[ad_1]

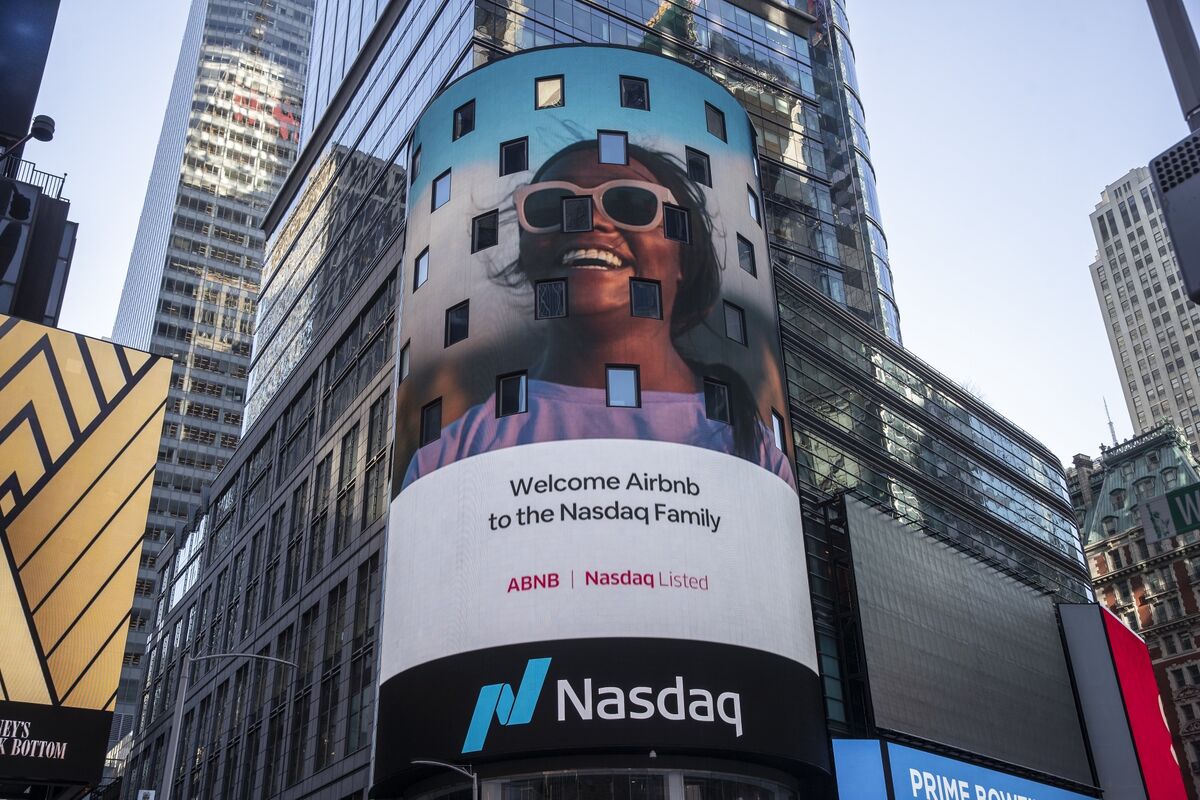

Airbnb Inc. signage on an electronic monitor during the company’s initial public offering (IPO) on the Nasdaq MarketSite in New York, U.S., Thursday, December 10, 2020.

Photographer: Victor J. Blue / Bloomberg

Photographer: Victor J. Blue / Bloomberg

Every morning we deliver world news that you want to keep track of before you start your day. Click here to subscribe to the Bloomberg newsletter.

On the US stock exchange on the 10th, the US private accommodation agency Air B & B, which reached the first day of trading, set the initial price at more than double the price of the new public offering (IPO), and the market value is about $ 100 billion (about $ 10.44 trillion). I went up to the yen). The rate of increase on the trading day was the highest ever.

The closing price was $ 144.71, 113% higher than the IPO price ($ 68). The starting price was $ 146. The day before, the largest gate in the United States reached the first day of trading with a meal delivery service using the app.He got off to a good start.

The travel industry has been hit hard by the spread of the new corona virus this year, but expectations of easing behavioral restrictions by supplying vaccines have been extended, and the US stock market is bullish on new publicly traded stocks, especially among individual investors. The mood emerges quickly. Although there are many veterans in the market who are skeptical about the rising valuation of IPO shares, Airbee is trading at least in the black numbers, which is different from 80% of the shares just launched this year.

Airbee’s market value based on the number of shares issued was $ 86.5 billion, the highest in the online travel industry, topping Booking Holdings’ $ 86.2 billion. It also exceeded the total market value of the four major publicly traded hotel chains.

Market value based on fully diluted shares, including employee stock options and restricted stock units, is approximately $ 100 billion.

Original title:Airbnb valuation hits $ 100 billion in business debut increase (2) (抜 粋)

(Update the stock price to the closing price and add background)