[ad_1]

Every morning we deliver world news that you want to follow up on before starting your day. Click here to subscribe to the Bloomberg newsletter.

The US stock market rallied on the 23rd. There has been a widespread move to buy the stocks that will benefit the most when economic activity returns to normal. By contrast, tech stocks were relatively weak.

|

Next United States President Byden Appoints Janet Jellen, Former Chairman of the Federal Reserve Board (FRB), as Secretary of the TreasuryAfter officials revealed it was a plan, the S&P 500 stock index rose even higher. Yeren recently said that if the fiscal spending bill, which would halt the rise in unemployment and allow small and medium-sized businesses to continue, is not passed in the US parliament, the economic recovery will be lopsided and small.

The S&P 500 species are 3,757.59, 0.6% more than the previous weekend. The 30-share average of Dow Industrial increased by $ 327.79 (1.1%) to $ 29,591.27. The Nasdak Comprehensive Index was up 0.2%. At 4:59 pm New York time, the 10-year US bond yield increased 3 basis points (bp, 1bp = 0.01%) to 0.85%.

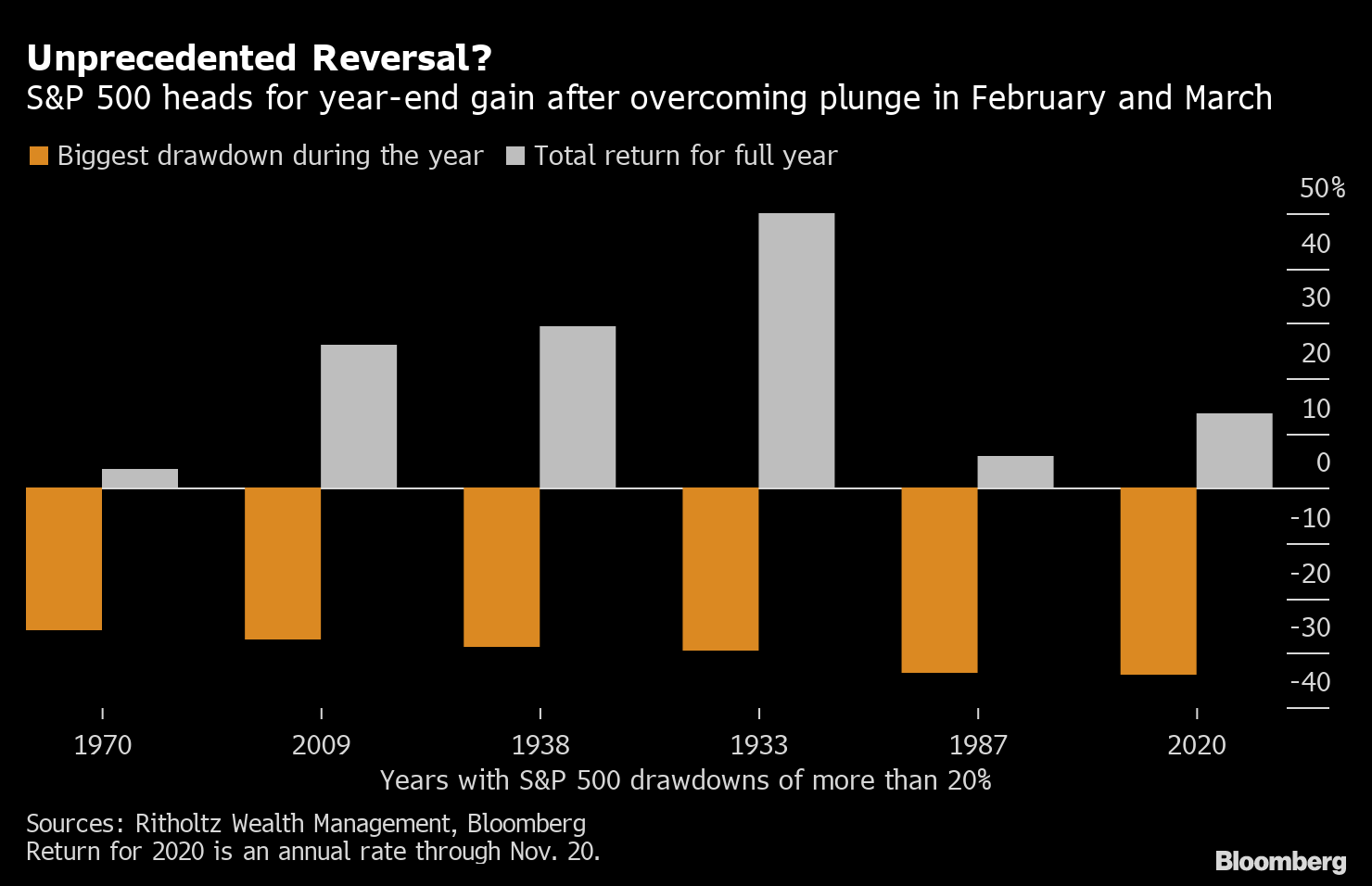

Unprecedented reversal?

S&P 500 Targets Year-End Gains After Overcoming Slump in February and March

Sources: Ritholtz Wealth Management, Bloomberg

Chris Zakarelli, CIO of the Independent Advisor Alliance, said Yeren’s nomination was “perceived as a market-friendly selection.” “At the very least, we probably have a good relationship with FRB Chairman Powell,” he said.

The NASDAQ 100 index is almost unchanged. The Russell 2000 index rose nearly 2%, increasing its monthly growth rate to about 18%. Regarding the new corona virus, the majority of people who received the vaccine from the University of Oxford and Astra ZenecaIt was shown to be effective in preventing infections and shares of cruise ship operators and airlines were bought.

In the currency market, the dollar has risen against most of the top 10 currencies. Comprehensive US Purchasing Managers Index Published by IHS Markit (Preliminary PMI figures) were higher than expected, indicating that US business activity has expanded at the fastest pace since March 2015. The euro and yen did not perform as well as other currencies important.

The Bloomberg Dollar Spot Index, which shows the movement of the dollar against the top 10 currencies, rose 0.2%. At one point, it hit a low for the first time in about two and a half years, but started to climb after the PMI announcement. The dollar is up 0.7% against the yen to $ 1 = 104.54 yen. The euro is down 0.1% against the dollar to 1 euro = $ 1.1841.

The New York crude oil futures market continues to grow. “I expect” vaccinations in the United States to begin on December 12, the director of the Trump administration’s “Operation Warp Speed” said on weekends.The statements have improved the outlook for fuel demand.

The January contract for West Texas Intermediate (WTI) futures on the New York Stock Exchange (NYMEX) ends at $ 43.06 per barrel, an increase of 64 cents (1.5%). The January contract for North Sea Brent in London ICE was up $ 1.10 (2.5%) to $ 46.06. At one point, it hit the highest price since March.

The spot market for gold has retreated and is the lowest price in about 4 months Spreading optimism about the new coronavirus vaccine and growing the US economy.Demand for gold as a haven declined as signs of momentum increased.

Gold spot prices were down 1.8% to $ 1,387.60 an ounce at 2:27 pm New York time. The February contract for gold futures on the New York Commodities Exchange (COMEX) ended at $ 1,844.10, down 1.8%.

Original title:US Stocks Rise After Rotation Reopens; Gold drops: markets wrap (抜 粋)

The dollar recovers from its two-year low; Yen, euro fall: inside the G-10 (抜 粋)

Brent Oil peaks in eight months with vaccine hopes in weeks (抜 粋)

Gold Extends Vaccine Fall, Signs of Improving US Economy (抜 粋)

(Add comments from market participants and update the market price)