[ad_1]

Click on the chart to enlarge it

Click on the chart to enlarge it

News reports have highlighted the personal crises caused by the impact of Covid-19 for migrant workers who lost their jobs and were unable to return to their countries due to the disruption of transportation between countries during the lockdown period. It soon became clear that the external effects of the crisis that hit these individual workers could also overwhelm entire countries, and this is due to the importance of temporary work abroad to support families through remittances and the importance of these transfers for entire economies.

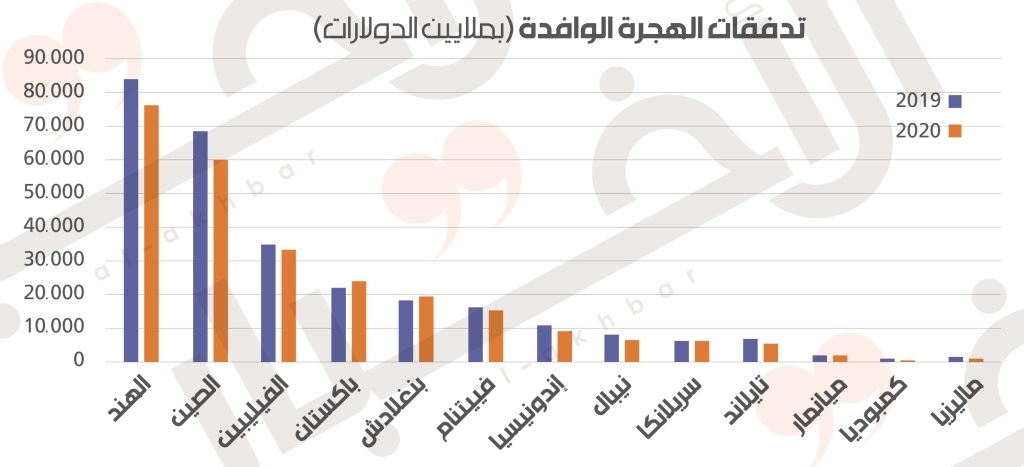

Asia was particularly negatively affected. There are 10 Asian countries, each of which received more than $ 10 billion in remittances in 2019. These remittances account for about 47% of all remittances to low- and middle-income countries, and 36% of the remittance flow in all the world. According to World Bank estimates, India was in the forefront, with inflows of more than $ 84 billion in 2019, followed by China, the Philippines, Pakistan and Bangladesh. Within Asia, South Asian countries appear to be more reliant on remittance flows from migrants.

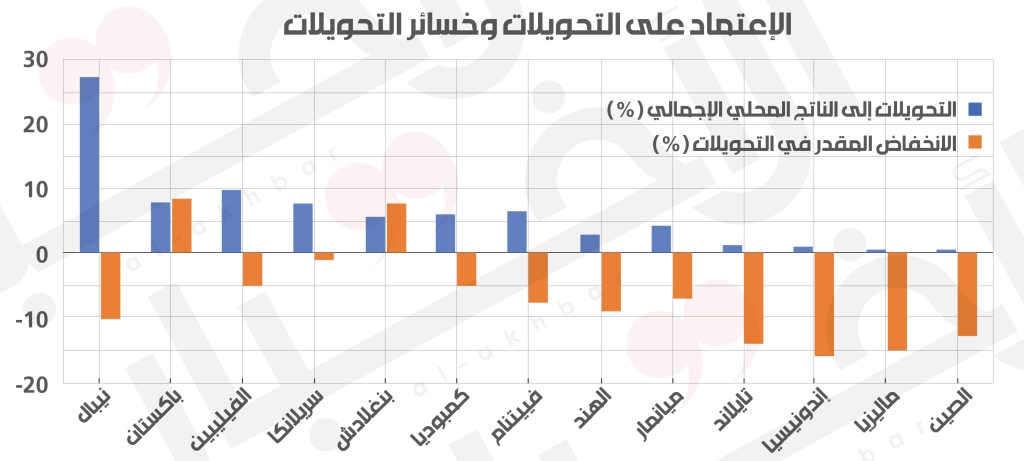

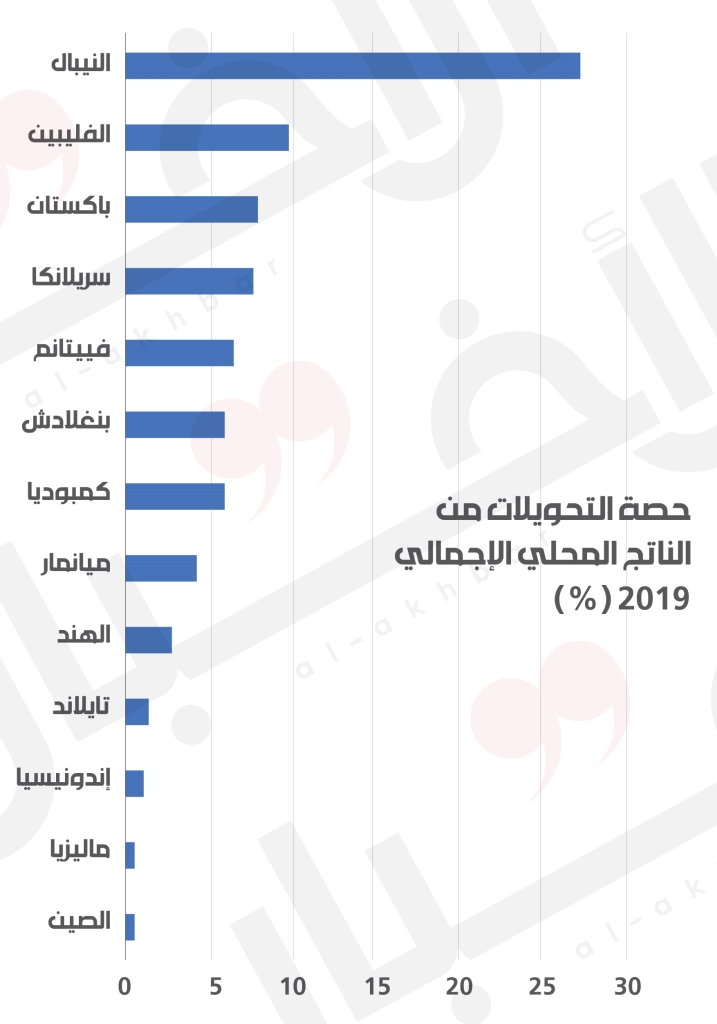

However, the absolute levels of remittance flows do not explain the vulnerability of all countries. By looking at the volume of remittances relative to GDP, you can see the importance of remittances for different economies. The value of remittances to India amounted to $ 83 billion in 2019, representing 2.8% of its GDP, while the value of remittances to Nepal amounted to $ 8.2 billion, representing 27% of its GDP. In terms of importance to GDP, behind Nepal, the countries that seemed exposed to any drop in remittances were the Philippines, Pakistan, Sri Lanka, Vietnam, Bangladesh and Cambodia, which received remittances equivalent to between 5% and 10% of the total. GDP. Most of these economies are among the smallest (and in some cases weakest) in the Asian region.

But even the index of dependence on remittances relative to the size of the economy does not fully reflect economic weakness;

First, remittance flows tend to be concentrated in some areas of large economies, such as Kerala in India, which makes remittance flows relative to the state’s GDP very high. Of the $ 83 billion in flows to India in 2019, Kerala is estimated to have received between $ 14 billion and $ 15 billion, which is 30% of the state’s GDP. So even if India as a whole is not affected by the impact of remittances, states like Kerala will be hit hard.

Second, it appears that the projections indicate that the decline in remittance flows could differ significantly between countries, and that decline may not even occur in some countries. Nepal, which is heavily dependent on remittances, is expected to record up to 27% of its GDP in 2019, and remittances will decline in 2020 by more than 10%. India is expected to register a decline of almost 9%, but these remittances represent only 2.8% of its GDP. Interestingly, Sri Lanka is expected to suffer a remittance loss of only 1%, and Pakistan and Bangladesh are also expected to see increases in remittance flows, even if they are not the same size as in previous years. One of the reasons for the differences in the decline in remittance flows could be differences in the dominant destinations of migrants and differences in the occupations in which they concentrate, because the destination countries vary in the severity of the unemployment crisis resulting from the epidemic and the associated freeze in economic activity.

Smaller and poorer countries are the most affected by the decline in remittances from expatriates, however, the negative impact cannot be fully identified without considering the role of remittances in providing foreign exchange needed to finance basic imports.

But this cannot explain the increase in remittances in Pakistan and Bangladesh. The World Bank’s “Migration and Development Report 33” issued by the World Bank in October 2020 attributes the increase in remittances to these countries “at least in part” to what it calls the “Hajj effect.” Migrants are transferring money saved by postponing Hajj to Mecca due to the significant drop in the number of visas issued after the pandemic. If this is true, then it means that the figures for these countries do not reflect the real impact of the epidemic on the income of their migrants or on the ability of these migrants to transfer money home.

In light of the factors, it appears that the smallest and poorest countries are the most affected. The negative impact cannot be fully recognized if only the decline in the ratio of remittances to GDP is observed, because the decline in GDP resulting from the crisis mitigates the impact of the decline in remittances on this indicator. However, if we add to this the role that remittances play in providing the necessary foreign exchange to finance basic imports and the negative effects on the balance of payments that the fall in remittances may have, the impact of the crisis will seem stronger.

Therefore, the transmission of the devastating effects of the epidemic caused by this route could be of great concern to small and poor developing countries such as Nepal. This reinforces the case presented for a number of other reasons for an international response involving debt forgiveness and substantial enhancement of additional facilitating assistance, particularly for those countries.

* This article was published on networkideas.org on November 17, 2020

Subscribe to «News» on YouTube here