[ad_1]

The general investor subscription for the IPO of Big Hit Entertainment, which belongs to the world-class boy group BTS (BTS), closes on the 6th. The competition rate on the first subscription day was lower than that of Kakao Games But with demand concentrating on day two, you’re paying attention to whether you can set a new record.

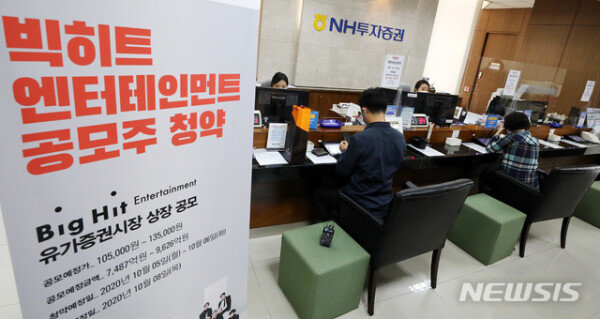

According to NH Investment & Securities, Big Hit’s representative listing organizer, the day before the first day of underwriting, the competition rate for underwriting Big Hit’s public offerings was 89.6: 1 combined with the four companies. of values. A total of 8.6242 billion won was removed from the underwriting margin.

It did not hit the record for Kakao Games, which was entered last month. Kakao Games posted a competition rate of 427.45 to 1 on the first day of subscription, and the subscription margin was 16 trillion won. This is higher than SK Biopharm’s subscription in June (competition rate of 62: 1 on the first day, subscription margin of KRW 5,941.2 billion).

In general, the demand for subscriptions tends to be concentrated on the second day, which is the deadline, rather than the first day. Prior to that, SK Biopharm’s subscription competition rate soared from 62 to 1 on the first day to 323 to 1 on the second day, and Kakao Games hit 1524.85 to 1 on the second day from 427.45 to 1 on the first. day. It is also observed that the final competition rate will increase even more, considering the recent craze of public offerings of shares and BTS’s global ‘fandom’Ami’. Actually, according to the Financial Investments Association, the balance of the CMA (Comprehensive Asset Management Account) for securities companies that can buy and sell financial products such as funds and equity-linked securities (ELS) per day 29 last month before subscription amounted to 64.9352 billion won. This is approximately 4 trillion won more than the day before the Kakao Games subscription (60 trillion out of 963.3 billion won). On the same day, the investor’s deposit was 53.8801 billion won, which was less than that of Kakao Games (60.527 billion won).

As competition increases, investors are less likely to receive public offerings. Big Hit’s public offering price is 135,000 won and the number of general public offering shares is 1,426,000 shares. The sale price itself is higher than Kakao Games (24,000 won) and SK Biopharm (49,000 won).

If the underwriting margin is 100 trillion won, the competition rate becomes 1038 to 1, and it takes about 70 million won to receive a week. If the subscription margin reaches 60 billion won, which is similar to Kakao Games (58,554.3 billion won), you will receive a week for 42 million won with a competition of 623: 1.

Big Hit general investor subscriptions can be made with NH Investment & Securities, Korea Investment & Securities, co-host of Mirae Asset Daewoo Securities and Kiwoom Securities, the acquisition company.

NH Investment & Securities has the largest stake of 64.8182 shares, followed by Korea Investment & Securities (55.5584 shares), Mirae Asset Daewoo (18.5195 shares), Kiwoom Securities (37,039 shares). ) In order. The redemption of the underwriting margin will be automatically transferred to the brokerage account on the 8th.

[서울=뉴시스]Copyright by dongA.com All rights reserved.