[ad_1]

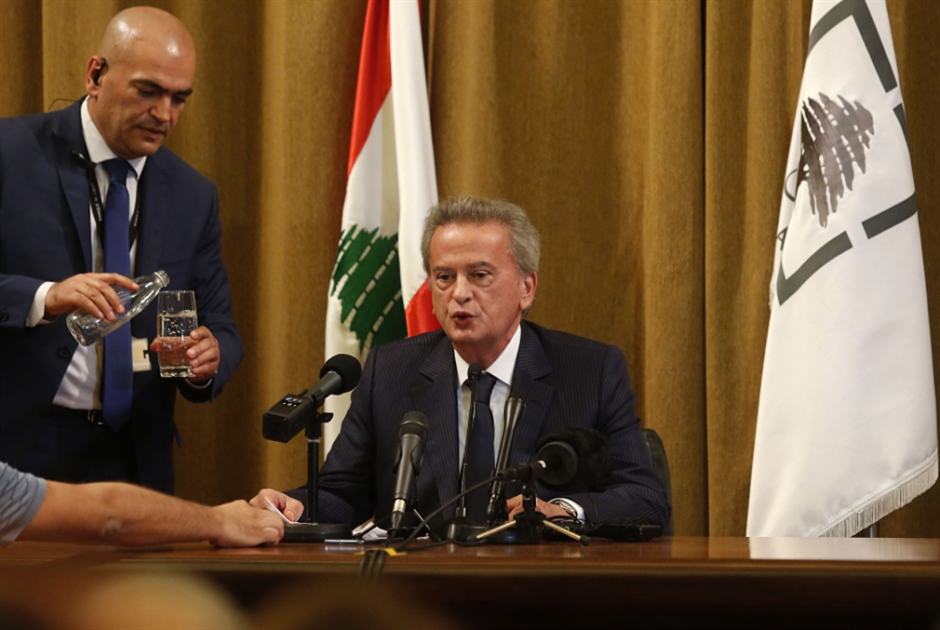

The results of the investigations constitute the first presumption of Salama’s participation in the threat of the security of the national currency, which means a clear violation of the obligations imposed by the Cash and Credit Law and the establishment of the Central Bank. Perhaps this explains some of the words of Prime Minister Hassan Diab, when he spoke of “suspicious ambiguity” in the performance of the Governor of the Bank of Lebanon regarding the lira’s exchange rate.

The Cash and Credit Law (in its article 70) gives the Central Bank the highest priority to maintain the integrity of the cash. Due to the importance of this issue, it is mentioned twice in the article, as follows: “The bank’s general mission is to preserve cash to ensure a permanent basis for economic and social growth. The mission of the bank in particular includes the following : – Preserve the integrity of Lebanese cash. ” After that, other tasks come, such as “maintaining economic stability” and “maintaining the integrity of the conditions of the banking system.” In the same law, paragraph (b) of Article 83 establishes the following: “The bank may, in exceptional cases and in agreement with the Minister of Finance, buy and sell foreign currency to the public.” Then, the law defines this matter in exceptional cases, and links it in agreement with the Minister of Finance, due to the seriousness of this matter. And if the Prime Minister and the Minister of Finance asked Salama, at their meeting with him on April 22, to interfere in the exchange market, then they told him that it was his duty to offer him dollars for sale, in order to maintain the lira price and reduce the severity of the collapse, so if research reveals that it did the opposite Intervention to buy dollars not to sell them.

This action leads to asking more than one question:

1- Does the Minister of Finance, Ghazi Wazni, know what Salama is doing and approve it? My weight demands that this be clarified.

2- Does the government not worry about holding an extraordinary session that Salameh requests to question him about what he is doing and give him a clear and direct order that it is necessary to intervene to stop the collapse of the lira?

3- Will the Financial Prosecutor, Judge Ali Ibrahim, dare to summon Salama to question him as a suspect in altering the security of national criticism, in what constitutes a clear and explicit violation of his labor duties?

4- What does the government expect to dismiss Salameh and appoint a replacement? What is the price that Lebanese society must pay under the pretext of fear of the repercussions of Salama’s dismissal?

5- Isn’t a security performance an indication that you are handling a bankruptcy case at the central bank and that you have been lying for the past period about the size of the Bank of Lebanon assets in foreign currencies? If he had around $ 20 billion, as he claimed before the Prime Minister and other officials, and after his decision to confiscate Lebanese money transferred from abroad in foreign currencies, and after Circular No. 148 in which he practically converts dollars on accounts of less than $ 3,000 in Lebanese pounds, what did “Why are the dollars” on the market need? Financing of importation and transfer abroad does not require tickets, since the dollars in restrictions and on computer screens are sufficient.

Would the financial prosecutor dare to summon Salama to investigate him as a suspect?

He is expected to justify the security of what he is doing in Circular No. 149, in which he decided, contrary to law, to establish a platform for banking. But that will not absolve him of the judicial responsibility that today is in the custody of Judge Ali Ibrahim. Will the last one do it?

Investigation follow-up

On the other hand, the Financial Prosecutor referred to the Ramez Seal, dedicated to banking and sending money with red wax. Parallel to the investigation carried out by the security forces under the supervision of the Public Finance Ministry, the first interim investigative judge in Beirut, Charbel Abu Samra, questioned two detainees in the lira piracy case. Yes, and decided to leave them with a financial guarantee of a million lire, after it became clear that they had bought dollar money to pay off loans or pay college fees. Forwarded the file to the Financial Prosecutor’s Office. Abu Samra had previously questioned seven detainees, including money changers and intermediaries, and released them with a financial guarantee of £ 10 million for each detainee. An investigating judge in Beirut also questioned Wael Sadiq, one of the money changers, and released him under a financial guarantee, but the Public Finance Ministry appealed the release.