[ad_1]

However, it was not the largest holders of US government bonds, namely Japan and China, that financed this increase in debt. Rather, these two countries worked to reduce their share of US debt, especially China.

There has been a slight increase in holdings of US bonds from other countries, noting that some of them are considered “safe havens” for US companies, such as Ireland, Luxembourg, the Cayman Islands and Belgium. The main parts of the new debt are related to the printing of money at the Federal Reserve, as well as the purchase of funds, banks and companies within the United States.

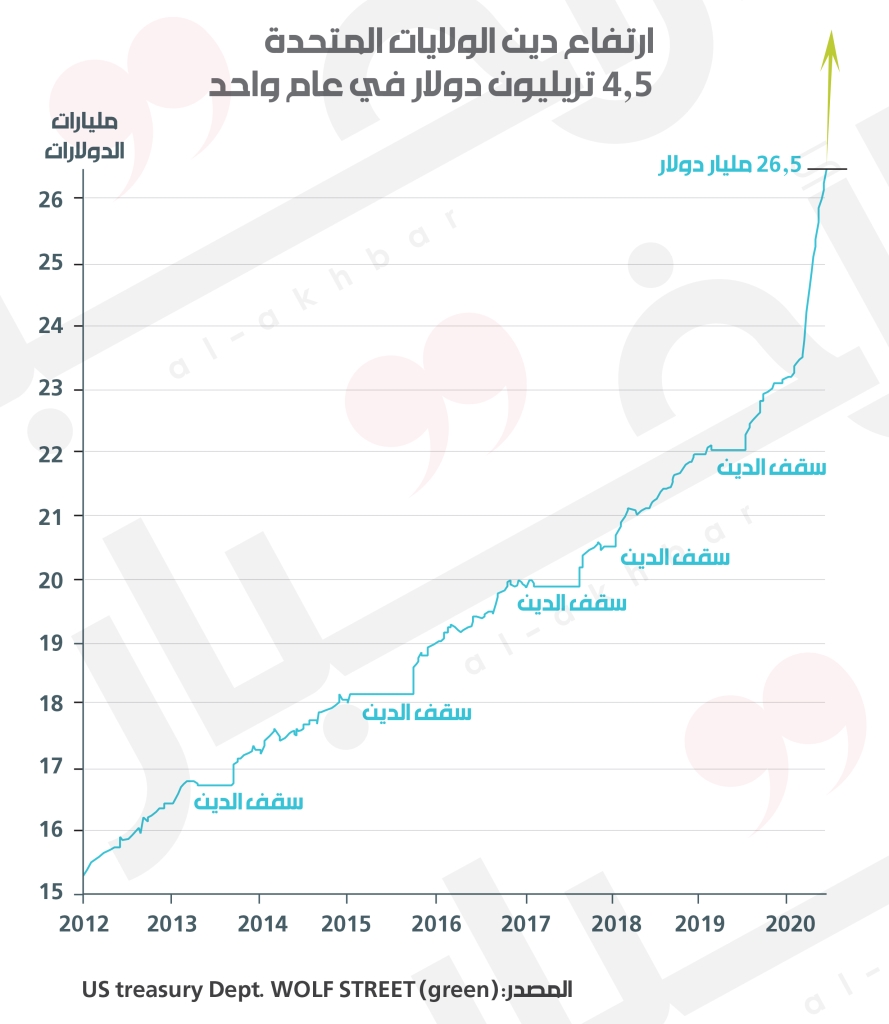

Click on the chart to enlarge it

Obviously, this path will eventually lead to a breakdown. China and Russia have significantly reduced their use of the US dollar in their business transactions in the past two years. And after your use of the dollar covered 90% of your transactions in 2015, it continued to decline until in 2020 it reached just 46%, and the path to zero percent may become very short.

In 2018, Finnish economist John Heilevig wrote an article based on a study by the Russian Awara Group that concluded the following:

In 2024, US debt will reach 140% of GDP, and the net increase in debt will reach between $ 10-15 billion from 2019 to 2024. By 2028, the United States will have spent $ 1.5 trillion on Interest payments, about 25% of the total budget.

There has been no real growth in America’s gross domestic product since 2007. Growth in public debt has outpaced nominal GDP growth for most of the years since 2007. However, the US accounts are full of manipulation. of numbers. The costs of wars generate a large deficit and considerably increase social spending, making it impossible to achieve a real reduction in spending.

Many Americans think that their pensions are a kind of contract between them and the state. But this is not the case. In principle, in theory, it is assumed that pensions and health costs should be covered through the establishment of funds. The problem is, they are actually bottomless! It’s a huge lack of coverage, estimated by the Government Budget Office at $ 46.7 trillion (Source: US Government Financial Report 2017).

According to Awara Group estimates, benefits, pensions and healthcare costs together will eat up 59% of the federal budget in 2028. The explosion in debt in 2020 and the extreme rise in unemployment due to the Corona epidemic will exceed even the Hellivig’s grim prognosis. According to statistics from the shadow government, the real unemployment rate in the United States in July this year was 30%.

In 2018, interest expenses increased to 7% of the state budget, which is in itself a very large percentage, but if Hellivik was right and interest expenses today have reached 25%, the same situation tells us that it is not a sustainable situation at all.

* Paul Stegan is one of the leading geopolitical analysts for Norway and Scandinavia.

Translated by Samir Taher