[ad_1]

Plans to apply for health insurance for important non-indemnity treatments such as spinal magnetic resonance imaging (MRI), echocardiography, and musculoskeletal MRI have been delayed. It can be interpreted as a “subsequent storm” due to the deterioration of health finances due to the rapid promotion of “Moon Jae-in Care (measures to strengthen health insurance coverage)”. In the first half of this year alone, the health insurance budget was in deficit of more than 1 trillion won. The increasing difficulties in the medical community due to the new coronavirus infection (Corona 19) also affected.

▶ See page A12 of November 26.

The Ministry of Health and Welfare held the 22nd Health Insurance Policy Deliberation Committee (Geonjeongshim) on the 27th and announced the ‘Implementation Plan of the Comprehensive National Health Insurance Plan 2021’ containing these details.

The plan included adjusting the reimbursement for spinal MRI and cardiac ultrasound, which was scheduled to be implemented in the second half of this year (health insurance application), to the second half of next year. The Ministry of Health and Social Welfare recently announced that it will postpone paying for spinal MRI for next year in a meeting with organizations involved in health care, and even echocardiography has been postponed.

The application of the MRI and musculoskeletal ultrasound health insurance, which would be promoted next year under the comprehensive health insurance plan, was delayed until 2022.

The government explained that the delay in consultations with the medical community was great. An official from the Ministry of Health and Social Welfare said: “As labor and management difficulties in medical institutions increase due to Corona 19, discussions related to wages are interrupted.”

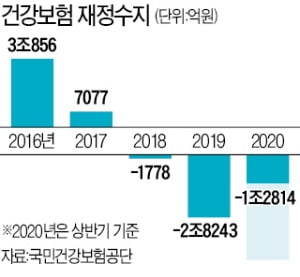

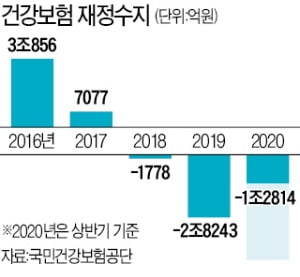

However, experts assessed that Moon Jae-in Care’s speeding was being slowed by a sharp increase in the health care budget deficit. Moon Jae-in Care is a policy to provide health care for all medical services except beauty and plastic surgery. Huge expenditures and consequent fiscal deficits are inevitable. In 2018, the health insurance fiscal balance posted a deficit (-1778 billion won) in eight years, and last year the size of the deficit increased to 2.8243 trillion won.

‘Wuncare’ accelerating after a storm … In the first half alone, the loss was 1.3 yen.

Health Report ‘Artificial Dermis’ for Burn Patients Applied … Medical Expenses 1.68 million won → 35,000 won

The financial situation for health insurance this year is even worse. It is common for health insurance to record a surplus in the first semester and a deficit in the second. This is because medical institutions tend to claim health benefits in the second half. In the first half of last year, when the annual deficit reached 3 trillion won, it was a surplus of 88.6 billion won.

However, in the first half of this year alone, there was a loss of 1,281.4 billion won. This is due to the decline in income from insurance premiums as the income conditions of citizens deteriorated due to Corona 19, while the flow of excessive treatment for new elements of health insurance continued. If the health insurance budget deficit in the second half of this year is only recorded in the second half of last year (about 2.9 trillion won), the annual deficit will exceed 4 trillion won. It significantly exceeds the original estimate of the deficit (2.727.5 billion won). This is the reason why the government began to adjust the pace of expansion of health security guarantees.

The scope of existing payment items is also shrinking. Since the financial expense for the brain MRI test performed in October last year exceeded the initial estimate by 1.7 times, the profit for this April fell dramatically. If there were no symptoms, the copayment rate for the MRI treatment increased from 30% to 60% to 80%.

The government also strengthens fiscal consolidation efforts in terms of revenue. The Ministry of Health and Welfare established the ‘Expansion of government support through revisions such as the Health Insurance Law’ as an important task in the implementation plan of the Comprehensive National Health Insurance Plan 2021. This means that the system will will revise in the direction of increasing the national treasury support rate for health insurance over the current 13-14%.

Professor Hong Seok-cheol from the Department of Economics at Seoul National University said: “We need to change the objectives of our policy towards the pursuit of adequate medical security, recognizing that it is impossible to apply health insurance to all medical services.” said.

That day, the Health Insurance Policy Deliberation Committee discussed plans to expand health insurance support for burn and injured patients. The Ministry of Health and Welfare decided to apply a health insurance from April next year by designating as an essential benefit the “artificial dermis”, which is widely used for the treatment of skin reconstruction of burns and wounds. In the case of surgery with two artificial dermis (based on 40-80 ㎠ or less), the cost of treatment materials is now 1.68 million won, but the burden is reduced to 35,000 won after applying medical care. About 90,000 patients will benefit, predicted the Ministry of Health and Welfare.

Two new drugs related to osteoporosis and lung cancer are also offered health benefits. Treatment of osteoporosis in postmenopausal women, ‘Ivanitiju Freefield Syringe’ and treatment of non-small cell lung cancer, ‘Vizimpro Tablet 15 · 30 · 45 mg’. The cost of new drugs for osteoporosis will be reduced from 2.97 million won to 890,000 won, and new drugs for lung cancer will be reduced from 11.7 million won to 580,000 won.

Reporter Seo Min-joon [email protected]