[ad_1]

Nothing reveals the crust movements that are occurring in the industry more than the supply shock. It reveals that slow changes have continued for years and the power to dominate the market has built up. In reality, this happened in the $ 400 billion semiconductor industry. It has become clear to everyone that some semiconductors are in short supply and that Korean and Taiwanese companies control the market.

The demand for microprocessors, which have been used in many fields, including fifth generation (5G) mobile communications, autonomous vehicles, artificial intelligence (AI) and the Internet of Things (IoT), is a novel coronavirus pandemic. . (all over the world). It had already increased significantly from before. Locks were implemented around the world and the need for telecommuting products, such as computer screens and laptops, expanded immediately.

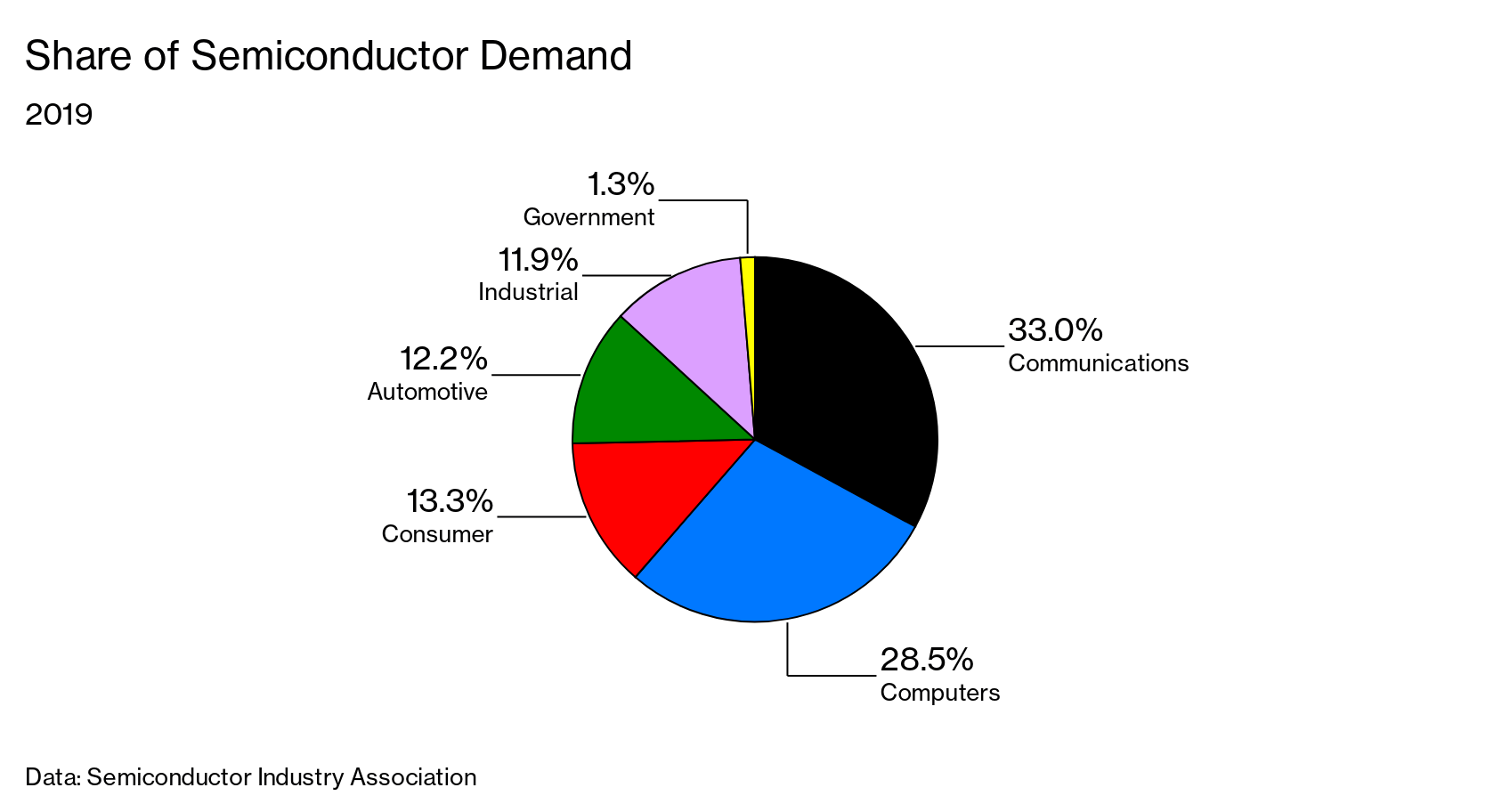

Share in semiconductor demand

2019

Facts: Semiconductor Industry Association

Due to the lack of semiconductors, GermanyDaimler and riceGeneral Motors, USACar makers like Ford MotorI was forced to stop production Auto Industry Sales in 2021, according to AlixPartnersA value of $ 61 billion could disappear.

In Germany, semiconductor shortages will hamper economic growth, which could affect economic expansion in China and Mexico. This situation is driving plans to strengthen domestic manufacturing capacity in the United States and China, the world’s first and second largest economies.

Korea Semiconductor Industry Association (“As the Organization of the Petroleum Exporting Countries (OPEC) did with oil, South Korea and Taiwan have become the most important players in the supply of semiconductors, as OPEC did,” said Ahn Ki-hyun, Executive Director of KSIA. No, but it has that power. “

Sure, there is no equivalent to a powerful oil cartel in the semiconductor industry, but like Saudi Arabia and Russia in oil, Taiwan TSMCTSMC) and South KoreaIt is true that Samsung Electronics can move the market just by turning the faucet.

When Samsung decided to reduce its capital investment in semiconductor memory in early 2019 to improve profitability, memory prices, which had been declining for many years, rose. TSMC announced on January 14 of this year that it will invest up to $ 28 billion in new factories and equipment in 2009, 37% more than the previous year. In response to this, shares of semiconductors were bought around the world and rice in trouble.TSMC is creating an environment for Intel to significantly reduce semiconductor production or even retire.I even invited speculation.

TSMC wafers

Taiwan and South Korea have taken the lead in semiconductor manufacturing by outsourcing production to the United States and other countries. Beginning in the 1980s, America’s manufacturing industry began to shift to “fables.” By not having production facilities, capital intensity can be reduced and employees no longer have to deal with cancer-causing chemicals.

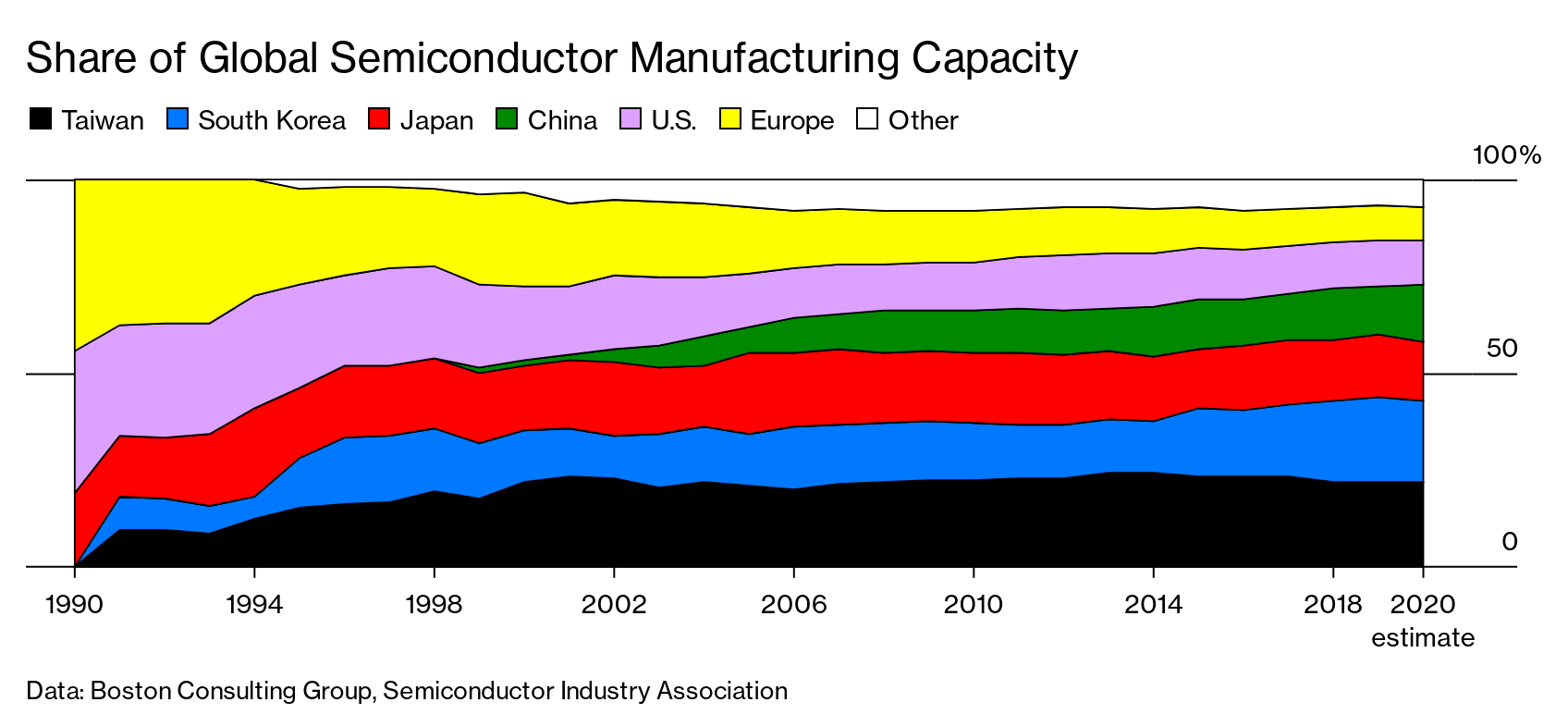

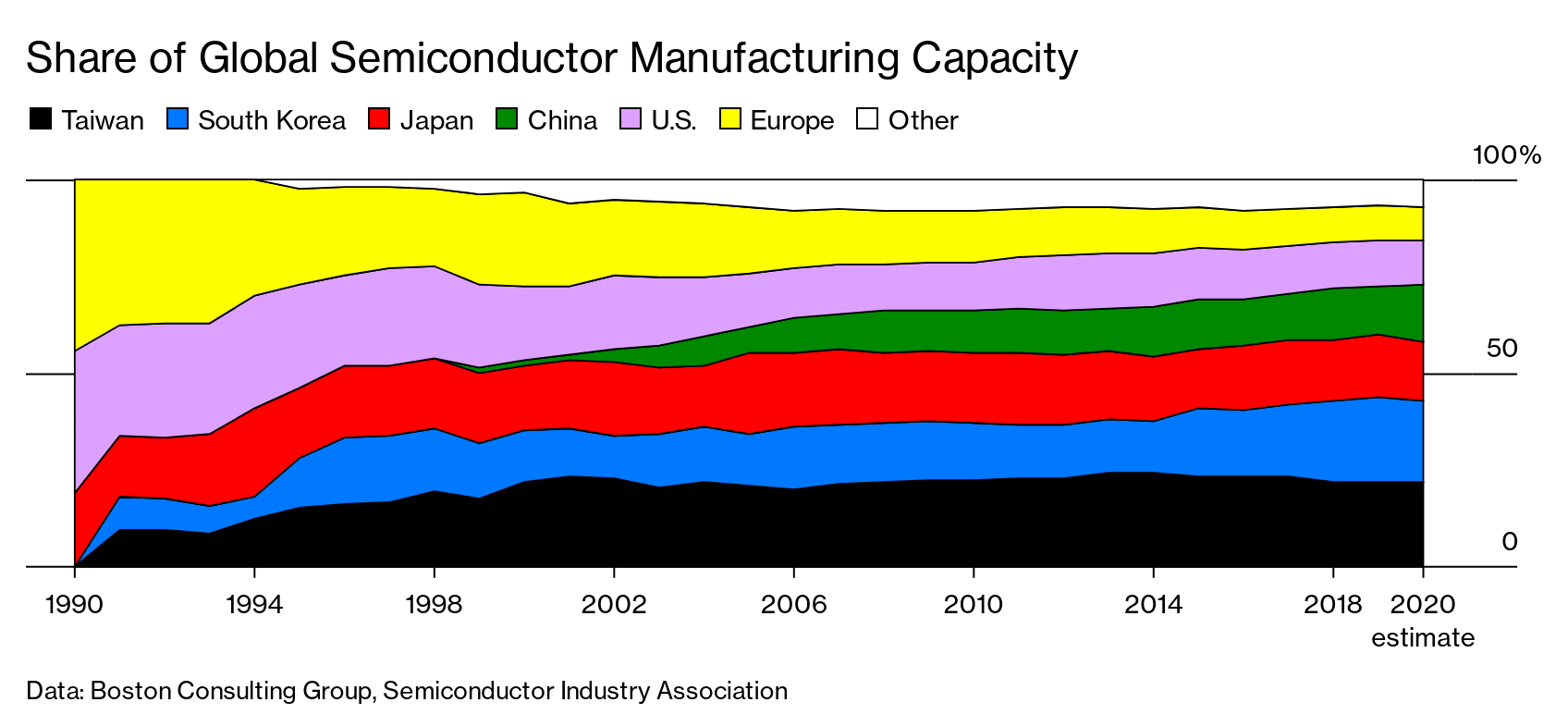

Published by Boston Consulting Group (BCG) and American Semiconductor Industry Association (SIA) in September 2020According to the report, the United States accounts for only 12% of the world’s semiconductor manufacturing capacity, and Taiwan and South Korea together estimate 43% in the same year.

Share in global semiconductor manufacturing capacity

Data: Boston Consulting Group, Semiconductor Industry Association

Although China is 15%, three points higher than the United States, none of China’s semiconductor manufacturers are considered world-class.

As the auto industry scrambled to secure semiconductors, governments like the United States, Japan and Germany asked Taiwan’s leaders to cooperate to solve the problem. Once again, the strategic importance of Taiwan, which China claims to be part of its territory, was highlighted.

For decades, the United States has supplied arms to the Taiwanese government, which is wary of attacks from mainland China and is strengthening its defenses. On Taiwan, the situation remains a source of extremely dangerous conflict between the world’s two superpowers vying for hegemony.

Both Taiwan and South Korea have close ties strategically with the United States and economically with China. In other words, the United States and China, which are heavily dependent on semiconductor supplies from Taiwan and South Korea, are currently under similar restrictions.

According to Lee Kyung-mok, a professor of business management at Seoul National University, Taiwan and South Korea may eventually have more power than OPEC. “At least the oil-producing countries have spread across the world.”

Samsung Electronics Semiconductor Plant

Original title:Chip Power from South Korea and Taiwan shakes the US and China (抜 粋)

(The original is published in “Bloomberg Businessweek” magazine.)