[ad_1]

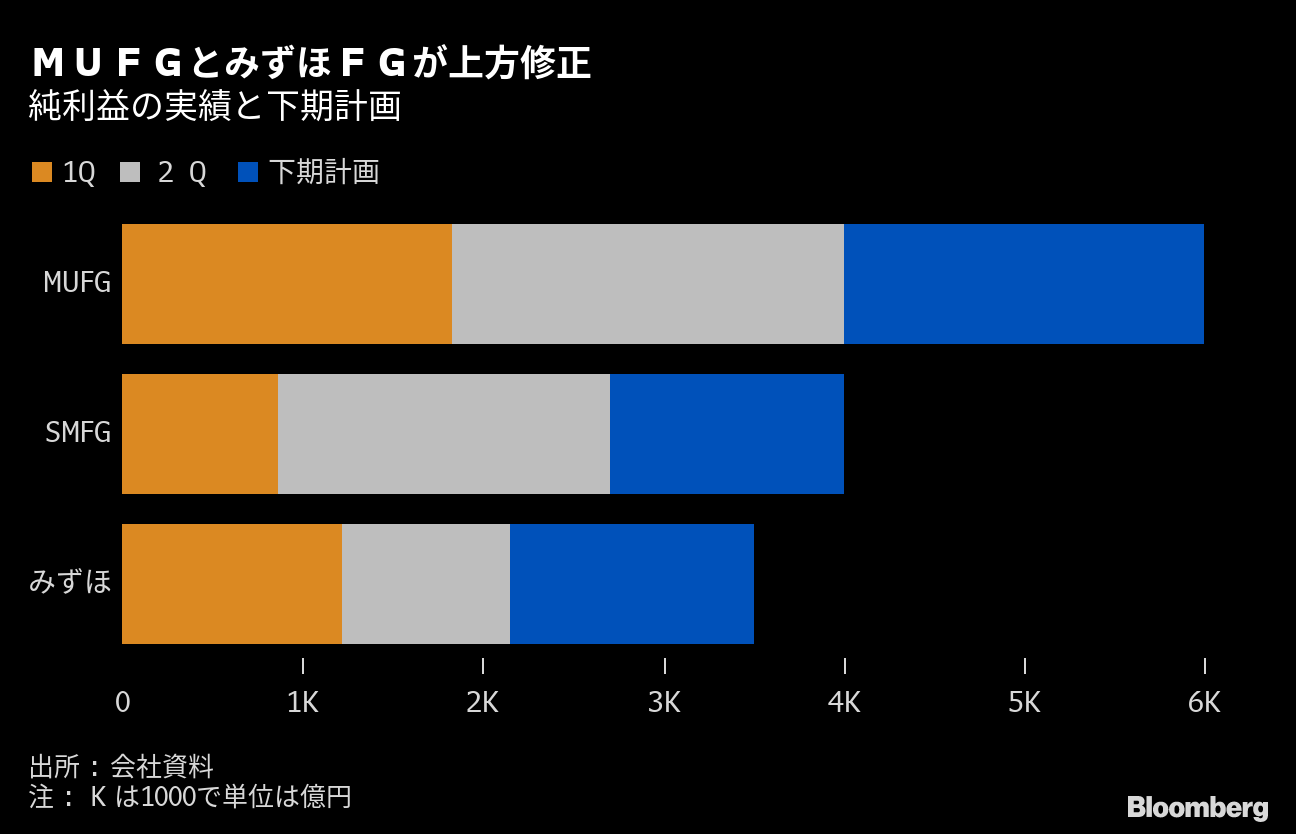

The consolidated financial results of the 3 megabanks for the second quarter of 2020 (April-September) are available on the 13th. The net commercial profit, which indicates the profit of the main business, remained firm,With Mitsubishi UFJ Financial GroupMizuho Financial Group has revised up its net income for the full year, andSumitomo Mitsui Financial Group also achieved a progress rate of less than 70% of the annual plan.

MUFG and Mizuho FG revised up

Net profit performance and second half plan

Source: Company materials

Consolidated net business profit, indicating earnings from MUFG’s core business, which announced its financial results on the same day, increased 18% year-on-year to 740.5 billion yen, and Mizuho FG increased 26% year-on-year to 438.4 billion yen. yen. On the other hand, SMFG decreased 0.6% to 551.2 billion yen.

Net income fell by double digits for all three companies due to rising costs of credit due to the spread of the new coronavirus infection. However, when comparing the amount of credit costs recorded with the initial forecast, SMFG and Mizuho FG remained low, in part because the government started supporting company financing.

MUFG increased by 50 billion yen

Real Credit Costs and Second Half Plan

Source: Company materials

On the other hand, the opinion on the earnings environment as of the second half is cautious. Hironori Kamezawa, president of MUFG, said that “the economic recovery will take longer than initially expected.” The annual cost of credit increased by 50 billion yen from the initial plan to 500 billion yen. Jun Ota, president of SMFG, also believes that many clients have potential risks, suggesting that credit costs may increase in the second half of the year.

Mizuho FG Chairman Tatsufumi Sakai, who revised trade results upwards, explained that the economic recovery scenario was “revised downwards”. Initially, it was assumed that the time to return to the level before the spread of the new corona infection was at the end of 2009, but for now, it is expected to be delayed until the end of 2010 or the first quarter (April to June) of 2011.

[Resultados de abril a septiembre y perspectivas para este período]| Net profit yield | Net profit for this period | Credit cost results | Credit costs for this term | |

|---|---|---|---|---|

| MUFG |

400.8 billion yen (-34% less) |

600 billion yen (14 %) |

258.4 billion yen (Impairment of 240.3 billion yen) |

500 billion yen (277 billion yen impairment) |

| SMFG |

270.1 billion yen (-38 %) |

400 billion yen (-43%) |

20.2 billion yen (Impairment of 135.8 billion yen) |

450 billion yen (Impairment of 279.4 billion yen) |

| Mizuho | 215.5 billion yen (-25%) | 350 billion yen (-22%) |

81.2 billion yen (70 billion yen worse) |

200 billion yen (Impairment of 28.3 billion yen) |

Note: Figures in parentheses are year-on-year changes.