[ad_1]

Inflation was also revised from “weakened demand and oil prices, which fell sharply earlier, to curb inflation” in January, to “inflation continues to fall below 2%” in March.

Hana Financial Investment’s economist Joong-Hyuk Na assessed that it was very similar to the January statement, except for the economic assessment in ‘Focus on March, reaching the highest level of verbiage’.

While there was no significant change in the content of the statement of confidence that was felt in the strongly improved economic outlook, the economic outlook released each quarter (Projection Materials) markedly improved compared to last December, giving officials of the Fed a considerable level of confidence in the economic recovery. It was said to imply that it is coming.

The economic growth rate and unemployment rate forecasts for this year were considerably revised to 6.5% and 4.5%, respectively, compared to last December (4.2% and 5.0%).

In particular, this year’s growth rate, which was adjusted up by 2.3% p compared to last December, and the forecast for next year’s economic growth rate, which has been revised up again by 0 , 1% p (3.3%), are due to the supply. of vaccines and strong economic stimulus measures from the Biden administration, suggesting that the US economy will quickly rebound from the economic shock of Corona 19.

On the other hand, the forecasts for general and basic inflation of personal consumption expenditure (PCE) for this year were 2.4% and 2.2% (last December, 1.8% and 1, 8%), respectively, which caused considerable inflationary pressure along with the economic rebound in the form of V Show that it will be.

However, in view of the fact that the median dot plot is still presented at 0.1% for 2023 (4 out of 18 people claim interest rate increases once or twice in 2022, and 7 people in 2023 claim rate increases of interest more than that). It tells us that we will hold a very dove-like stance until we can see the economic recovery.

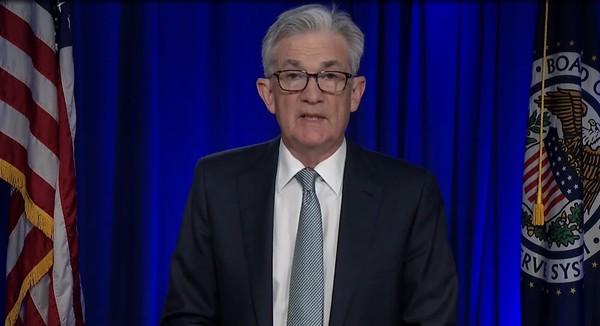

The Economist interpreted in the same context that “President Powell is temporarily watching inflation through a press conference, and for policy changes like downsizing, we should see substantial progress in economic indicators, not prospects.”

The Fed succeeded in the last word without further action. This March FOMC was an event in which the Fed’s confidence in the recovery of the economy felt stronger than ever, the economist evaluated.