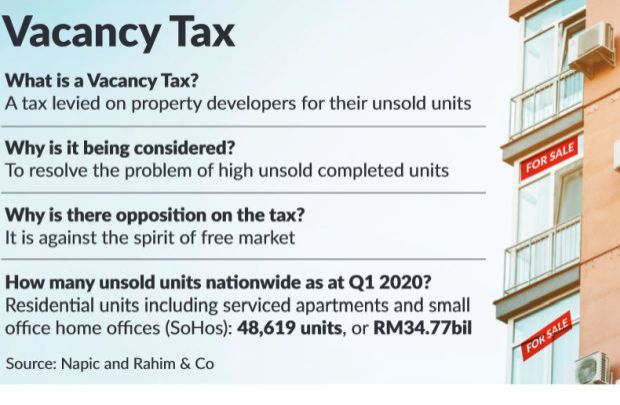

Sulaiman said a vacancy tax was typically applied to properties that were left vacant and unused for a period of time.

Its purpose is to deter speculators and developers from “hoarding properties”, with the aim of making a profit when the price rises.

“The developers want to sell their units and they don’t want to hog them,” he said.

Therefore, the position of the Ministry of Housing relates more to the unsold property tax than to the vacancy tax per se.

The unsold property tax, Sulaiman said, goes “against the spirit of the free market.”

It has “merits” in a rising market to curb overbuilding, but Malaysia is not in that situation either, he added.

Furthermore, its relevance depends on the underlying problem, Sulaiman said.

“This inability to sell (by developers) is not just about price, but is also a function of income levels, consumer sentiments and attributes of the product itself,” Sulaiman said. (photo below)

He said developers have already started to reduce the effective price through markdowns, discounts and other incentives, but the prices are still prohibitive for the general market.

According to the latest Q1 2020 report from the National Information Property Center (Napic), Malaysia has unsold housing units totaling 29,698 units worth RM18.91bil.

Including serviced apartments and small home offices (SoHos), units increase to 48,619 worth RM41.59bil.

SoHos and serviced apartments are built on commercial land but have living elements.

Known as a glut in the parlance of ownership, this refers to units that have received their Certificate of Completion and Compliance but remain on the shelf more than nine months later. These cantilever units have been collecting snow for years.

Sulaiman said the total unsold properties stood at more than 45,000 units since 2018, a big jump from just over 12,000 units in 2015.

Forcing such a tax can put pressure on developers to “panic,” which can lead to a further drop in prices. While it may sound good to home buyers, there will be ripple effects in other aspects of the housing market.

Sulaiman proposed that developers carry out mandatory independent market and feasibility studies, which will be commissioned by banks and / or local authorities, at the start of any project. A comprehensive study would allow developers to discover purchasing power, demographics, competition, and supply and demand from buyers to formulate the correct prices.

Since land is a state matter, the respective local state authorities hold the key for project approval. Banks provide financing to developers. An independent study can be a condition for developers to seek planning approval or apply for a development order. If the developer delays the project, another abridged version of that first financial and market feasibility study should be carried out, he said.

“The approval of the local authorities should not be in perpetuity. It must have a validity period. So when a developer looks for an extension, they have to do a separate study or a shortened version of the first study, ”he said.

The user of the report, be it the lender or the local authority, should make a call about it, he said.

Economist Carmelo Ferlito said putting the vacancy tax on the back burner is “good news.”

He said there are other mechanisms to solve the problem of unsold finished units. Of these, it could become a criterion for developers to conduct independent market and feasibility studies.

“It is normal practice for any entrepreneurial company to do an independent study before embarking on it,” he said. “The developer’s profit depends on the viability of the project.”

[ad_2]