[ad_1]

From “cash” to “digital”: What challenges?

The monetary economy is an economic system (or part of an economic system) in which financial transactions are carried out in cash and not through credit, standing orders or bank transfers. Developed countries are constantly moving towards a cashless economy, relying on digital technologies secured by banking infrastructure and communications technology.

In a study titled: “Bringing Digital Money to a Cash Economy”, Jackie O’Neill, Anupama Daryshwar, and Srihari Moralidhar highlight the pros and cons of embracing the digital economy. In his view, cashless payment systems (especially digital) aim to overcome the shortcomings of other payment mechanisms by making the payment process fast, secure and largely invisible to the user, as well as reducing costs. of payment transactions and increase the level of transparency in them.

But they argue that the speed of transactions is not a constant concern for users. That is, the social context in which the transactions take place also has consequences. Payments of all kinds are of great importance in the context of their conformity with the social and cultural requirements that determine the extent of their widespread use. The variety of practices surrounding the payment process, such as negotiation, support service, and multiple use of receipts, are very important in the social context to adopt any of them. The existence of a “trusted ecosystem” also forms the basis for older generations to adopt any payment mechanism other than cash, especially digital ones.

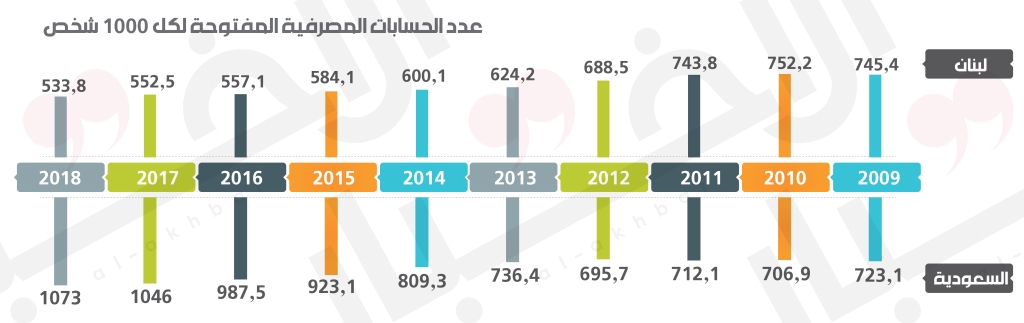

Click on the chart to enlarge it

Money in the world is an integral part of social practices. This means that incorporating money, whether it is cash, a card, or a phone, affects the way money is used and understood. According to the study, there is another challenge: the transition from a cash economy to a digital economy. People who do not do business with banks often rely on informal financial services that are often described as unsafe, uncomfortable and expensive. In countries with high poverty rates, it is difficult for banks to access these sectors efficiently due to cost, even if there are government mandates. Furthermore, it turns out that the biggest beneficiaries of digital payment mechanisms are employers, who reduce the cost of workflow by eliminating cash handling and reducing the chances of fraud.

Humphrey Moshe also addressed the complexities of the transition to the cashless economy in a study entitled: “The implications of cash transactions in relation to money laundering.” It says that there are a number of factors that explain the low levels of access to non-monetary financial services. The first is that most developing world countries have lower branch and ATM penetration demographically and geographically compared to developed countries. In addition, low population density and poor communications and transportation are likely to increase the cost of market exchange among agents in the economy, as people, goods, and services must travel longer distances. Low income levels and the lack of constant income streams also affect financial transactions for a large part of the population, who cannot use banking services. In addition, macroeconomic instability in developing countries, due to economic or political crises, encourages the use of monetary transactions. Banking conditions, such as high minimum balances and monthly fees required by some banks, prevent large sectors of the population from accessing formal financial services. Also, the documentation requirements for opening bank accounts can be a major hurdle. The list of products offered by financial institutions may not be adequate to meet the demands of the population, especially if the banking sector does not finance small businesses or projects related to agriculture.

Fight against money laundering

There is a key point that Moshe focuses on as a reason for the non-proliferation of cashless financial transaction mechanisms: the fight against money laundering. Anti-money laundering legislation adopted in several countries is believed to be a barrier to accessing financial services. Among the conditions to combat money laundering are the rigor of documentation and traditional identification problems and the prevention of innovative financial institutions from eluding them … The informal nature is often an obstacle to accessing formal mechanisms of financial negotiation, especially in the absence of formal documentation of property claims on real estate. That can be used as security. In other words, contractual claims cannot be asserted against companies that are not officially registered. This is because money laundering requires anonymity during financial transactions.

Moshe discusses the types of money laundering. The first may be the acquisition of luxury cars and high-value goods. The second is through the theft and smuggling of large amounts of cash. The acquisition and development of real estate can fall into the category of money laundering mechanisms, as well as companies and businesses that generate cash returns and show high profits. And perhaps most suspiciously, cash is moved in large quantities through the use of cross-border cash couriers.

The Lebanese Paradox

All the complications mentioned above prevent the emergence of a cashless economy in Lebanon. Today as before. The challenges and social contexts of payment processes in Lebanon make it difficult to adopt non-cash payment mechanisms. In addition to the limited diffusion of the commercial infrastructure that allows payment through cashless mechanisms. Therefore, it is not allowed to say that the Lebanese economy was a cashless economy. Even the banking infrastructure was also limited in this regard, either due to the limited spread of branches and ATMs outside the main cities, or because of the weakness of the services and digital technology that banks provide. The conditions and costs involved in opening bank accounts limit access to the banking system. Regarding the financial services provided by the banks, they did not respond to the economic demands of the population, but rather focused on personal and consumer loans and legalized loans for small agricultural businesses, which greatly limited the wide dissemination of banking services. On top of all this, the constantly increasing poverty rate in the last two decades in Lebanese society required the exit of a large proportion of the population from the banking system.

What Governor Riad Salameh says about Lebanon’s transformation into a monetary economy is suspicious and suspicious because financial transactions in the Lebanese economy were not originally digital.

When it comes to money laundering, every type of money laundering that Moshe refers to has been present in Lebanon in the last three decades. Most Lebanese can grope for evidence. The proportion of luxury cars that can be seen on Lebanese streets is staggering despite the economic decline of recent years. As for the number of businesses that continue to operate despite the shortage of customers, they are also large, and can only be noted, in addition to many other indications that the country was a corridor of a large monetary block whose origin is unknown or it is unknown. Originally, Lebanon did not embark on an attempt to move from a cash economy to a digital economy until recently. The amount of money a person can bring in at border crossings was limited to about $ 10,000 only, compared to previously unlimited amounts. Lebanon did not really adopt clear mechanisms in the banking system to combat money laundering until after the accusations made by the US administration against the Canadian Lebanese Bank. The collapse of the bank put a lot of pressure on the banking system. Faced with this accusation, the anti-money laundering law that was issued in 2001 was simple and perfunctory, but a completely different law was issued in 2015, and a set of laws such as the regulation of cross-border money transfer and tax evasion followed. their example … and since then, circulars related to the regulation of anti-money laundering mechanisms began to be issued. Such as the establishment of independent agencies in banks to monitor and report suspicious transactions.

What we can see in the statements of the Governor of the Banque du Liban on the monetary economy is that it refers to the presence of cash in the hands of citizens. Since the term money economy was first mentioned after the events of October last year, it has been associated with withdrawing sums of cash from banks and holding them in households. His focus on the issue increased after the opening of the airport and the influx of expatriates with their money to Lebanon. Of course, this money will not enter the banking system automatically and quickly, due to the loss of confidence in it. But this does not mean that its final destination will not be in the banking system, because in the end this money when it is used, whether to buy consumer goods, real estate, cars or any type of asset, will enter most of it into the banking system to pay debts or to open accounts to open lines. Credit for importation.

While some of the financial transactions in the Lebanese economy were conducted through non-monetary mechanisms, cash transactions were overwhelming due to weak banking and commercial infrastructure and due to difficult conditions, high cost, and disproportionate banking services. .. all this leads to the conclusion that the Lebanese economy was partly monetary. The main one (take, for example, the debts of merchants to each other, which do not go through the banking system), but what happened is that the percentage of non-monetary transactions in it decreased after that time due to the concern of the banking system. people for a collapse in the price of the lira. So why focus on this point? Is the goal a quick restoration of the BDL’s foreign currency reserves, after they have been dispersed? Or is the objective of causing international organizations to float the banking sector and intimidate them so that they do not turn Lebanon into a focus of money laundering, since most of the money that enters today does not enter through the banking sector that has been in the custody of US supervisory authorities for more than two decades?

Subscribe to «News» on YouTube here