[ad_1]

Cards such as the temporary transfer tax reduction can be used to avoid excessive imposition of the tax on people with multiple households, but the government has not yet developed a detailed plan for this. Fiscal strength is interpreted to be deteriorating, with state debt topping the 800 trillion won mark for the first time in late September, following the execution of the fourth additional budget to respond to Crown 19.

However, not only real estate experts but also the National Assembly committee are convinced that easing the transfer tax can help stabilize the housing market.

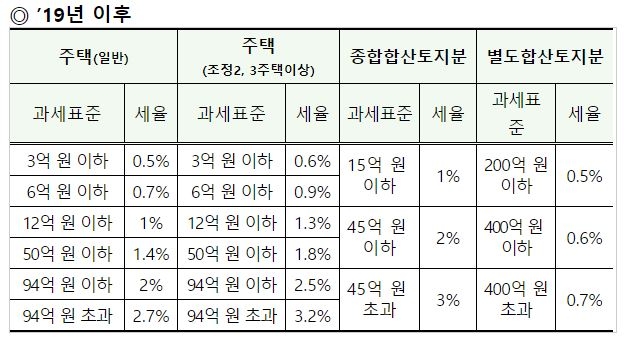

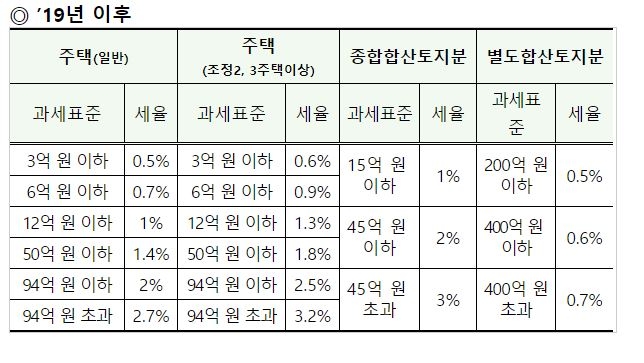

Comprehensive real estate tax rate table / Source = National Tax Service

◇ “Measures already exist” by the ruling party to criticize the “increased tax burden for homeowners”

The final tax is a tax levied on the portion that exceeds the deductible amount by adding the published prices of houses and land per taxpayer (per person). In the case of houses, if the sum of the published prices exceeds 600 million won, they are subject to tax. However, a first generation owner is deducted up to 900 million won.

The amount of the deduction for the total combined land (bare land, hybrid land, etc.) is 500 million won and 8 billion won for the combined separate land (commercial and office land).

The tax rate for the tax is 0.5 ~ 3.2% depending on the number of houses and the amount of the tax base. The tax rate is the same as last year, but last year’s taxpayers will receive a bill that has risen significantly, and the tens of thousands of single-family homeowners paying the new tax are expected to reach tens of thousands of people. only in Seoul. The government explained: “The tax rate has not changed, but the number of people notified and the amount of taxes notified have increased significantly due to the published price adjustment.”

Among them, the opposition party spilled a strong reaction to the increase in the tax burden on single-family inhabitants. Party leader Joo Ho-young harshly criticized: “Even a homeowner who lives with my own house cannot escape the tax bomb” and “how can people not resist tax resistance?”

In this regard, Han Jeong-ae, chairman of the Democratic Party policy committee, explained: “In the case of the elderly with long-term incumbents, the comprehensive real estate tax rate has already been adjusted to be reduced to 80%. “.

However, due to disagreement between the ruling Democratic Party and the government, the property tax easing for single-family homeowners has yet to reach consensus, resulting in only one “Advisor of Hope” .

One of the reasons why such relaxation of property taxes has not gone smoothly is the “lack of tax revenue”.

According to the ‘November Fiscal Trends Monthly Number’ released by the Ministry of Strategy and Finance, total revenue from January to September this year was 35.4 trillion won, a decrease of 5.5 trillion won from the previous year.

In contrast, following the Corona 19 incident, four emergency supplements were implemented and expenses increased. According to the Ministry of Science and Technology, the total cumulative spending from January to September was 43.8 trillion won, an increase of 48 trillion won compared to the previous year. The consolidated fiscal balance, which subtracted total spending from total government revenue, was 80.5 trillion won, and the administrative fiscal balance, representing actual fiscal strength, was in deficit of 10.84 trillion won. As a result, at the end of September, the scale of the national debt has increased by more than 100 trillion won since the end of last year (699 trillion won), to 800 trillion won.

◇ From real estate experts to the National Assembly Committee, “Transfer Tax Relief, Helping Provide Housing”

Despite such a situation, multiple real estate experts are convinced that easing the transfer tax could help solve the real estate problem.

One real estate expert said: “If we only tighten regulations in a situation where purchase demand is not absorbed at all, it will be difficult for any policy to take effect.” This will have to be accompanied, “he said.

A real estate industry official asked, “If the acquisition tax, the possession tax, and the transfer tax are increased at the same time, what kind of person will sell for a money-losing business?” ‘I have to prepare, but the current government is making things worse to avoid accusations of’ policy failure. ‘

The Planning and Finance Committee of the National Assembly has also assessed that the reduction of the transfer tax will help provide housing.

The People’s Power representative Gyeong-joon Yoo recently presented a view that the strong capital gains tax system for housing should be abolished in areas subject to multi-household adjustments.

In this regard, the Committee evaluated: “It seems that it will be possible to contribute to solving the phenomenon of confinement by increasing the supply of housing by lowering the capital gains tax on homes in the area subject to adjustment.” “There is a positive aspect, since it is criticized that the consideration in terms of tax equity is insufficient because all of them are reflected in the calculation of the number of homes without taking into account the location or price of the sales rights, etc.”, added.

However, it is necessary to take into account that the original bill of Congressman Gyeong-Jun Yoo eliminates the institutional device that represses the demand for housing in the area subject to adjustment, and that there is room to induce the demand for housing in the area. subject to adjustment as the after-tax rate of return increases when the home is transferred in the subject area. There will be, ”he added.

Reporter Jang Ho-sung [email protected]

[ad_2]