Prepared by Stephanie, analyst at BAD BEAT Investing

Those who follow our exclusive chat room often know that we said that finances were going to face pressure, but there was only one that we fully endorsed, while everyone else was negative. This was, of course, the best JPMorgan Chase (JPM) in its class. We are frequently asked about banks, along with hundreds of other actions per week, in our group. We’ve been clear: stay away from other banks in the short term, but consider JPM. On the downside, we have very low rates. We also have strong risks due to leniency, mortgage deferrals and direct defaults affecting the sector. But we felt that the name was a good buy from $ 80-85. This market gave him multiple opportunities to enter. While the actual economic data weighs in, the company actually launched a heroic quarter, showing why it is dominant. But it was not all good news. Relative to its competition, it was impressive. Let us argue. We remain optimistic and believe that it is a solid action not only to trade, but also to invest in the long term, that is why we want to scale.

Headline numbers impress

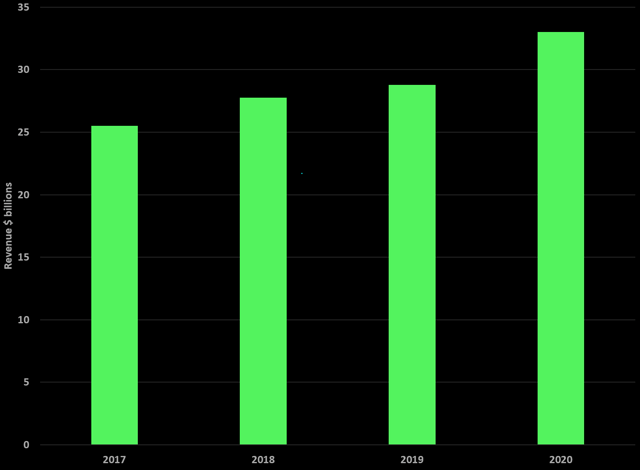

JPMorgan had a tremendous quarter when it came to headlines versus historical performance, but relative to expectations, it was heroic. No one really knew where it would go. Overall, the headline numbers reflected the pain of the COVID-19 crisis, which has led to reduced demand and changed banking activity from the norm, but exceeded expectations. Of course, after a close to 50% drop from the peak to the minimum in stock, well, we can see the market price in disaster. Q2 was better than expected, but Q3 could see that the pain continued, at least operationally. Managed revenue was $ 32.9 billion, approximately 15% year-over-year. This exceeded our expectations of $ 30 billion by almost $ 3 billion. This continues a pattern of strong growth in second quarter revenue in recent years:

Source: SEC filings, BAD BEAT Investing charts

What a result. Obviously we had been lowering our expectations for the year. The same thing happened with analysts. The competition has had problems. But JPM hit a home run. The income was amazing. However, it was not all sunshine and roses here. Operating expenses increased 4% from a year ago, while loan loss provisions were appalling, at a whopping $ 10.5 billion versus an average of $ 1.5 billion in each of the last 3 quarters of 2019 It was also higher than the $ 8.2 billion in the first quarter of 2020. This offset the massive revenue, and EPS showed a reduction from the second quarter of last year:

Source: SEC documents, BAD BEAT Investing charts

In the second quarter of last year, the company posted earnings per share of $ 2.83, or $ 9.6 billion in total. The result this quarter exceeded our expectations of $ 1.10 by $ 0.28, and that was with us expecting $ 30 billion in revenue and not nearly as many credit losses. Let’s dig a little deeper into the main revenue metrics.

Interest and interest-free income

So those who follow our work know that when we look at a bank, we like to look at the two main income classifications. Often they are dichotomous, with growth in one area and contraction in others.

That said, JPMorgan’s performance reflected such a dichotomy on these metrics. Over the years, the trend is higher for both measures. In this quarter, interest-free income increased a massive 33% to $ 19.1 billion. This was the result of a ton of customer business activity.

Net interest income had grown for years, but now we are seeing the impact of rates. This quarter, net interest income was flat compared to last year. The growth rate has slowed down due to rates. It reached $ 13.8 billion, 4% less, which was not as bad as we thought. The impact of the rate cuts did not weigh as we thought. We have to note that assets under management increased to $ 2.5 trillion from last year and increased 12% from just 3 months ago. Huge trade was taking place. As assets under management continue to grow, it is important to note any movement in the company’s provision for credit losses. And the arrangements were quite amazing.

Loan growth continues along with provisions for credit losses

We saw continued growth in the loan portfolio from last year as total loans increased 2% from last year. With the increase in loans, we must take into account possible credit losses, and believe me, those losses were huge.

Provisions for credit losses have increased dramatically since last year, but even before COVID-19, things had been volatile and provisions had increased over time. But what we saw here was crazy. When provisions expand, we are cautious because it may mean that the company is making risky loans or that borrowers cannot pay. In this case, it’s the last one: with all unemployment on the rise, and with small businesses that have no income, businesses close. The results are pessimistic for the economy and consumer health, but the bank will do well in the medium term.

Typically, we view this as a measure of loan security. Please note this does not mean there will be losses, we just want to point out how much is being reserved.

Much of the reserves are in the consumer portfolios, where much of the new credit activity is ongoing. The company entered this crisis in a position of strength, and still remains well capitalized and highly liquid with total liquidity resources of over $ 1 trillion.

While it is tightening some lending criteria, in the second quarter, the company’s underlying results were extremely good. However, given the probability of a fairly severe recession, it was necessary to build credit reserves that resulted in total credit costs of $ 10.5 billion for the quarter. The arrangement was intentional but much more than we expected. We thought they would be flat from the first quarter of 2020.

Highly efficient bench

One measure that has not improved in recent years is the efficiency ratio, but again, it really doesn’t matter because the bank is highly efficient.

The efficiency index analyzes the costs spent to generate a dollar of income. This metric has long been attractive to JPM. Overall, JPMorgan Chase has seen its efficiency ratio remain strong, and this quarter was the best we’ve seen for this metric for JPM at 51%. Lower is better, of course. Overall, we’ve been left with a textbook goal of about 50% for this critical indicator, so JPMorgan’s 51% efficiency demonstrates another reason why it’s the best.

Final thoughts

There is little doubt that JPMorgan Chase produced good results here. The company spent the quarter positioning itself for a recession, playing defense. He got a huge boost from credit and wealth management. In addition to the virus, complex geopolitical problems remain, and global growth is now a major concern. However, this virus problem will not last. It will be a few more quarters of pain, and the financial woes will largely last until the end of the year.

The company still has a fortress-like balance sheet and is positioned to defend itself in the coming quarters. We always maintain that in the long run, the ups and downs of stocks don’t matter, and you should seek to buy a quality company at a fair price. Here we have a high quality company that has a discount, even with EPS that wears it on the chin for a few quarters. He is a long-term winner. You should be widening the slopes. Don’t buy all at once, let the market inevitably offer you better prices.

This is a key difference between being a winner and a loser.

We turn losers into winners

Do you like our thought process on JPM? Stop wasting time and join the merchant community at BAT BEAT Invest.

We are available around the clock during market hours to answer questions and help you learn and grow. Come earn real money.

- Gain access to a dedicated team, available around the clock during market hours.

- Quick return business ideas every week

- Point inputs, profit taking, and stops rooted in technical and fundamental analysis

- Deep value situations identified through proprietary analysis

- Analysis of stocks, options, exchanges, dividends and individual portfolios

Divulge: I am / we are long JPM. I wrote this article myself and express my own opinions. I receive no compensation for it (other than Seeking Alpha). I have no business relationship with any company whose shares are mentioned in this article.