[ad_1]

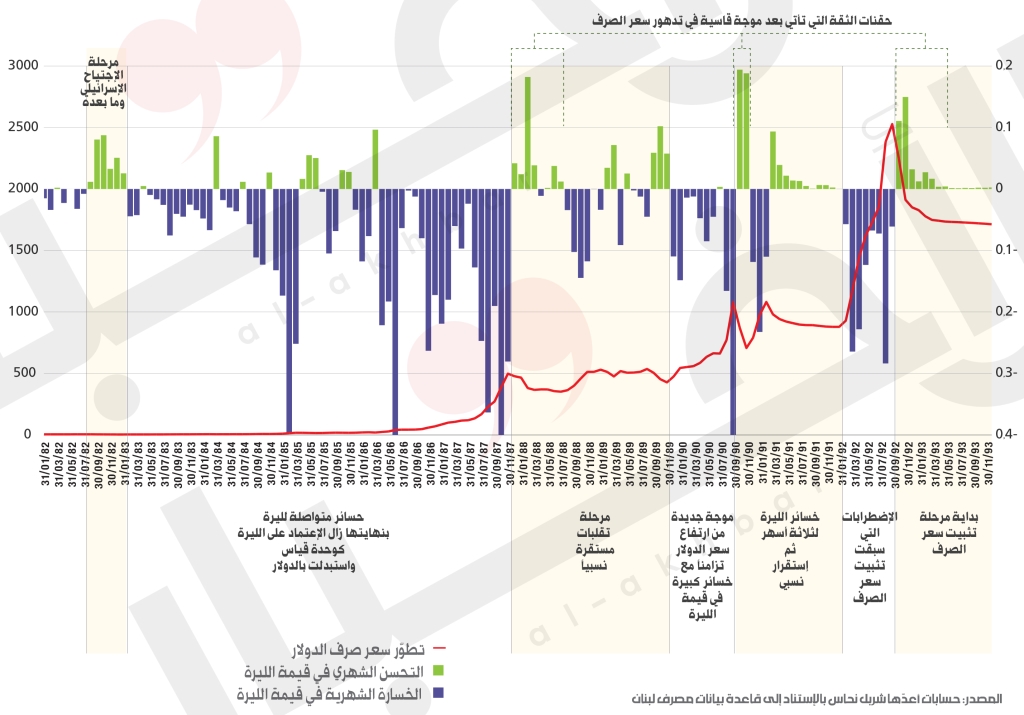

– In the period from July 1982 to early 1983 (the stage of the Israeli fury and its aftermath), the value of the Lebanese pound improved against what is believed, and there are many explanations for the reasons for this improvement with the flow of money from abroad.

Click on the graphic to enlarge

– In the period between February 1983 and 12/31/1987, the Lebanese pound suffered the highest volume of losses, coinciding with the increase in the value of the dollar. In this period, the price of the dollar jumped from 4.26 pounds to 498 pounds. All these losses (indicated in red) were needed to set the matter in a clear equation when adopting the unit of measurement and, consequently, the price: giving up the Lebanese pound and replacing it with dollars. Of course, there were many political and security events during this period.

– In the period from late 1988 to August 1990, the lira improved again or at least settled within a limited range of fluctuations (fragile stability), but rather at an exchange rate ranging from 400 pounds against the dollar and 771 pounds at the end of the period. However, it is interesting that at the beginning of this period, specifically between the end of 1989 and March 1988, the lira improved, and there are obvious reasons for this. After all these strikes for more than five years, some confidence was restored because the lira’s losses were significant and allowed the entry of new money that financed the purchase of assets after their prices dropped to undervalue. This is precisely what is happening to restore confidence and this is the pattern that can be expected in the current wave of sharp fluctuations in the exchange rate.

– In the following period, and over a two-month period (October 1990 and November 1990), the lira improved due to a short-lived confidence “injection”, followed by losses in the lira for three months, and then It ended with an earnings ceremony similar to the previous pattern of earnings earned due to confidence injections that come after massive deterioration. In political, security and critical situations.

The next wave of losses suffered by the lira was in the period before the late Rafik Hariri came to power. This stage started in February 1992 and until September 1992. After that, the graph clearly shows (the green line) the gains made by the lira, but the exchange rate has reached its maximum or monthly average of £ 2527.75 against one dollar.

Of course, these stages can be read in detail along with political and security developments, but the main thing is that they involve clear and fixed patterns of the high price of the dollar and its fragile stability in the context of confidence injections that benefit the owners of funds to buy assets at low prices. Today, the importance of this reading seems to know what lies ahead for Lebanon, the lira exchange rate, price inflation and who will pay for it. It is clear that we are still at the beginning and it is not clear whether there is the capacity or the desire to stop these developments and absorb their social and security implications.