[ad_1]

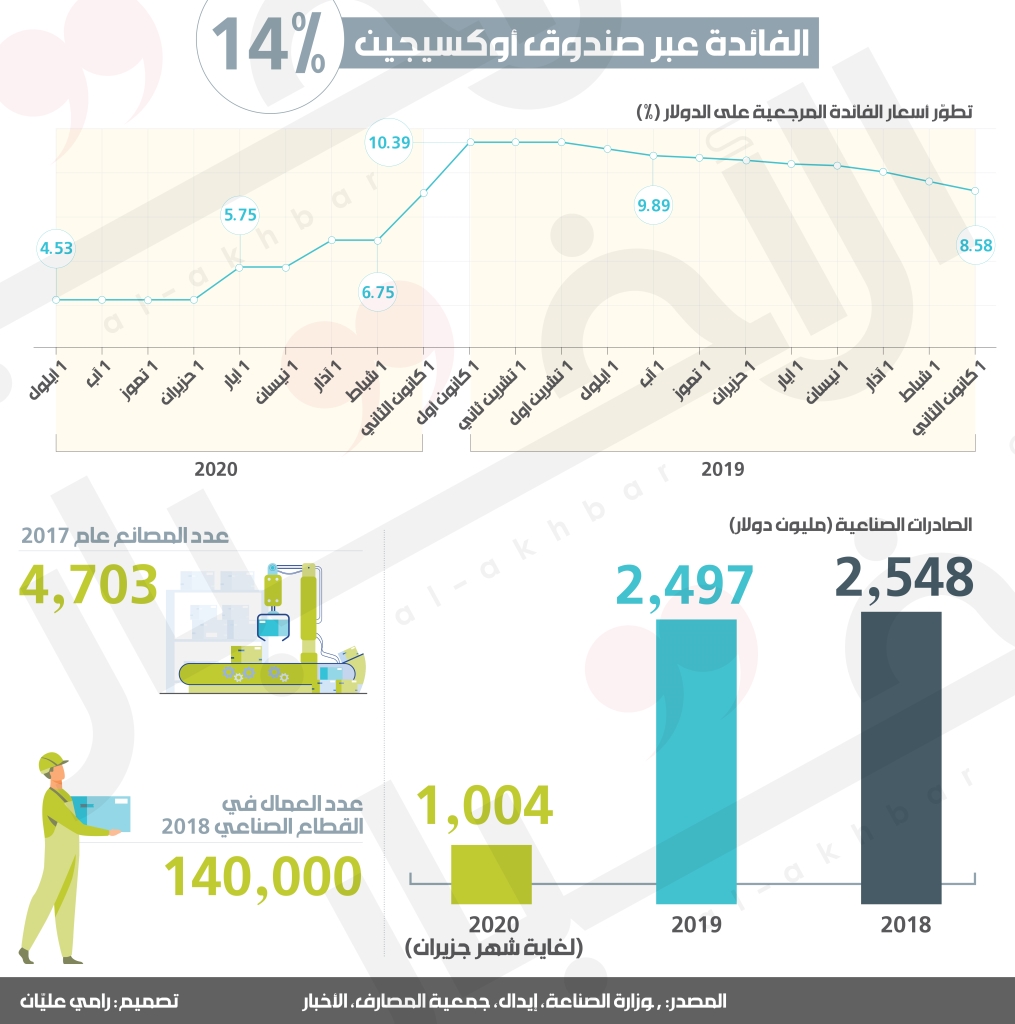

This high level of interest imposed through the fund is higher than the market interest currently imposed by banks through the BRR index on dollar loans, which peaked at 10.39% in December 2019, then decreased to 4, 5%. Imposing a high level of profits like this means that the cost to be incurred by the industry will be very high and will not contribute to reducing production costs, and it is not certain that it is a clear step to stimulate exports.

Click on the chart to enlarge it

This is not the only problem with the Fund, but rather the benefits mechanism itself. The fund cannot be sustainable unless there is a kind of balance in clients between industrial exporters and non-export industrialists in terms of the size of their business, which means that the dollars that will come from industrial exporters will contribute to the process of cumulative financing. In general, industrialists fall into two categories: industrialists who export the majority of their products abroad and industrialists who sell most of their products at home. Those most in need of benefiting from the fund’s financing are industrialists who sell their products locally. They are currently raising the dollars needed to import the raw materials needed for their informal market products, based on the highest exchange rate, which reached £ 7,400 to the dollar late last week. On the other hand, the least necessary are the industrialists who export most of their products abroad. This category of industrialists does not have a clear and defined interest in negotiating with the Fund in the first place, because they obtain “fresh” dollars from abroad in exchange for their exported products. Furthermore, most of this group have bank accounts abroad which prevent them from dealing with local banks and make them relatively immune to the Lebanese crisis. This distinction was necessary to pave the way for the following question: Why would the exporting industrial group resort to benefiting from the fund whenever it requires to obtain a part of the sums it will recover in exchange for its exports, exclusively in Lebanese pounds? The worst thing about that is that the amounts paid from the fund will be according to the market exchange rate, and can be according to the exchange rate specified in the BDL platform, as a kind of temptation to involve them in it, but this means that This group will lose much of the value of their money compared to the price of the dollar. In the informal market.

Likewise, the Fund obliges industrialists to secure 30% of the dollar value of the loan in cash that industrialists obtain from the informal market at the highest price, which means that this issue will not positively affect the cost of production, but rather will increase. This is in addition to the cost resulting from the higher interest rates.

So far, there are more than 70 industrial files under review at the Luxembourg-based fund. All transactions submitted by industrialists to benefit from available financing are subject to audits carried out abroad amid a very high level of bureaucratic and technical complications. The audit itself takes into account that internal risks are very high and that the probability of non-compliance is high, putting pressure on industrialists at a time when Lebanon needs to accelerate work to increase exports.

In addition to that, the fund also imposes high administrative fees on its affiliates, of 1%, and there is no clear hope that European bodies that have shown positive participation in funding will participate in it and therefore it is possible that the fund is unable to secure the required $ 750 billion amount. It is operating regularly. This amount may not provide an adequate basis for sustainable financing, compared to the feasibility study, which indicates that the $ 750 million amount finances exports worth $ 3 billion annually. The participation of industrialists in this fund continues to be very cautious, especially since the financing through it is not blunt. Rather, it will inevitably lead to an increase in production costs, and will consume the bulk of the competitiveness that has been achieved due to the deterioration of the price of the lira and the decrease in the value of wages and their profits paid by industrialists, that is that is, it raises legitimate questions about the degree of competitiveness it will ensure factories as part of a step it was supposed to rely on to attract dollars to Lebanon.

Subscribe to «News» on YouTube here