[ad_1]

Angel Poligan – Mexico

Among the most outstanding basic concepts of this system is the Governor of the Bank of Lebanon. It is true that the plan, which was finally approved, stands out in the basic necessary issues, such as the control of customs and maritime property and regulatory agencies … but the biggest flaw is that the Bank of Lebanon did not reform. The reform must include the governance of the Bank of Lebanon, the Central Council and the Higher Commission of Banks. The former governor of the Banque du Liban, Edmond Naim, responded to what was raised about his status as a lawyer and not a specialist in monetary affairs, saying that he applied the legal texts. Herein lies the need for reform. For example, article 75 of the Monetary and Credit Law establishes that “the Bank of Lebanon uses the means it deems necessary to guarantee the stability of the currencies, and for this it may, in particular, work in the market in accordance with the Minister of Finance as buyer, seller of gold or foreign currencies, taking into account article 69 “. Regarding Article 69, it stipulates that the Bank of Lebanon will keep in its assets gold money and foreign currencies that guarantee a coverage of the Lebanese currency equivalent to at least 30% of the value of the cash it issued and the value of its deposits at sight, provided that the proportion of gold and said coins is not less than 50% of the value of Cash issued. The assets of the Banque du Liban are not taken into account in the Lebanese money to calculate the two percentages mentioned. Edmond Naeem did not participate in financial speculation at Merrill Lynch, but he always used monetary and credit law. While the current ruler acquired the power of the Central Council from the Superior Banking Commission without anyone asking him what he had done or what should have been done in the implementation of the monetary and credit law to protect the national currency. This was later repeated when he implemented financial engineering. Also, no one asked about it.

The job of the Banque du Liban is to preserve the value of the national currency that it did not keep today, as there is no coverage for the pound as stipulated by the Cash and Credit Law, and if we escape it, it will have no

There is a central theme in the Bank of Lebanon reform. This process should lead to the disappearance of the ruler’s dictatorship. If this dictatorship continues, then there should be no vice rulers. For example, he established and chaired the integrity of the Special Investigation Commission despite the fact that this body is linked, in other countries, to the intelligence services. He also established and chaired the Financial Markets Authority, although his work is related to the stock market. What is your income with that? He put his hand in the Middle East, the Casino du Liban and other institutions. Create an empire with the coverage of most politicians. They gave him what he asked for.

The Bank of Lebanon must be removed from the logic of the existing political system. This logic was imposed at various stations, including the establishment of the Banking Supervision Committee. The establishment of this device was a legal copy of the Banking Supervision Commission in France. In the French version (from which the Lebanese Monetary and Credit Law was transferred) it was mentioned that the First Deputy Governor of the Bank of Lebanon chairs the Oversight Committee, but in Lebanon the Sunni community demanded a position at the Bank of Lebanon , and won the position of Chairman of the Committee. The limits of the relationship between the financial and monetary authority lie in the cooperation between them, also based on the monetary and credit law. The Minister of Finance has the Government Commissioner at the Bank of Lebanon, and the Director of Public Finance is a member of the Central Council. They can both inform the minister about what is happening, but the two authorities are supposed to cooperate for the public good. The finance minister must know what is going on. As for his powers with the Banque du Liban, they are limited to what is established in the monetary and credit law, in the sense that the ruler, in agreement with the minister, decides the market interest rate of the bonds and deposits.

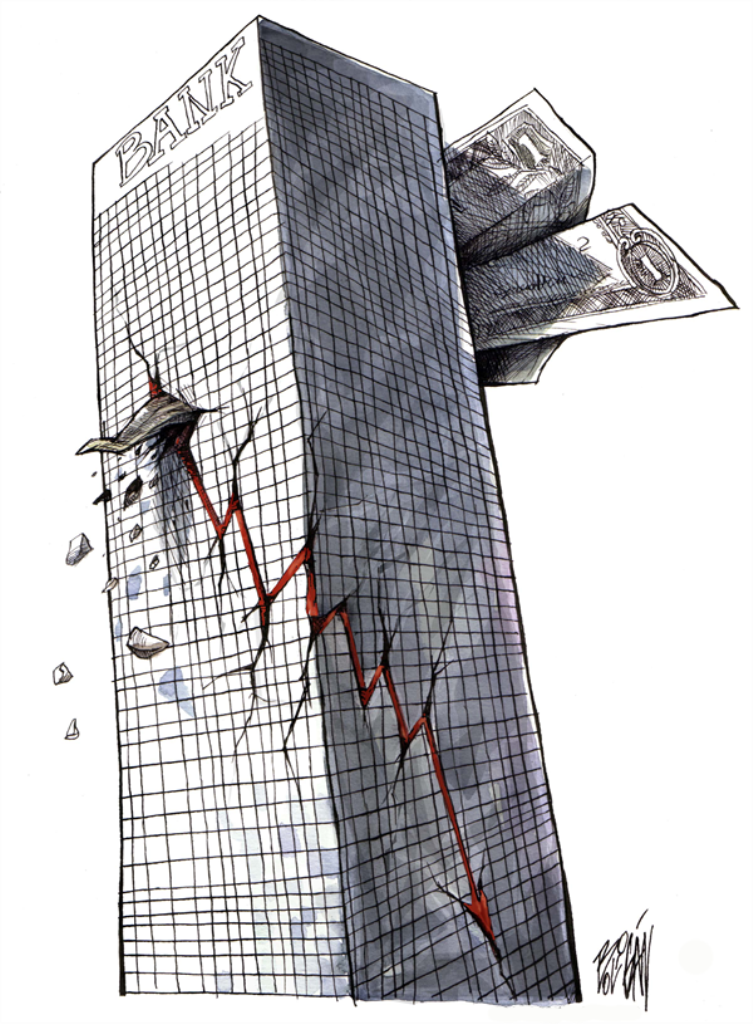

The function of the Banque du Liban is to preserve the value of the national currency that it did not maintain. Any coverage on the lyre today? If we leave the lyre, it will have no value. Confidence in the banking sector has flown today (and along with it has also flowed with deposits), while this sector is the backbone of the nation’s resurrection. Where will trust be restored? The need to reform the Bank of Lebanon is linked to restricting its powers and tasks to what central banks are doing around the world, that is, protecting the national currency and people’s deposits. It is your duty to set bank limits so that they do not go too far. The day the interest was 12% on dollar deposits, the interest in the United States was 1%, and when the governor of the US Central Bank was asked. USA That he increased it by half a point, he replied that he would not increase it as long as the unemployment rate reached 9%, that is, he linked the exchange rate with unemployment in society. This is part of the responsibility of the monetary authority, but we have not seen something like this in Lebanon despite all the awards and recommendations that the Governor of the Bank of Lebanon obtained.

It is useful to restore some of what Edmond Naim did when some of the banks fell. Based on the principle that the bank was a merchant, bankrupt banks in the Naim era were allowed to form their capital or mortgage real estate in exchange for loans from the Bank of Lebanon, or to partially deliver them to protect the depositors’ money. During that period, the Banque du Liban was able to establish a portfolio of real estate collected from the relapsing banks, the current value of which is estimated at between two and three billion dollars, so at what prices are these wallets sold today?

There is much to do at the Banque du Liban when reviewing our “books”. The composition of the central council must be reviewed and the dominance of the ruler over other sectors unrelated to it must be stopped. The reform lies in analyzing the true roots of the Bank of Lebanon, amending the monetary and credit law and implementing it. Didn’t you notice that parliament did not convene Riad Salameh to ask him about financial engineering? No one asked him what to do until he thought of himself as a god. It is a rotten and collapsed political system, with a rotten and collapsed central bank as well.

Friend Fouad al-Turk used to say, “We are down and not down.” The Governor of the Banque du Liban should implement the monetary and credit law and not harm depositors’ funds, but, before touching these funds, he could advise the state and abstain from playing the role of the financier. You could say you don’t have the money. Today they took deposits and loaned them to the state, to become ministers and fellow billionaires. A hungry minister is said to have left the ministry for up to $ 50 million.

The political system is the gateway. If this same authority remains, it is impossible to advance. I once told a leader about a flaw in the Bank of Lebanon, and he replied, “As long as the ruler gives me what I want, let him do what he wants.” If we continue to be doctrines, sects and militias, this mentality does not build a country or an institution. If we don’t change our political system and somehow head towards secularization and efficiency, then we are at risk. ”

* Former deputy governor of the Bank of Lebanon