[ad_1]

Pedestrians cross a street in front of the Bank of Japan (BOJ) headquarters in Tokyo, Japan, on Monday, September 14, 2020. The Bank of Japan left the bond purchase amount unchanged in a regular operation on Monday.

Photographer: Kiyoshi Ota / Bloomberg

Photographer: Kiyoshi Ota / Bloomberg

At the monetary policy meeting on 19, the Bank of Japan decided that the allowable range of fluctuations in long-term interest rates (interest rates on 10-year government bonds), which would lead to around 0%, it would be around 0.25 percentage points. both up and down. The objective is to maintain the function of the market.

The “6 trillion yen a year”, which is a guideline for buying exchange-traded funds (ETFs), will also be eliminated. We will maintain the upper purchase limit of 12 trillion yen per year, and if the market becomes significantly unstable, we will make large-scale purchases. The upper limit continues even after the new coronavirus infection has subsided. In the future, we will only buy the type linked to TOPIX, which has the highest number of constituent shares.

In the inspection, as an effective means of additional flexibility, the reduction of long- and short-term interest rates was repositioned as an “important option”, and it was necessary to consider the role of financial intermediary when reducing interest rates. It decided to establish a “loan promotion interest rate system” linked to the short-term policy interest rate in order to mitigate the impact of deepening negative interest rates on financial institutions’ earnings. Adding a positive interest rate, etc. According to the loan that includes the new coronavirus compatible with the financial institution, “it is possible to reduce long and short-term interest rates more flexibly.”

| Key points |

|---|

|

Taking into account the situation that it takes time to reach the price stability target of 2%, various policies were inspected. The policy interest rate was minus 0.1% and the 10-year public debt interest rate was unchanged at around 0%.

Hiroaki Muto, senior deputy director of Sumitomo’s Life Insurance Management Department, noted that “the content was strongly intended to reduce the damaging effects of YCC.” “It appears that the Bank of Japan is concerned that the side effects of negative interest rates are becoming increasingly severe and that the bank’s profit base will be damaged if nothing is done.”

Mr. Minami Takeshi, Principal Investigator at the Norinchukin Research Institute, said the decision “was made on something that can be maintained while relaxation should be continued for a long time.” The loan promotion interest rate system is a system that “strengthens the prospect of borrowing” by expanding the interest rate on loans from crown-compliant financial institutions. Change of crown support to another category “.

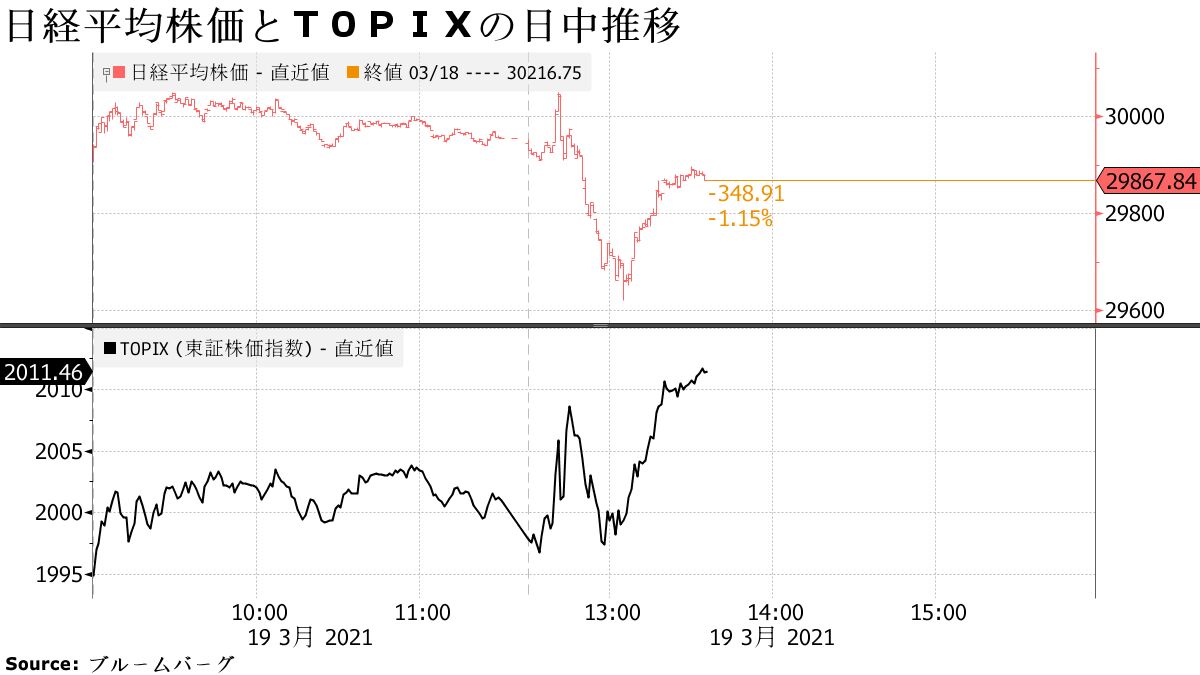

Following the announcement of the ETF purchase policy, the average Nikkei shares temporarily declinedExpansion. On the contrary, TOPIX turned positive.

The objective of the inspection is to maintain the framework of quantitative and qualitative monetary easing with manipulation of short and long-term interest rates, and to make the policy “more efficient and sustainable”. It was aimed at managing the control of the yield curve (YCC, short and long-term interest rate operations) and the review of asset purchase methods, such as ETFs.

According to a Bloomberg survey of 46 economists 4-9, 80% of respondents expect to adjust their policies at this meeting. Regarding ETF purchases, 90% said they would more clearly propose flexible purchase methods according to market conditions, while only 20% expected an increase in tolerance to fluctuations in long-term interest rates. term.

(Add market movements and commentary from economists)