[ad_1]

Every morning we deliver world news that you want to follow up on before starting your day. Click here to subscribe to the Bloomberg newsletter.

MeterIntel announced on the 23rd that it plans to invest heavily in building a new factory and embarking on a foundry business that makes semiconductors for other companies. Its goal is to regain its leadership position in semiconductor manufacturing. Following the announcement, Intel’s share price temporarily rose 5%.

The plan announced by new CEO Pat Gelsinger is to manufacture Intel’s Taiwan TSMC (This is an aggressive move that will lead to direct competition with TSMC).

Intel will initially invest $ 20 billion to build two new plants in Arizona to enter the foundry business. Additionally, more factories are planned in the US and Europe. The CEO said he would produce most of Intel’s semiconductors in-house.

By designing its products in its state-of-the-art factory, Intel has maintained its dominance in the $ 400 billion semiconductor industry for decades. But with most other manufacturers taking advantage of foundry companies, Intel’s traditional strategy has started to unravel in recent years, including missing deadlines for new manufacturing technologies.

Gelsinger’s predecessor considered abandoning in-house production entirely, and some investors expected Intel to cut costs by outsourcing production. The new plan negated either approach and re-committed to Intel’s manufacturing tradition over the years at great cost.

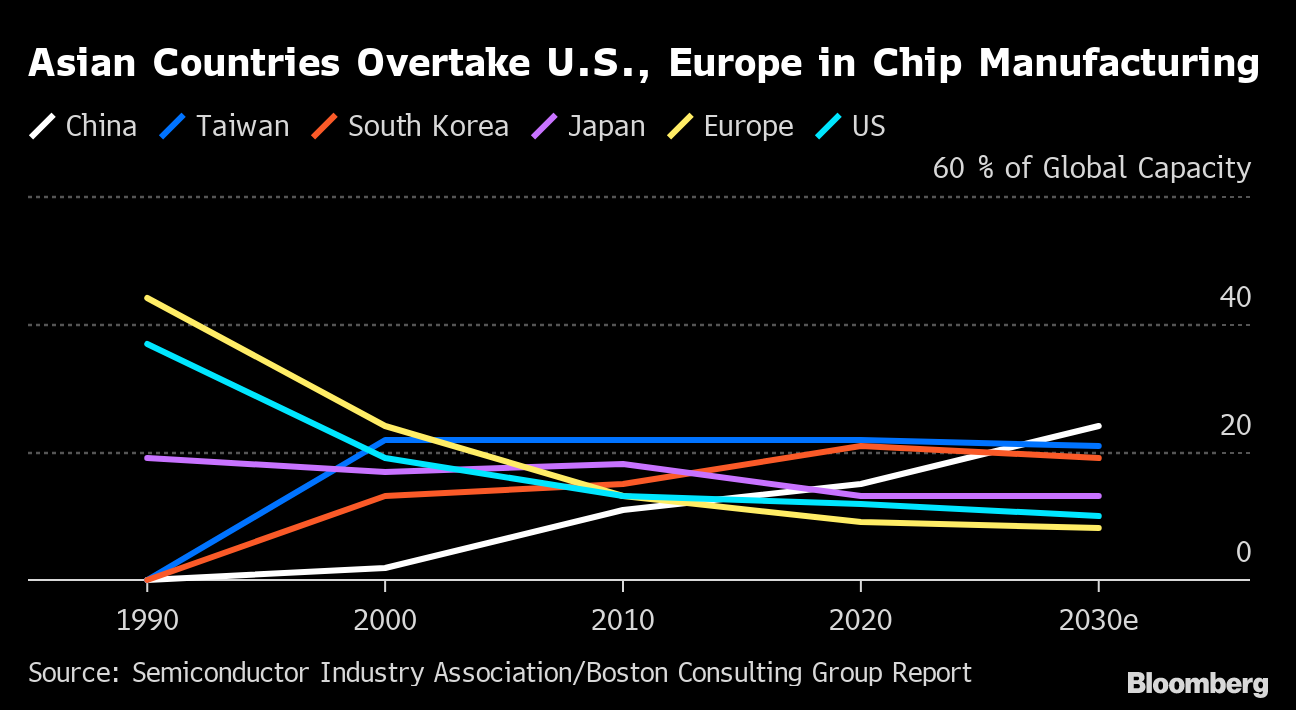

Asian countries overtake the US and Europe in chipmaking

Source: Semiconductor Industry Association Report / Boston Consulting Group

The company said in a filing on the 23rd that it expects capital investment in 2021 to reach $ 20 billion. It will increase from $ 14 billion last year. The company’s sales outlook for this year fell short of Wall Street’s expectations.

Original title:Intel spends billions to revive manufacturing, Chase TSMC (2) (抜 粋)

(We will update adding capital investment perspective etc.)