[ad_1]

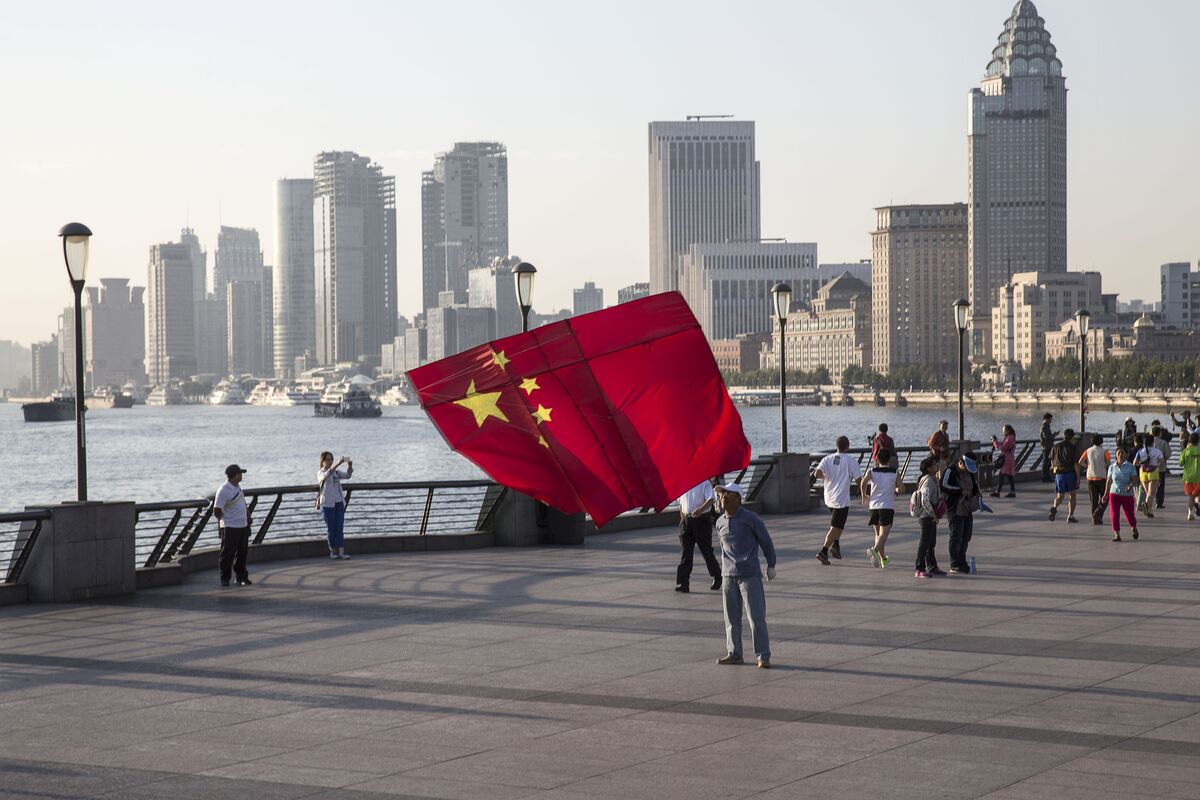

A man launches a kite in the shape of the Chinese national flag on the Bund in Shanghai, China, on Friday, October 2, 2015. China’s consumer inflation moderated and deflation at factory gates extended a record high. declines, indicating the People’s Bank of China still has room to ease monetary policy further to support a slowing economy.

Photographer: Qilai Shen /

Photographer: Qilai Shen /

Bond investors looking for yields and effective hedging in preparation for market depreciation are increasingly looking to China.

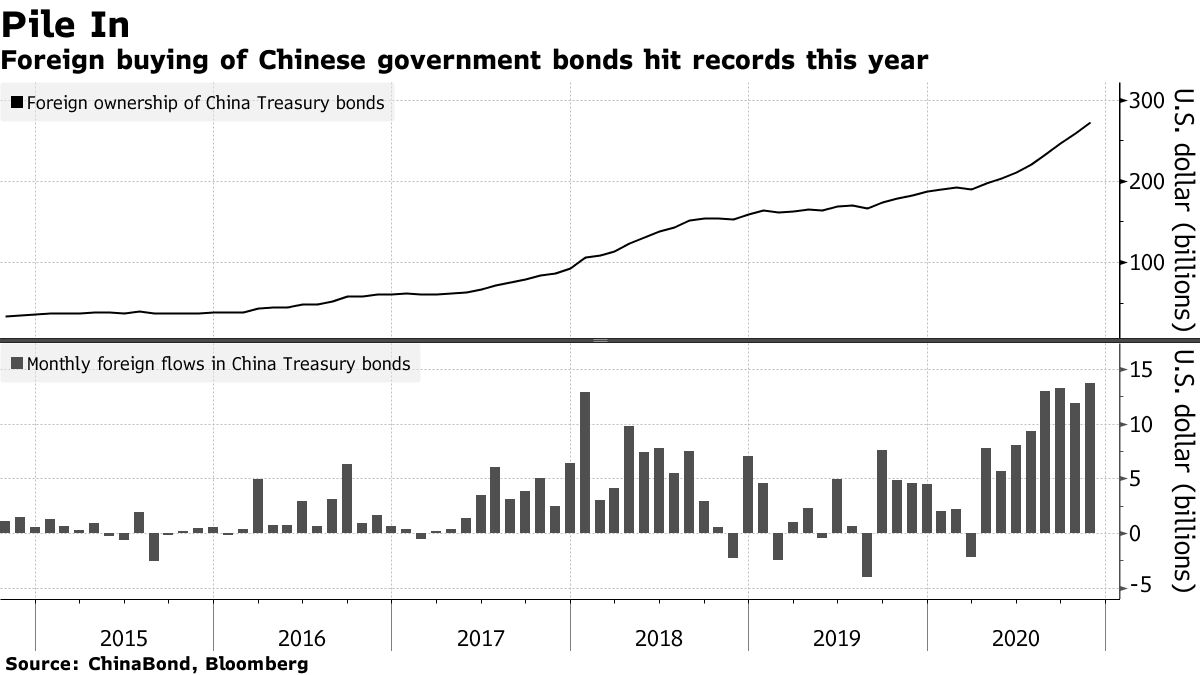

The appeal of Chinese government bonds since the beginning of this year is clear. In major countries, extremely aggressive stimulus measures have led to lower yields and weaker currencies. According to data released by China Bond, holdings of Chinese government bonds by foreigners have skyrocketed to a record 1.79 trillion yuan (about 28.5 trillion yen) amid a sharp drop in prices. yields on government bonds in the United States and other countries.

Against the backdrop of China’s relatively dovish monetary easing, adoption in the global bond index, and performance inequality, Citi expects a $ 100 billion annual inflow into the Chinese government bond market over the next three years. The group hopes. The traditional approach of using 60% of the portfolio as stocks and 40% as bondsQuestions are rampant on Wall Street, making Chinese bonds a sweet spot that offers positive returns and risk coverage.

Hong Kong-based Citi economist Yukou Sakae noted that the People’s Bank of China is unlikely to move toward large-scale monetary easing after developed countries, and given the widening yield gap, the foreign demand should continue. ..

The People’s Bank will also support the market by limiting the sale of Chinese government bonds and achieving market stability. He also said last month that the market was destabilized by a series of corporate bond defaults and yields rose, ready to support the bond market in the event of market pressure.

Chinese government bonds have proven useful as a safe haven this year. The 10-year index bond yield fell more than 60 basis points (bps, 1 bps = 0.01%) from January to April, when the market as a whole was turbulent. The prices of government debt in Europe, the United States and Japan have also risen (yields have fallen), and few countries currently offer significant returns. The yield gap between the US 10-year bond and the Chinese government bond, which is an indicator, is currently above 230bp, widening from 125bp at the beginning of the year.

Yields are also high in some Asian countries, such as Indonesia and India, but they are still susceptible to stress and their ratings are several notches lower than those of Chinese government bonds. A lot of foreign money has flowed into China, but about $ 15 billion has flowed out of Indian bonds this year.

Actions taken this year by strong but performance-focused Japanese investors are probably the most typical trend. In January-September, it forfeited bonds in India and South Africa, cut its holdings in Southeast Asia, and invested 420 billion yen in Chinese bonds.

Original title:

This year, Chinese sovereign bonds became a global performance game (抜 粋)