[ad_1]

Click on the chart to enlarge it

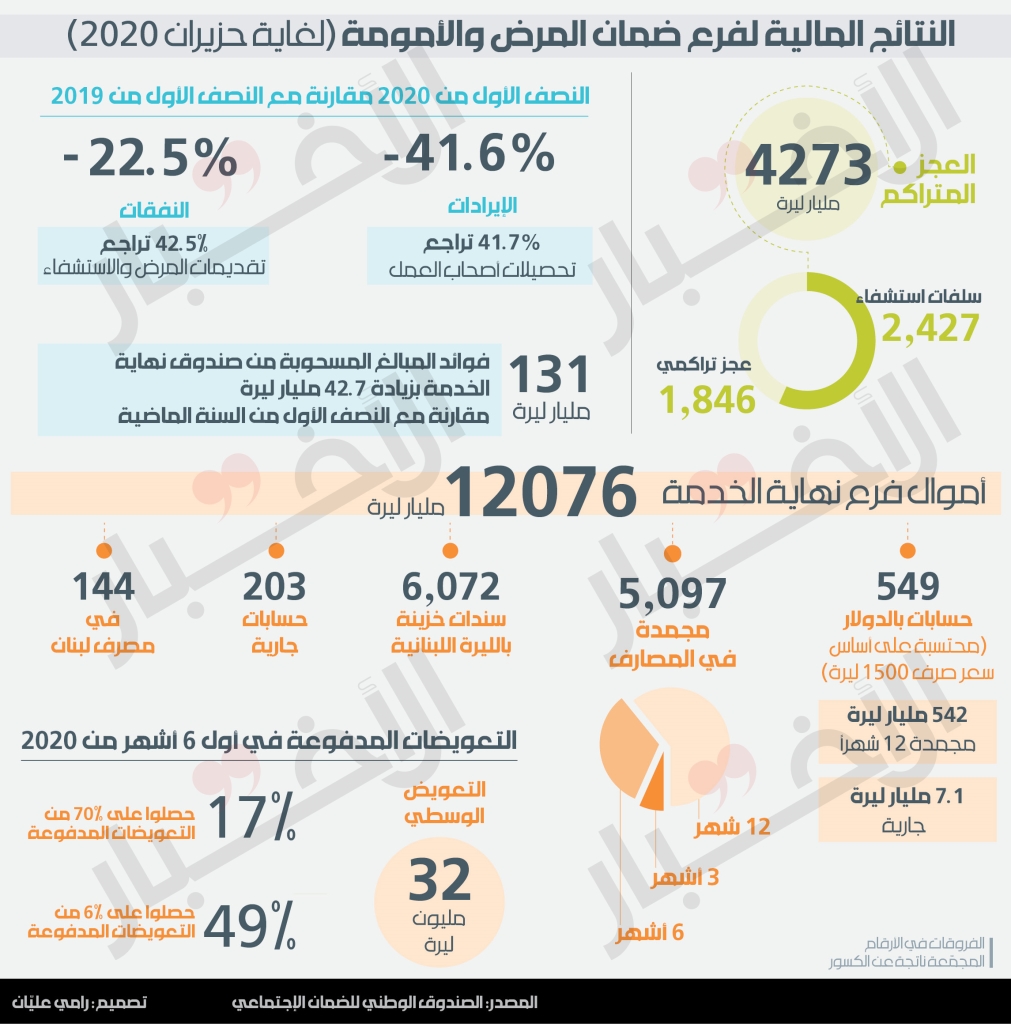

In practice, the shortfall is all illegal withdrawals from the end-of-service branch. Withdrawals now represent 36.5% of all funds available in this branch, which means that in practice they are almost irreplaceable losses. This is in addition to a greater loss incurred by the end-of-service compensation arm following the erosion of the value of your money due to the rise in the parallel market exchange rate to around 8,000 pounds per dollar, and inflation of the Prices of raw materials that consumed more than half the purchasing power of the average salary in 2020 alone, that is, without calculating the loss. Accumulated by inflation. In this sense, the real value, or purchasing power, of termination funds has been considerably reduced, and is threatened with further erosion due to the annual increase in health expenditures incurred by the Sickness and Maternity Fund in 7% per year, according to figures from the Finance Committee of the Insurance Board of Directors. A high rate, which will lead to an acceleration of the worsening of disability and more compensation in the absence of urgent and radical measures. This was at the end of 2018. Since then, no urgent or drastic action has been taken.

The only emergency measure that was taken about a month ago when the Department of Social Security asked the Banque du Liban to treat termination compensation paid to those who left work or reached the legal age or the age of 64 as deposits in dollars to hedge on the basis of an exchange rate of 3900 pounds per dollar (to convert to The dollar is based on the price of 1520 liras, then it is converted back into liras at a price of 3900 liras). So far, the Central Council of the Banque du Liban has not issued a final approval pending the study of the matter, but it was found that covering the total value of the compensation during the year 2020, estimated at more than 1 billion pounds, will impose to the Banque du Liban the creation of additional amounts of cash estimated at 1.5 billion pounds. Annually, or the equivalent of 130 billion pounds per month, that is, the money supply in circulation in pounds will increase on average by 10%, compared to the current average monthly increase estimated at 1.3 billion pounds.

What will happen is that the Banque du Liban will support compensation by creating cash, just as it seeks to stop subsidizing food and staples and create additional cash worth more than 1,100 billion pounds a month, which means an increase in the amount of cash by 85% on average. Creating cash in this way and with such acceleration is a big problem, because it will increase the demand for dollars and can contribute to further weakening the Syrian pound. If the dollar rises, prices will inflate even more and the Central Bank of Lebanon will have to generate more cash. It is a closed cycle that will end in a catastrophe with uncalculated consequences and further erode the purchasing power of the funds remaining in the end-of-service fund.

Faced with this situation, the only thing that Social Security proposes is to obtain an emergency advance from the Lebanese State to face the crisis, increase contribution rates, or force the State to pay its debts for the guarantee, since increasing the amount of money will increase the purchasing power of compensation! All of these solutions come from the same “box” that has prevailed for decades. The problem is about a very late release of the guarantee to protect workers’ compensation, if not too late. In addition, the increase in the insurance deficit will force to withdraw more claims in the coming months and use them to pay hospital advances. It is the dominance of capital over labor in its clearest form. It is a sovereignty in which the political leaders who intend to represent the workers under their custody of the fund participate, and their sponsorship of the General Labor Union, which has 10 members of the Governing Board of the Insurance Board. They represented workers the day the debate to raise wages in 2012 raged, while unfazed if workers’ compensation is lowered or almost entirely used to pay for hospital advances.

Subscribe to «News» on YouTube here