[ad_1]

Click on the chart to enlarge

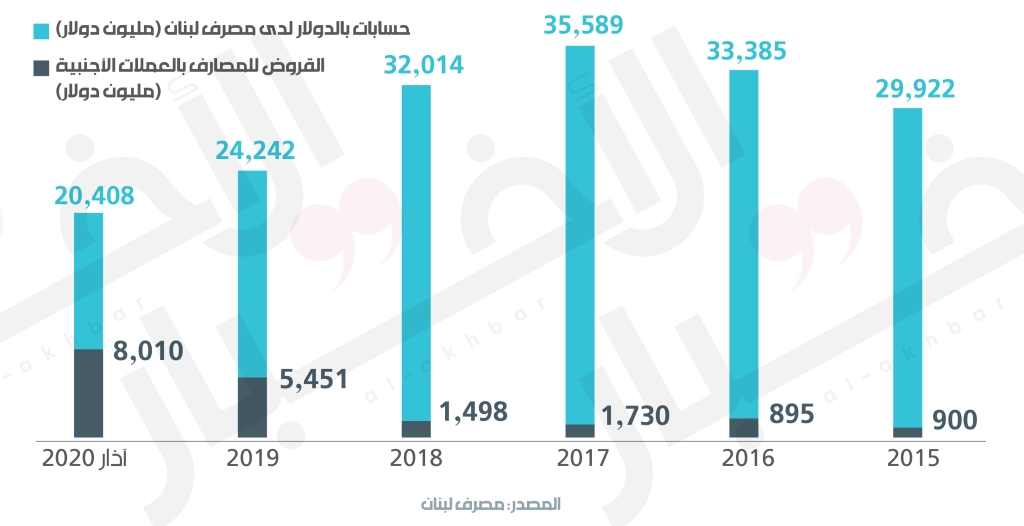

Days passed and Salameh continued in his post as governor, while the lira sank and the dollar exchange rate against it rose, in less than a year, from 1507.5 liras on average to 8700 liras at the end of the week last (in the parallel market). As for the Banque du Liban, it increased its foreign currency loans to banks, from $ 1.5 billion at the end of 2018 to $ 8 billion at the end of March 2020. There is speculation about additional loan amounts in the period covered. between March and September of the current year, but there are no guarantees of its real existence. . Until the end of March, the number of banks that acquired these loans was 15 banks. Regarding the concentration indices in loans, they were the following: one bank acquired 34% of total loans, two banks acquired 58.5% of total loans and four banks received 88.5% of total loans. loans, six banks obtained 97.4% of the loans.

fifteen %

It is the mandatory deposit percentage imposed by the governor of the Banque du Liban, Riad Salameh, on bank deposits in dollars, according to an internal circular and not under any legal text since it is imposed on deposits in Lebanese pounds. Therefore, a distinction is made between mandatory deposits that are not related at all to the mandatory reserves imposed by Basic Decision 7835 entitled “Mandatory Reserve”

The loans granted by the Banque du Liban to banks were in foreign currencies convertible abroad, they are subject to an interest rate of 20%, which means that they have a high interest and suggest that the objective of their existence is to stop banks to obtain these funds. On the other hand, the topic turned out to be completely different. These funds obtained by the banks of free foreign currencies, that is, the so-called “fresh dollars” or “fresh dollars” or even “real dollars”, were recorded in the budget of the Banque du Liban as assets (assets), while the interests were paid by the banks in so-called “dollars”. Fake “or” local dollars. “In other words, while banks used to make use of fresh money to pay their obligations abroad, whether these obligations were funds transferred” smuggled “, loans opened with correspondent banks or hedging of positions to lose investments … the interest on these funds was paid from The dollars held in the Banque du Liban, which were previously used or deposited there, coveted high interest. This fresh money, instead of being used by the Banque du Liban with “wisdom” to finance the import of commodities for as long as possible, decided to use it to rescue the banks from the impasse they had gotten into.

At the end of 2018, the Banque du Liban had foreign accounts worth $ 32 billion in foreign currency, in parallel with loans to banks for $ 1.5 billion, but at the end of 2019 the value of the amounts in external accounts amounted to $ 24.2 billion, while the value of loans to banks amounted to $ 5.4 billion, then ended In March, a decrease in the value of accounts to $ 20.4 billion compared to bank loans worth $ 8 billion.

During the 15 months ending in March 2020, the value of dollars in foreign accounts decreased by approximately $ 11.6 billion, of which 70% went to banks

The fall in external accounts during this period (15 months) amounted to 11,600 million dollars, of which around 70% was allocated to bank budgets. These are Salameh’s priorities, and they did not change during the following months, that is, between March and September of the current year. Rather, the mechanisms and channels it uses were different. During this period he created a huge money supply and pumped it into the market, while his decisions fluctuated regarding the payment of transfers from abroad, in currency. In which it was transferred (a dollar or euro is calculated on the exchange rate against the dollar), or the imposition of the payment in the local currency at an exchange rate that he arbitrarily set. Until the end of September, the value of the money supply in pounds was 23.743 trillion pounds, an increase of 13.180 trillion pounds compared to the end of December 2019, and 17.269 trillion pounds compared to the end of September 2019. Compared to This mass, Salameh’s own estimates indicated that the dollars available in the local market, which are Most of it was withdrawn for the purpose of storing it in homes, not to exceed $ 5 billion. In other words, the size of the block in pounds equals $ 6 billion at the exchange rate of 3900 pounds (the platform), which is believed to be composed of a group of accounts that take into account the demand for dollars of the market size consumers of imported subsidized and unsubsidized goods. Although there are estimates that indicate that the amount of $ 5 billion was exaggerated, the imbalance between the size of the monetary block in circulation in pounds and dollars is an indication of the additional issuance by the Central Bank of money that leads Lebanon towards a massive price inflation, to bottom out after years. Where hell is promised.

Subscribe to «News» on YouTube here