[ad_1]

Lebanon suffocates

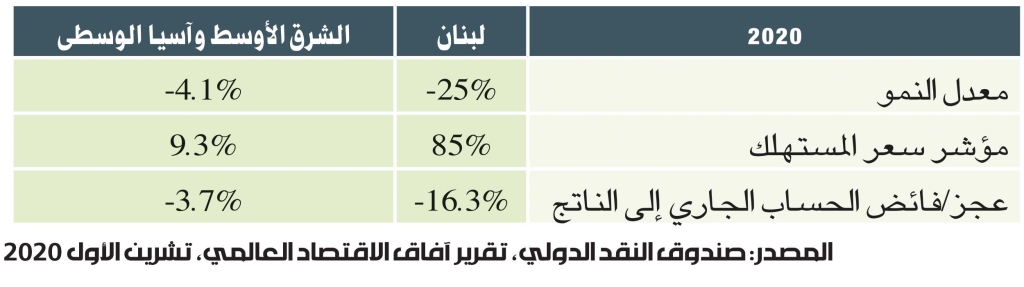

Lebanon is suffocating from the shortage of dollars that used to flow into the arteries of its economy to feed its open appetite for imports and consumption, its clientelist system and rampant corruption in its public sector, from border facilities to ministries. vital. In cases of political harmony, the sponsoring countries and international organizations support the sectarian system through donations and loans. However, changes in the regional and international scenario and with them the internal transformations of Lebanon place it on the margin of that balance. The best that can be hoped for today is a close agreement between Washington and Tehran after the US elections. Meanwhile, in Lebanon, the repercussions of the marginalization of the global financial system and submission to US sanctions will materialize. The complex and complex crisis is exacerbated by the Covid-19 epidemic and is pushing the economy to contract by about a quarter this year with no horizon on the next stage, according to the latest IMF report on the global economic outlook titled : “The long and difficult way up”.

Lebanon’s economic performance is by far the worst in the region. Globally, it is the second worst economy after Libya, the country that witnesses civil wars in motion, awaiting the arrival of the political process to a definitive solution to the reality of the militias. But in general, the Lebanese case has two sides: the Venezuelan side and the US side.

On the one hand, Lebanon is similar to the Venezuelan case. The Latin country, which is subject to US sanctions against external interventions to stifle its political management, is registering an economic contraction equivalent to that of Lebanon, but its currency crisis is equivalent to the crisis of the lira several times and this is reflected in the index of consumer prices, which is up 6500%.

On the other hand, the case of Lebanon is similar to that of the United States. Although the index of global social unrest has plummeted dramatically since March 2020 and reached its lowest level in five years as a result of people’s concern about facing the virus, “Lebanon and the United States are the two most prominent examples of anomalies.” , notes the IMF. In the first country, protests against the existing regime and the call for political and economic change continued, and in the second country, clashes between civilians and police intensified due to the massive proliferation of weapons.

Affected by the coronavirus and a serious political crisis, Lebanon is recovering from the economy while waiting for political solutions. Right now, its vulnerable social strata are suffering from rising unemployment and inflation. The experts of the Monetary Fund estimate that the consumer price index will rise in the last quarter of this year to 145% year-on-year.

A partial recovery led by China

IMF experts confirm the beginning of the global economic recovery from the recession that the epidemic has generated during 2020. In the last remaining quarter of the epidemic there is a rebound in the movement that is expected to extend over the next year so that the global economy grows 5.2%. »That cost the global economy 4.4% of production.

This recovery will not be identical between different groups of countries, from industrial to emerging and poor. The growth of developed economies, led by the United States, the European Union and Japan, will reach 3.9%, while the economies of developing and emerging countries will grow at a rate of 6%.

It is noteworthy that China, where the epidemic began in the last quarter of 2019 (according to scientifically accepted estimates to date), will register one of the best global growth rates, reaching almost 10%, since “economic activity has returned to normal faster than expected the day after the country’s reopening. At the beginning of April, and after production registered surprising growth in the second quarter due to solid support policies and strong exports, ”according to IMF experts.

In effect, the epidemic broke the chains of production and trade between regions and established protectionist policies in many joints, including medical tools and equipment, and even microchips. As a result, international trade contracts more than 10% this year and, with the drop in demand, the price of oil fell by a third. However, supportive economic and monetary policies adopted by governments, including the Chinese government, revived national business cycles. Since Covid-19 became a pandemic, as of early last spring, the value of financial and monetary stimulus packages, including tax breaks and direct support measures, has reached $ 6 trillion. . Major central banks are expected to maintain their current measures for the foreseeable future until the end of 2025.

All these factors are related to the measures to stimulate companies, the interests of the countries, the extent of the second wave of spread of the virus and, subsequently, the chances of success of the vaccine and the capacity of health systems to absorb patients, but the human aspect of the prevailing global crisis remains the most important. Wage earners and day laborers who depend on irregular work witness a sudden decrease in their income and as a result more than 90 million people may fall below the extreme poverty line, defined on the basis of a daily income of $ 1.90.

At the same time, the economic crisis will have a severe impact on the indicators of socioeconomic inequality. The most vulnerable groups, ie young groups from the labor force to women, will be more affected than other groups. Likewise, according to the Fund’s research, the burden of the crisis falls indefinitely on the different economic sectors, since some benefit from the possibilities of working remotely, while this option will not be available in other areas, which it entails the elimination of jobs and layoffs. And with higher unemployment rates, the deepening patterns of inequality observed since the 1990s in developed countries and some fast-growing emerging countries will worsen.

In addition, the debt factor that ultimately falls on the shoulders of low-income and middle-class families is added through taxation and restructuring and reprogramming policies that are generally reflected in social benefits. While current low interest rates would contain the repercussions of high indebtedness, this situation only applies to developed countries that enjoy many negative interest margins on their bonds. In developing and emerging countries, the increasing proportion of public revenues that will be absorbed by servicing the public debt will mean that less revenues are allocated to sensitive areas such as spending on social needs; It is an increasingly important expense to get out of the repercussions of the epidemic and the recession that it has left behind.

Subscribe to «News» on YouTube here