[ad_1]

On the 14th, NTT Docomo held a press conference on unauthorized use of Docomo accounts.

In the docomo account the docomo account and the bank account, which are unfamiliar to the affiliated local banks, were linked, and the damage caused by illegal withdrawals occurred one after another nationwide.

In response to this, DoCoMo has suspended the new link between the DoCoMo account and the accounts of the affiliated banks, and the bank has taken steps to suspend the charge to the DoCoMo account.

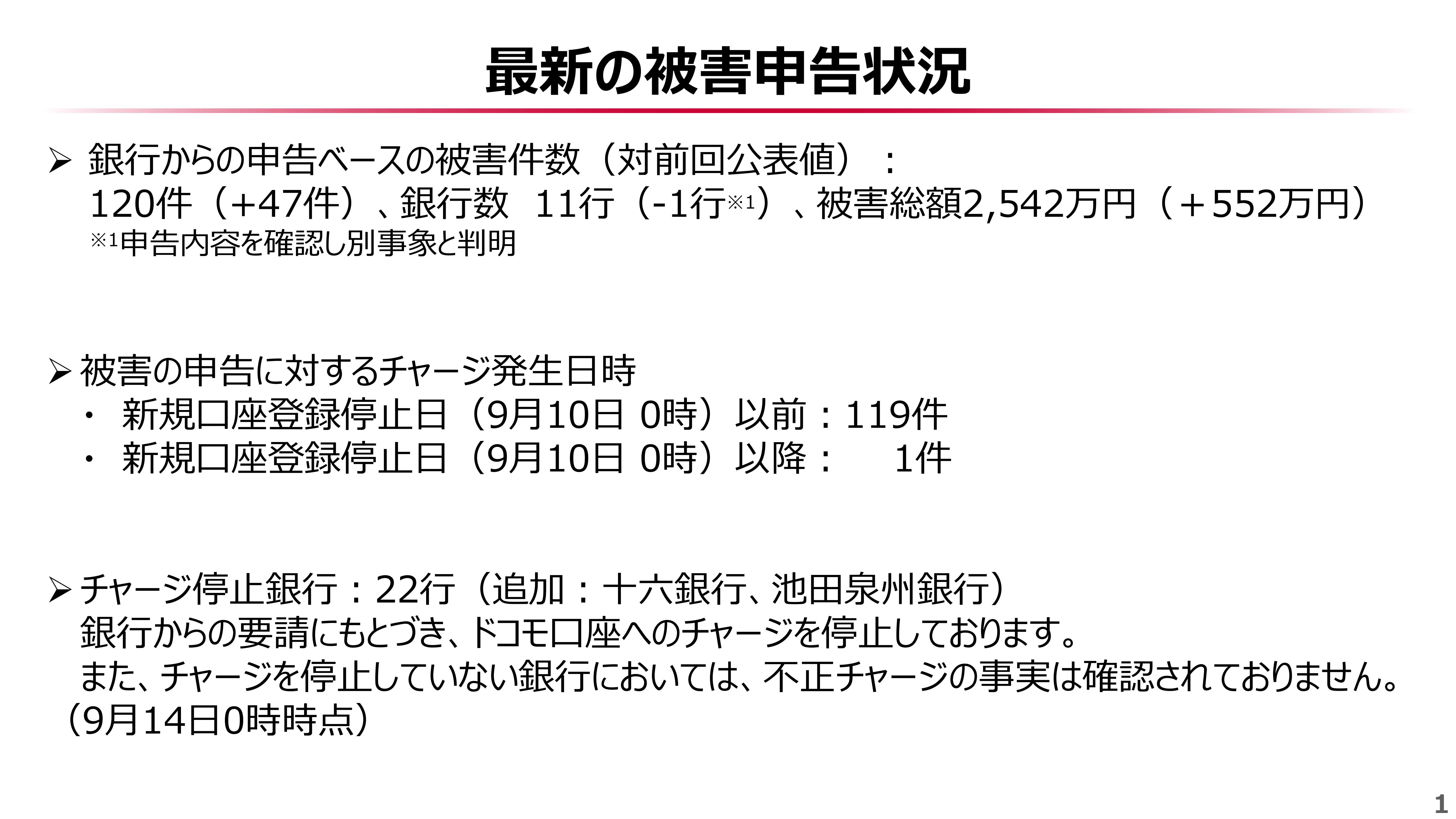

The latest damage situation

According to Docomo, the number of unauthorized uses was 120 at 00:00 on September 14. Also, the number of banks where it occurred is 11. The total damage is 25.42 million yen. According to the announcement of the 10th, the number of banks that suffered damages was 12, but it was corrected because it turned out to be one more fact.

The breakdown of fraudulent use was 119 cases that occurred before September 10 when the link between the docomo account and the bank account was stopped. One case occurred even after the new cooperation was stopped. This is believed to have been removed from an account that had already been linked before the new link was suspended.

DoCoMo says similar damage is unlikely because new registrations have been suspended and the bank has taken steps to suspend the charges.

22 banks also stopped charging from their docomo accounts as of midnight on the 14th. As of the time of the announcement on the 10th, Juroku Bank (Gifu Prefecture) and Ikeda Senshu Bank (Osaka Prefecture) have recently been added.

Response to unauthorized use

As announced at the meeting on the 10th, DoCoMo is not currently accepting applications for bank account registration. As a result, it is currently not possible for a third party to link a docomo account and a bank account to collect illegally again.

In addition, the use of docomo accounts suspected of similar fraudulent use has been suspended. Specific criteria for determining fraudulent use are not disclosed from the perspective of providing information to the offender.

In addition, as of September 12, a dedicated call center has been created for this unauthorized use. DoCoMo has initiated the full compensation procedure for the victims in cooperation with each bank.

Introduction of SMS authentication as an additional measure

As additional measures in the future, in addition to the introduction of eKYC (online identity verification) and SMS authentication at the time of registration of the bank account announced on the 10th, the identity verification by eKYC will be performed again for the users who have already registered a bank account.

Even registered users will not be able to charge new charges until they complete eKYC, but they will be able to use charges that have already been charged.

Also, in cooperation with each bank, measures such as individual bank contact for history of charges that may be fraudulent will be implemented.

Is there a possibility that it will be damaged without knowing it?

The problem that occurred this time is that the deposit is illegally withdrawn by linking the docomo account opened by a third party with your own bank account just by opening an account at a financial institution linked to the docomo account. Was that.

When withdrawals are made, details like “Docomo Koza” and “Divalai” line up, but there is concern that users who don’t normally log may not notice the damage.

DoCoMo locks the DoCoMo account, which is believed to have been corrupted by a similar method, as a countermeasure in such a case. By notifying the bank and establishing a system to contact the user from the bank, it is a mechanism to prevent unauthorized use without knowing it.

Summary of questions and answers

――I think there was a problem verifying the identity of the bank where the damage occurred, but does Docomo request a correction?

Docomo

We also ask banks to increase security. In such circumstances, measures such as stopping charging have been taken.

――There is no case of damage even after response measures on day 10 due to slow response? It may have been possible to avoid this by quickly stopping the new record. Can you tell it won’t happen in the future?

Docomo

That’s right, we should have responded earlier, 10 days ago. It cannot be said that there is no such thing. However, the damaged bank stopped charging. The suspicious account is locked and we believe further damage will be largely avoided.

――Banks that haven’t stopped charging don’t appear to be fraudulent, but do they really need to take action?

Docomo

At this point, there is no fraudulent use and we believe that these banks have advanced authentication mechanisms and do not need to be stopped.

――Don’t you suspend your own docomo account?

Docomo

The service will not stop because some users are using it normally. If the damage spreads, several measures must be taken, but that is not the case.

――Did all the victims not use the docomo account? Wouldn’t the user realize it without the habit of accounting?

Docomo

We are currently in the confirmation process with the bank. The bank will contact you giving information to the bank that is identifying similar cases from the system.

――How many call centers have been used since the 12th?

Docomo

As of September 12 and 17, there were 1,496 consultations. Subsequently, at 5:00 p.m. on the 13th, there were another 749 consultations.

――What is the success rate of linking fraudulent user accounts?

Docomo

The failure rate is not that high. At the moment, I think there were not a lot of attacks, but that they were located and linked.

――What are the specific measures to increase the robustness of security?

Docomo

Increase the number of authentication items, perform additional authentication, etc. The current situation is that discussions are taking place to improve safety when resuming.

――Did Docomo trust the regional banking network service and use it to link Docomo accounts?

Docomo

It was up to the bank to decide which element of the regional banking network service to authenticate. I interacted with banks every day and talked about how to improve security to prevent unauthorized use.

――When is the oldest damage? Is there a possibility that it will increase in the future?

Docomo

October 2019 is the oldest, but past damage may continue to increase. Check with each bank.

――How much damage did you know on the 8th when the problem arose?

Docomo

24 cases as of the 8th. On the 9th, there were 9 bank reports. However, this is the day the bank declares it and it actually debits before then.

――Where is the money of the abused user?

Docomo

You cannot go to work as cash from your docomo account. For example, there are cases where cigarettes are bought from convenience stores and expensive appliances are bought from mass retailers and resold. The payment store and the date and time are known from the docomo system, and it is necessary to confirm with the member store what was actually purchased.

――Are all damages for users who do not have a DoCoMo line contract? Why did you add a docomo account that lowers the security level to the payment charge method d when it is carrier free?

Docomo

It has not been confirmed if the victim has a line contract. I explained to the bank when I made it career free, but I was not happy with the common understanding of the identity verification levels of each. I want to reply in the future while communicating.

――According to some reports, the unauthorized use comes from Niigata, but is it true?

Docomo

I am not aware of such information.

――I think there was a hearing from the Ministry of the Interior and Communications, but when and what kind of report did it make?

Docomo

I reported it before the meeting the other day. The situation is that the current situation is being communicated as appropriate.

――It appears that the fraudulent use at Resona Bank in 19 was a docomo contractor, but what was the situation?

Docomo

At the time, it was a service for docomo subscribers. It happened because the name could not be verified between Docomo and the bank due to specifications. By the time it became carrier free in October 2019, the specifications had been revised.

[ad_2]