[ad_1]

Designed by: Ramy Elyan | Click on the chart to enlarge it

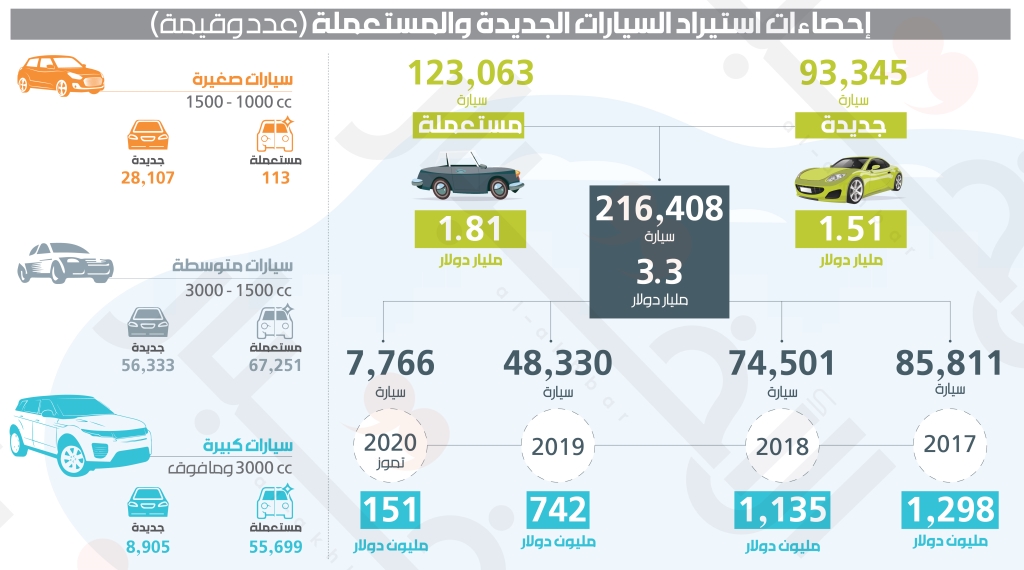

The main driver of this pattern was the fixation of the exchange rate at 1507.5 pounds on average against the dollar. This facility allowed a $ 1,500 fee employee to install a European car with a recent manufacturing history. In other words, the stabilization of the exchange rate perpetuated a pattern in which consumers who had not only bought a car to cover the necessary need, but also to cover their well-being, were drowning. This pattern included buying new and used cars. According to Lebanese customs statistics, between the beginning of 2017 and the end of July 2020, Lebanon imported around 216,408 new and used cars, with a total value of $ 3.3 billion. As for the spare parts associated with transport vehicles, their annual value ranged between $ 230 and $ 260 million. Revenue from the car trade to the public purse was also high, amounting to 1085 billion pounds in 2018, but the drop in imports and sales was also reflected in tariffs (import duties, registration, traffic, driving) , which registered around 755 billion pounds in 2019, that is, a decrease of 30.4%. There are also job losses that will force the new car import companies to restructure their structure and reduce the number of their salaries to less than 10,000 workers now.

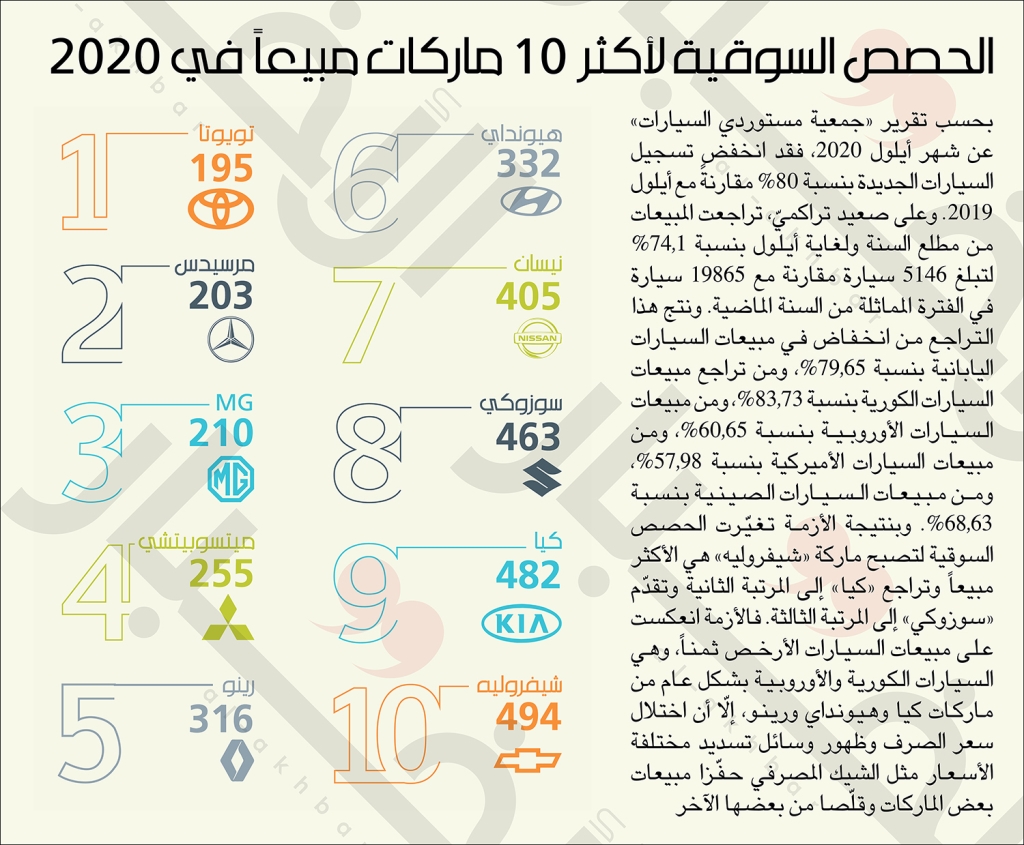

Since the summer of 2019, with the onset of exchange rate changes and the devaluation of the Lebanese pound against the dollar, society has been forced to change its behavior and renounce false “privileges”: importing cars is one of them. This market is prone to shrinking to the maximum in line with the fall in sales resulting from the collapse of the purchasing power of rents. At first, the imported automotive sector tried to “coexist” with financial and monetary developments by selling through “dollar checks”, but the value of dollars issued by bank checks began to decrease (the price of the dollar issued by check is equal to 37% of the (real) price of the paper dollar Importers need real dollars to finance auto imports Stop selling cars with checks.

Click on the chart to enlarge

This situation continued from the beginning of 2020 until August 4, when the port of Beirut exploded. The effects of the explosion on the economy wiped out what was left of the Strip. Cumulative price inflation reached 120% at the end of August, the extreme poverty rate increased from 10% to 22%, and 45% of Lebanon’s residents are below the poverty line. So who is the group that today has the luxury of having a new car or even replacing their old car with a used one without adding the “after-sales” costs of changing oil, tires, glass and others whose cost is calculated from according to the price of the dollar in the parallel market, or is the payment required in US dollars? cash.

Fayez Rasamny, CEO and Chairman of the Board of Rymco Automobile Company, says the beginning is “cutting expenses to a minimum. This situation will not change for five years or until some changes occur. No one will be able to pay the cash dollar to buy a car, as long as they can’t get food and drink, and maybe they can’t replace the windows in their house that were smashed in the port explosion. The focus will be on “after-sales services, because used car owners will never stop maintaining their cars.”

Many agencies have stopped importing new cars and require that the amount be received in cash in dollars before shipping transactions can begin. Samir Homsi, president of the Lebanese New Car Importers Association and Chairman of the Board of Directors of “Impex”, told “Al-Akhbar” that each of the importers “is trying to go on raw.” We still accept payments by bank checks at the company.

The automobile market is vulnerable to shrinking to the maximum in line with the drop in sales resulting from the collapse of the purchasing power of income

In fact, companies that still accept payment by check have raised car prices in proportion to the cost of importing them in real dollars, and the issue of continuing to accept payment by check is a matter related to each company and its ability to cash checks or pay your bank debts.

Other agencies were also reported to have relocated their businesses from Lebanon, seeking to expand abroad. Fayez Rasamny believes that “it will not be easy for Lebanese agencies to develop in other countries, due to the decline of the global market due to the spread of Covid-19 and its repercussions on the markets.” It also underestimates the importance of rumors that some dealers have shipped their cars abroad to sell in other markets. “We do not have the right to sell in a second market, otherwise they will withdraw our license. Is not easy. Unless the process is carried out in coordination with the factory ”.

So will this crisis lead to the sale or merger of agencies? The painters respond: “Some people could do that, but no one would agree to leave the market. As for Samir Homsi, “It is not possible to predict, there is still no plan. They all try to ensure continuity. “The New Car Importers Association advisor, Salim Saad, adds that” in the year the war broke out, 4,200 cars entered Lebanon. Our money was in the banks, “referring to” our inability to open loans with banks in dollars, until we can import merchandise We contacted the Banque du Liban more than once, to help us, at least, with the import of spare parts.

Subscribe to «News» on YouTube here