[ad_1]

Every morning we deliver world news that you want to keep track of before you start your day. Click here to subscribe to the Bloomberg newsletter.

Robinhood Markets, a stock trading app operator, and executives at hedge fund operator Citadel argued with lawmakers at a hearing held by the U.S. House of Representatives Financial Services Commission on the 18th on the GameStop US share price volatility Legislators sought that the two companies would benefit at the expense of individual investors, but could not get a clear answer, expressing discontent.

GameStop’s closing price on the 18th was down 11% to $ 40.69, the lowest price in about a month.

At the attention-grabbing hearing, Robinhood CEO Vladimir Tenev and Kenneth Griffin, who runs Citadel, said the Robinhood app was free of transaction fees and restrictions on trading like GameStop shares. I was hit with a volley of fire on the question of whether it was really “free”.

Conspiracy theories have been spread in Washington by trade restrictions that the two companies may have worked together to prioritize their interests over individual investors.

Although there were times when lawmakers interrupted and ridiculed Tenev and Griffin’s remarks, they always provided individual investors with access to the Wall Street-dominated market.

Robin Hood has been criticized for not fully communicating risk to retail investors. Congressman Maloney (Democrat) notes that “individual investors must be prevented from being recruited.”

“I’m sorry that happened,” Tenev said, admitting that Robin Hood was not doing what the client needed. “I’m not saying that I have not made mistakes, and I promise to improve in the future,” he said.

Congressman Sherman (Democrat) complained about Griffin’s unclear response, accusing him of “I’m wasting my time for you.”

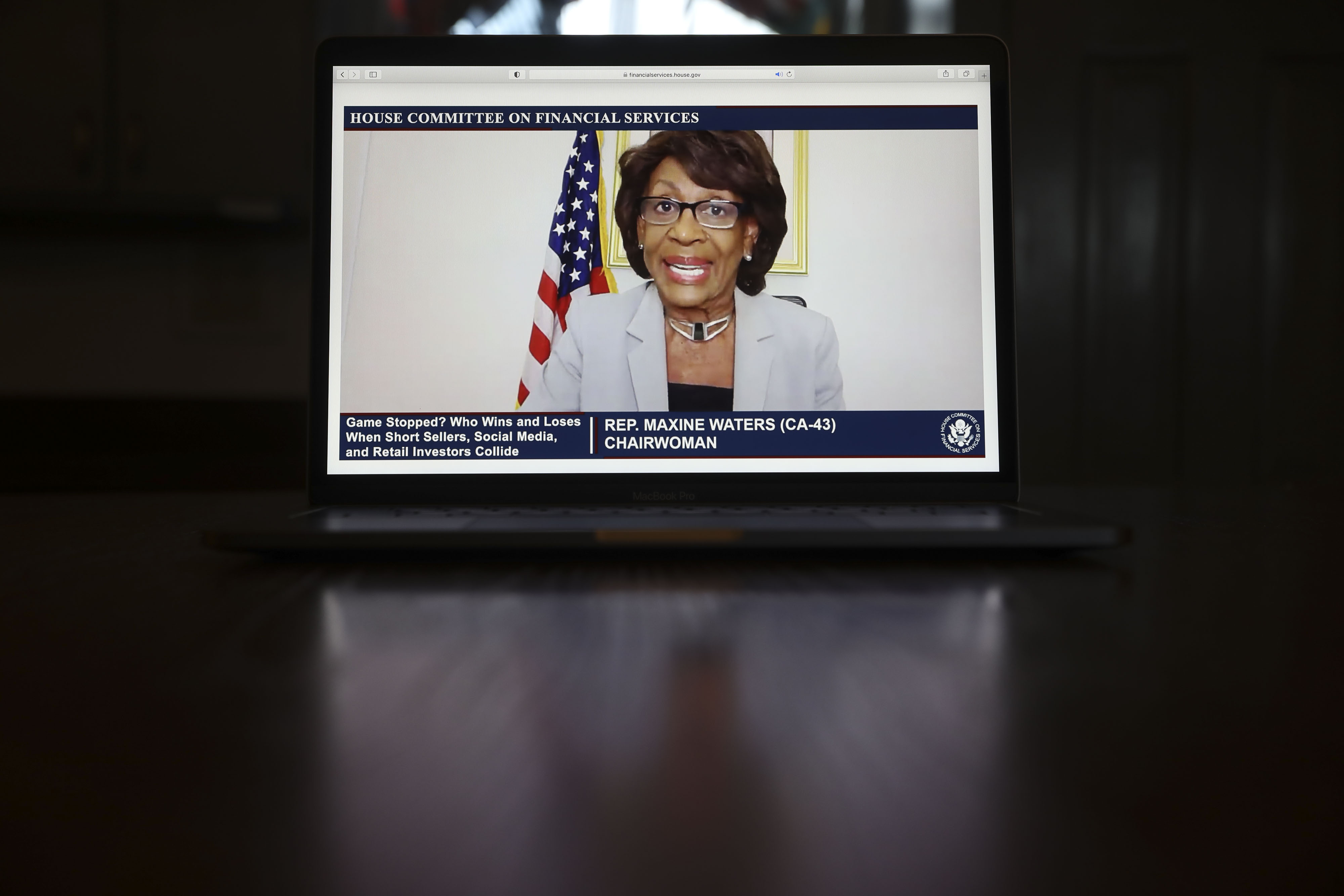

“A lot of people in America think the system is at a disadvantage for them and Wall Street always wins, no matter what,” said Waters, chairman of the House Financial Services Commission. He acknowledged that the GameStop stock issue highlighted the “predatory approach” of some hedge funds.

Gabe Protokin, the founder of the fund management company Melvin Capital Management, who suffered a large loss in response to the offensive by individual investors in response to the post on the online “Reddit” bulletin board, also testified on audience. He said the hedge fund industry would adapt to prevent this from happening again.

He mentioned the astronomical accumulation of short positions in GameStop shares. “I don’t think investors like me want to be sensitive to this kind of dynamic,” he said, adding that he intends to keep an eye out for online bulletin boards in the future.

President Waters speaking in a virtual audience (February 18)

Photographer: Daniel Acker / Bloomberg

Original title:Robinhood, Citadel CEOs discuss retail with lawmakers 、GameStop Slumps As Lawmakers, Fund Chiefs Take On Retail Merchants 、Plotkin says hedge funds will adapt in the wake of GameStop’s defeat 、GameStop Shows Wall Street’s ‘Predatory Ways’, Says Waters (1) (抜 粋)

(Update with additional testimonial from the founder of Melvin Capital)