The recent merger of Livongo (LVGO) with Teladoc (TDOC) surprises many people, myself included. That the company felt the need to merge with slower-growing, less sticky Teladoc was a bit strange when Livongo even the latter was able to scrap its own guidance and grow revenue 124% in its last quarter and increase user membership by 113%. That Teladoc felt the need to spin and merge with an entity as large as itself, so soon after grinding InTouch for $ 600M just a few months ago was just as surprising!

At first glance, the merger of the two companies seems like an unlikely link. Communication from users is very different between the companies. While Livongo plays a very active role in the daily lives of its members, assisting them with frequent nudges and monitoring their condition, Teladoc has the perception that they are used less frequently by members, and functions as more of a ” backup service “for urgent care.

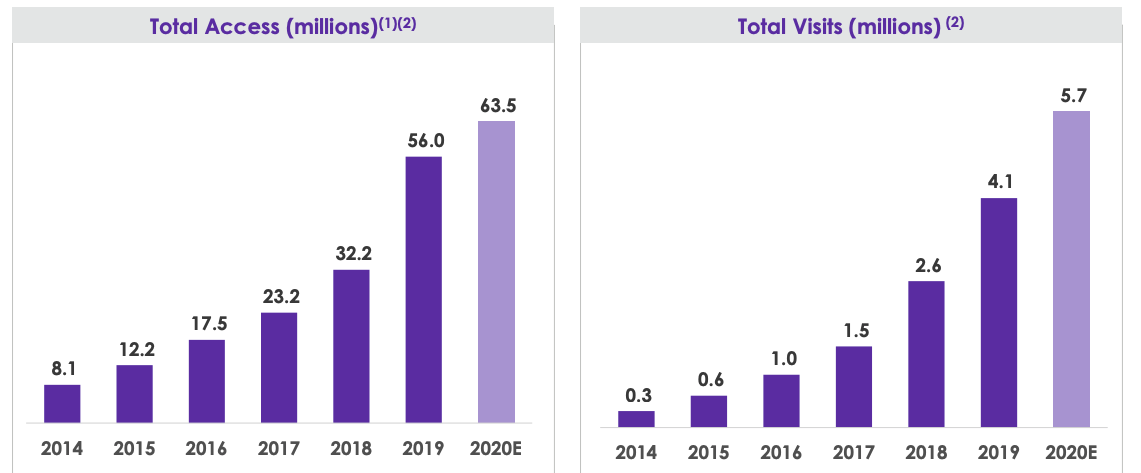

This helps explain usage levels which are around 10% of the total members. Telemedicine also suffers from the perception that they are not sufficient for physical examinations of patients with an inability to dive too deep into more complex circumstances.

Source: Teladoc Investor Day, March 2020

The presence of the pandemic has been a boon for both companies with Teladoc usage rates increasing due to members still needing medical consultation, and Livongo members benefiting from the opportunity to get continuous monitoring of their chronic conditions in ‘ the absence of access to their existing medical provider than other specialist offices.

The Livongo Teladoc deal was announced based on the identification of a maximum of $ 500M in revenue energy within a few years and close to $ 60M in annual cost energies at the end of the 2nd year to close. It was my experience typically that although cost synergies are realized more often, revenue energies sometimes tend to stop as a result of performance challenges. For the merger of Livongo Teladoc to make sense, there must be a good shot to realize these synergies.

Cost Synergies

It is quite easy to make the case for shared cost savings between the two companies. Livongo and Teladoc serve many of the same type of customers (self-managed companies, health insurers). So they sell to many of these customers in similar ways. Efficiency of operation in sales and marketing expenses are low hanging fruit, and easy consolidation that can be made.

New vendors that were slotted to cover additional areas can now be fired, and planned marketing expenses can be shared. Some consolidation of development costs should also be possible. Other than this, consolidation of IT infrastructure, administrative expenses and customer support are all things that can be easily justified.

Shareholders should feel some confidence in entities that reach $ 60M in shared cost savings within a few years.

Income Synergies

While cost synergies are great, most of the consolidation fall is the “revenue synergy” component. $ 500M in new revenue generation is a massive number and represents almost what Teladoc did in 2019 full year revenue. Cross-selling and solution co-marketing makes a lot of sense given broadly about the same base of customers.

Teladoc Upsell in Livongo Base

Livongo and Teladoc each have a robust base of managed health insurers and self-managed companies between them. Interestingly, there is only a 25% overlap across the customer base of both companies. This should mean that there is ample opportunity to sell solutions in each other’s customers in a way that will provide less friction than one of the companies having to “break into” unpenetrated accounts without pre-existing relationships.

This should greatly speed up the time to revenue and sales productivity, and both sales teams can train very quickly on the solution of each business. Sales compensation plans need to be well-tuned to create the right behavioral stimuli, but I believe they should get them over time.

The sale of the Teladoc consultation remotely to existing Livongo health insurers and self-employed employers is not brainwashing. Livongo already had a partnership with Doctors on Demand and MD Live to conduct telemedicine consultations for behavioral health and medication management for diabetes.

For insurers and self-employed employers, this provides a way to not only get their patients quick consultation in an easy way for sudden problems that may arise, but can also take these companies costs out of the system, with these cheaper, virtual consultations at ~ $ 45 per remote visit, vs more than double for one person personal visit.

Easy planning and easy access means that a patient is likely to use a virtual consultation and not wait until they are in crisis or forced to go to Urgent Care, benefit from Teladoc’s revenue, overall patient health and lower ultimate treatment costs for the insurance company as an employer.

The motion with this cross sell is clear, easy to understand and probably effective. In fact, these regular check-ins can even be requested by the regular readings and data collection that the Livongo application collects and provides another hug if the Livongo user asks to schedule a telemedicine consultation with a Teledoc doctor, creating a seamless income for the new entity.

Greater acceptance of insurance and higher compensation

For Teladoc, having a chronic health management solution makes the case much stronger for health insurers to provide coverage now. Chronic illness is a very high cost for insurers, and health insurers will now have a greater business justification to reimburse the use of Teladoc, beyond simply the lower cost of a periodic consultation for telemedicine. Teladoc will now provide a means to reduce the total cost of long-term patient care.

Source: Teladoc Investor Day, March 2020

Source: Teladoc Investor Day, March 2020

With such a fully-fledged platform that provides urgent remote care, medical second opinions, nutrition management, mental health care and chronic health management, Teladoc also reduces the chance that any competitive platform management platform will drive it away.

In addition to greater coverage over more health plans, the combined Teladoc Livongo solution could also ultimately lead to a higher rate of insurance reimbursement to Teladoc, something the company has successfully managed to achieve with every successive capacity it has added to it. platform.

More Frequent membership

In the call of the analytical briefing, Glen Tillman, Livongo chairman suggested that the Teladoc network of doctors crossing the Livongo monitoring solution over their ~ 70M plus patients was another revenue stream that made a lot of sense.

The reason for this is clear. Not only does this provide the location of an immediate new source of revenue, but it solves one of the issues that Teladoc has struggled with what was previously low usage and repeated engagement, which could slip the pandemic as users look to return to live consult with their doctors and downgrade Teladoc to a ‘backup’ service.

Livongo’s high daily involvement is helping Teladoc members abandon telemedicine when the pandemic closes. The Livongo solution offers Teladoc patients a reason to have repeated consultations with their Teladoc doctors.

The user base of Teladoc users with chronic health conditions is likely to be substantial. Livongo estimates 140M American adults with a chronic health condition, and 40% of those adults with more than 1 condition. Thus, Teladoc acquires itself a more engaged user base and a substantially large addressable base overnight.

Source: Livongo Q1 2020 Investor Report

Source: Livongo Q1 2020 Investor Report

Because these consultations are not for assessing new circumstances, but for the most part for periodic monitoring of conditions, discussion of variation in patient metrics and general guidance, these are the perfect kind of visits that need to be done with an easy solution. remotely, instead of a requirement in person visit.

If there is any point of friction with this sales movement, it may be as an addiction that Teladoc doctors are introducing new technology and systems for Livongo remote monitoring in a remote session.

My concern here is that effectively relying on uncompensated physicians as “sales staff” to advocate for a new technology in an online consultation can be challenging. The post-consultation follows to get patients comfortable with the technology and is familiar with facility and setup needs to be considered, otherwise the expected revenue energy here may be much less than expected.

Acceleration of international growth

The international presence of Teladoc could give Livongo a significant boost to international ambitions. Although Livongo has yet to go international, Teladoc is deployed in more than 175 countries, providing a solid base and springboard for Livongo to generate full revenue. Europe and the Asia-Pacific in particular could provide significant opportunities for Livongo to grow its business very rapidly, and the merger with Teladoc provides a way to accelerate this.

Concluding thoughts

The merger of fast-growing companies is fraught with challenges, including sales structure, cultural fit and other operational implementation. Teladoc and Livongo will have to be careful that they do not fall victim to these things. Nevertheless, the justification for business dealings is solid. Livongo helps derisk Teladoc be regulated back to ‘back-up’ status at the close of the pandemic.

The combined entity’s value proposition gives health insurers and self-employed employers a reason to cover this platform not only for members, but to proactively push it. Teledoc and Livongo have a real chance to be the dominant digital health platform for the next decade.

Announcement: I am / we are long LVGO. I wrote this article myself, and it expresses my own opinions. I do not receive compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose supply is mentioned in this article.