[ad_1]

Option contracts are insurance policies to protect against speculation or dramatic changes in the market. However, the logic of the remaining Lebanon at this stage seems weak. The possibility of exceeding the maximum price of a barrel of oil in the period covered by the “options” is considered unlikely, except in the case of war or exceptional growth as a result of the discovery of a rapid vaccine for the Corona virus, which it dismantles the state of the global stone and opens the world economy quickly.

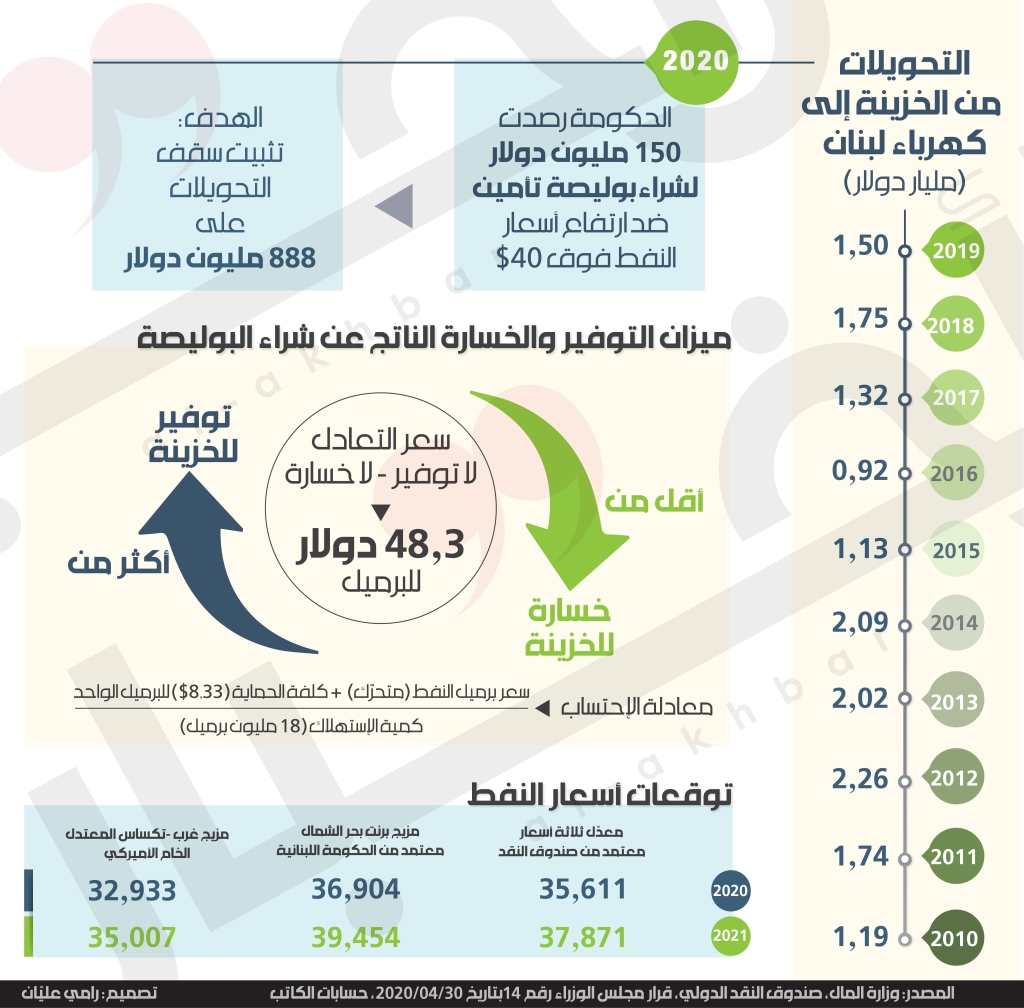

Click on the graphic to enlarge

With this insurance, the government seeks to achieve two objectives: the first is to set the maximum funds that must be transferred to the EDL to cover the fuel deficit, at a maximum of $ 888 million. Secondly, requesting the satisfaction of international financial institutions in light of a general recognition that the way out of the crisis necessarily passes through these institutions. The resolution says: “Such programs should generally be well received by the International Monetary Fund and global credit rating agencies.”

However, determining the deficit in this way is very expensive in times of a tight dollar, which raises many questions about your financial health. Since the early 2020s, demand for oil has declined further as a result of the Covid-19 epidemic, which forced an almost complete closure of almost half the planet and thereby reduced the demand for fuel. Demand will really revive in 2021, and with it prices, but the government’s own expectations are contrary to the logic of its decision. It says that the average price of a barrel of oil during the last quarter of this year will be $ 32, and that the average in the last quarter of 2021 is $ 38.4. Consequently, the cost of taking refuge from rising prices seems very prohibitive in the absence of serious reason to fear it. Wouldn’t it be better to cover spreads, if they did occur, rather than commit to a fixed amount for all scenarios? Or even invest money in alternative energy production to reduce dependence on oil?

On the other hand, the International Monetary Fund, which the Ministry of Energy and Water and the Council of Ministers collectively expect, expects in its latest report on “World Economic Outlook” that the average price per barrel will be $ 35.61 in 2020 and $ 37.87 in 2021. It is true that the fund is based on a combined ratio of the Brent mix, the price of the Dubai / Fateh barrel and the price of US crude. While the government depends only on the Brent mix (which is more expensive than the mix), but this difference does not spoil anything in the analysis because the Fund’s expectations for the Brent mix only indicate that it will not fluctuate dramatically. For the next five years.

But it seems that Lebanon has different accounts in the era of cheap oil that is withdrawing on another important issue in that decision, which was presented as a prelude to a policy of structural correction in the electricity sector: the basis for a stable and specific deficit that it opens the way for determining rationing needs and even the possibility of “a proportional adjustment in the rate for the sale of electricity”.

In reality, the decision is at the core of the expenditure of 225 billion Lebanese pounds (according to the imaginary exchange rate that still seems to exist between the Ministry of Finance and the Bank of Lebanon) that can be easily provided, because its Lack is not a great bet at a time of declining demand for oil and its price.

The following can be drawn: There may be positive intentions behind this type of decision at the level of public administration and in global markets, but in the case of the Lebanese government it is clear with its conservative objective: “Protect the state’s public finances by to reach a certain budget in relation to the purchase of oil to produce Electricity ». However, this protection is very expensive, and Lebanon appears to be without it.