[ad_1]

After it was confirmed again that any integrated monetary economic program for Lebanon can only go through Washington to secure the corresponding agreements, all parties agree that there is no problem for the country’s poor and middle class to suffer more losses, at the same time. Waiting for the American signal. Approaching, Riad Salameh claims that the worst is over. But where was the country left after its politicians completely abandoned it a year ago?

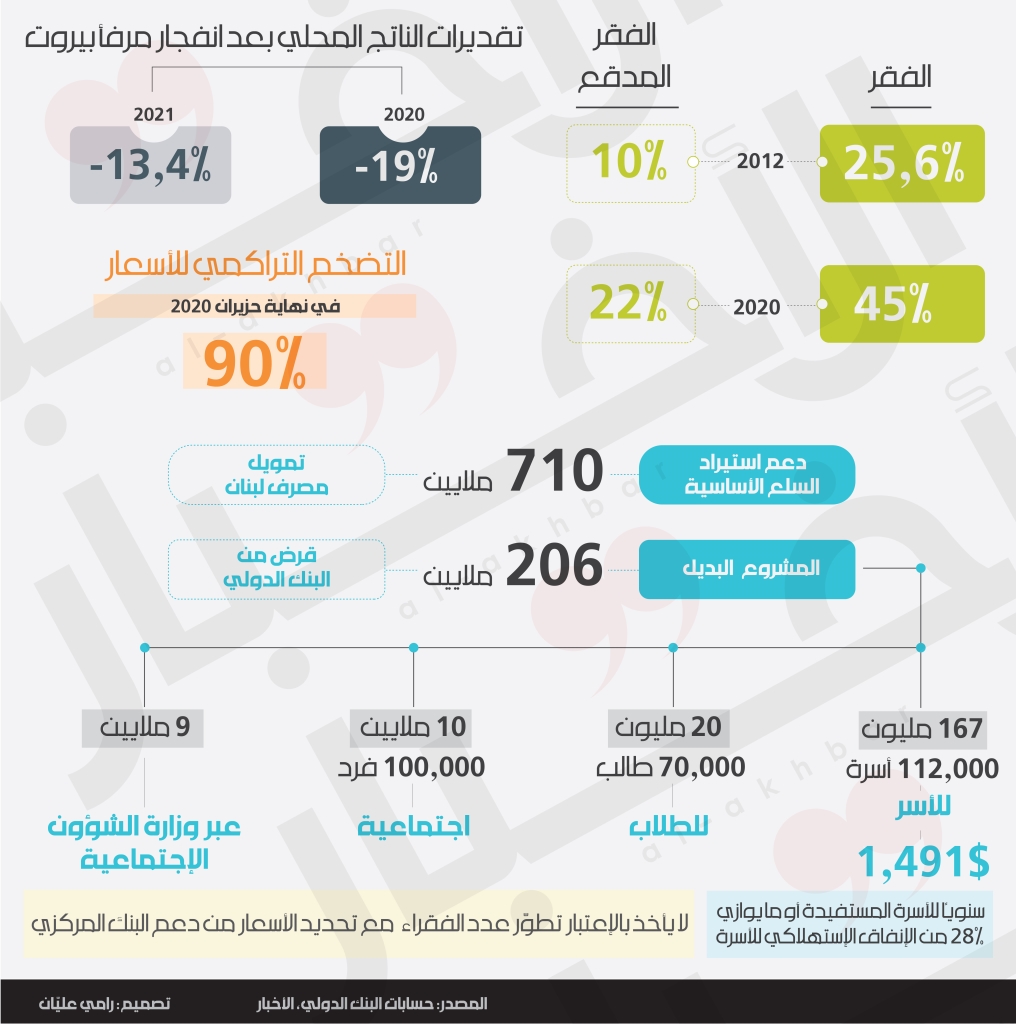

Click on the chart to enlarge it

The complex and complex crisis, which has worsened since last fall, will cause the economy to contract by almost a fifth this year, which means that productive activities that generate wages, profits and incomes of more than ten billion euros. dollars will evaporate completely. Thus, the recession directly affects vulnerable groups, and the rate of poverty and extreme poverty is expected to almost double from 2012 levels, reaching 45% and 22%, respectively.

In light of the local search for mechanisms to empower citizens through projects such as the support card, and the efforts of parties and leaders to buy political and sectarian loyalties through aid baskets, international organizations address this situation of practical but flat way. The World Bank’s emergency safety net support program takes the same approach, allocating $ 206 million in its first phase to be distributed among the various systems. Its authors presume that coverage will increase to include 112,000 very poor families, that is, from 1.5% to 22%. They forget that the increasing number of poor is the main transformative factor and not the success rate in reaching out to help them. The bank also adopts a parallel exchange rate of 3,850 pounds against the dollar. Is it really practical for the poor?

This is what brings us to the root of the “acute crisis (that) is behind us,” according to Riad Salameh. For what continued to aggravate the situation was a clear decision of the Central Bank and the political authority to liberalize the exchange rate and hit the purchasing power to impose a new balance in a framework of covert negotiations with the poor of this land. In principle, when the official exchange rate is left to market mechanisms to determine its levels in clearing houses as a result of supply and demand, the price does not experience a total free fall, unless the parallel market finally determine this balance is in turn in free fall.

This scenario applies to Lebanon. It is part of a group that also includes Argentina and Zimbabwe, which have recently seen rapid exchange rate deterioration in the parallel market. However, the case of Lebanon is exceptional because it reflects the policy of “death by a thousand stabs”, according to the expression used in a recently published work by the International Monetary Fund, which is a cold and appropriate expression at the same time. Such an option means, in practice, that if the monetary, political and financial authorities do not adopt the direct adjustment of the exchange rate closely and quickly to reduce the cost, the alternative is a gradual approach that will incur the economy in general and its most vulnerable groups, especially in high costs that can only be contained by significantly raising interest rates. Curbing the expectations of a future drop in the exchange rate. However, this approach may never achieve the desired balance and keep the country suspended between formal and parallel markets without a horizon, as is the case in Lebanon today.

And if the factors that constitute pressure on the exchange rate continue, the price is expected to weaken further until structural problems – political or economic – are addressed or direct financial and monetary results are achieved that positively affect current account operations. and the country’s position abroad and hard currencies. The Lebanese dilemma is that the existing political system is no longer suitable for the administration, much less for the tranquility of the national currency market. Perhaps the lyre will have great strides ahead and a thousand more stabs, before final stability.

Subscribe to «News» on YouTube here