[ad_1]

The US stock market fell on the 21st. Although the prospects for additional economic measures were bleak and the investigative reports on suspect funds from global banks were disgusting, sales preceded, but large-scale high-tech stocks returned and market as a whole was reluctant to fall. US dollars and bonds are on the rise.

|

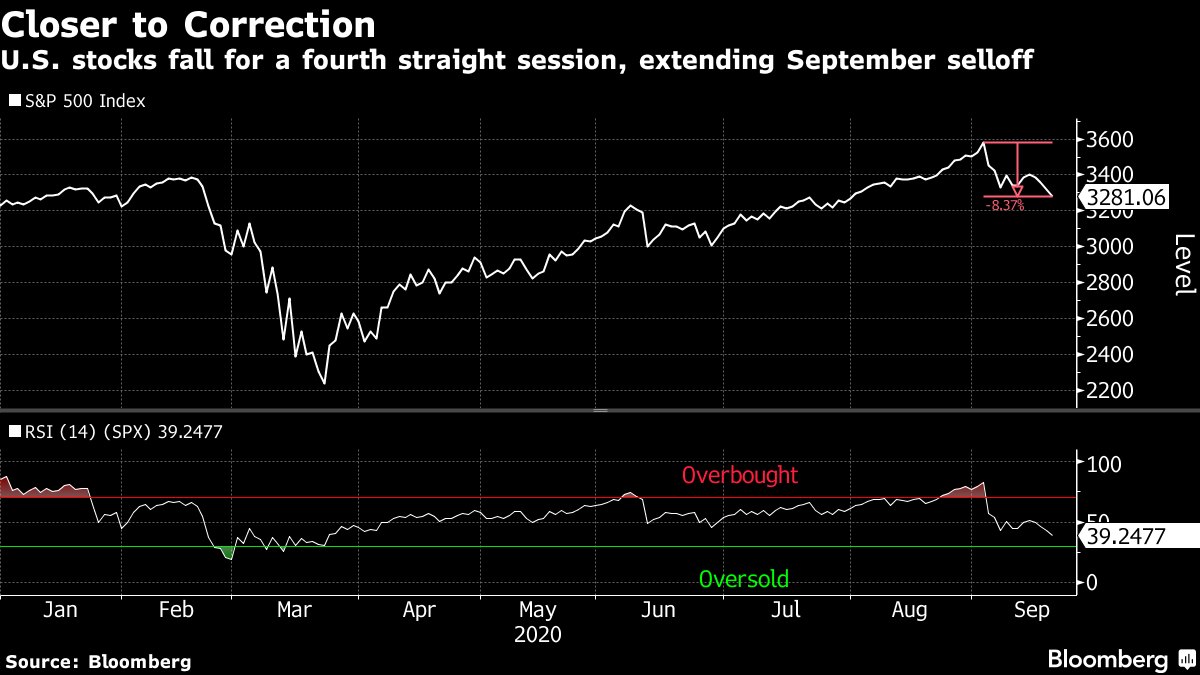

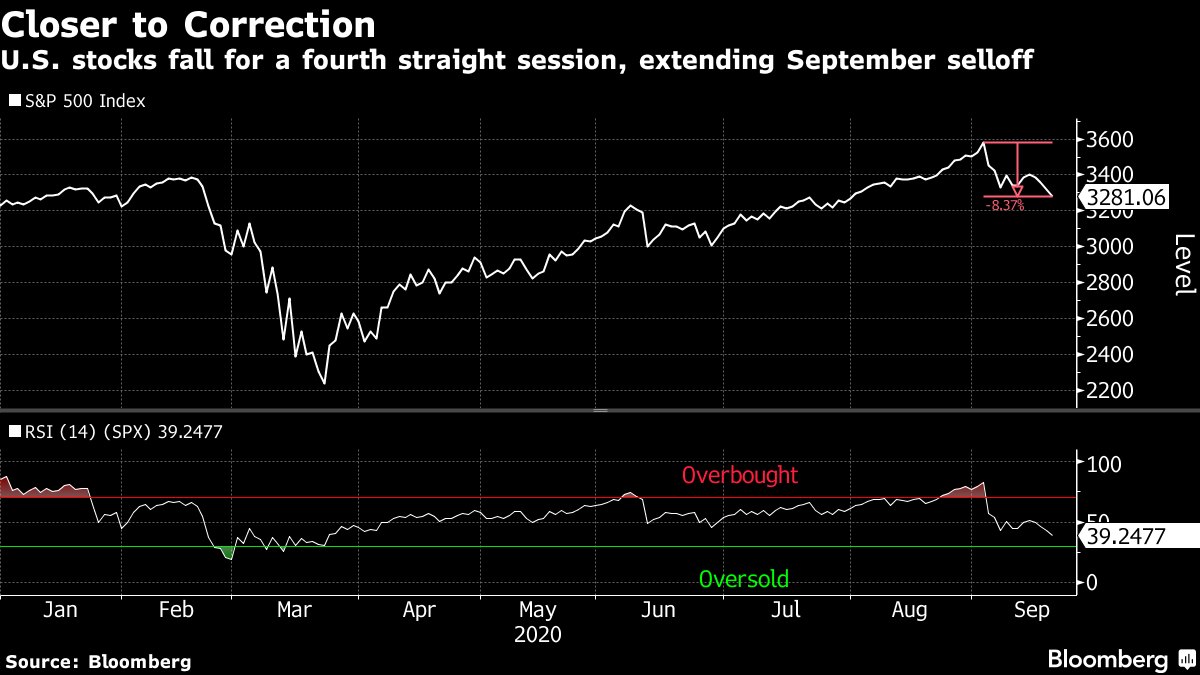

The S&P 500 stock index has fallen for four business days in a row, the lowest price in nearly two months. However, after approaching the level of entering the tightening phase, it was reluctant to go down and left the low price range of the day. The NASDAQ 100 index rose slightly. On the other hand, the values of materials, industry and financial have fallen. JP Morgan Chase, Bank of America and Citi Group fell more than 2%. Travel-related stocks such as Carnival and American Airlines Group are also cheap due to concerns that the spread of the new Crown will strengthen lockdown measures.

The S&P 500 class ended at 3,281.06, 1.2% less than the previous business day. The 30-share average of Dow Industrial closed at $ 27,147.70, down $ 509.72 (1.8%). The Nasdak Comprehensive Index is down 0.1%. At 4:33 pm New York time, the yield on 10-year US bonds fell 3 basis points (bps, 1 bps = 0.01%) to 0.67%.

The Democratic Party and the Republican Party clash over the successor to US Supreme Court Justice Ginsburg, who died on the 18th. The prospect of additional economic measures passed by Congress has become even darker.

The International Federation of Investigative and Press Journalists (ICIJ) is new the day beforeGlobal banks “have continued to benefit from powerful and dangerous players” after being sanctioned by US authorities for the past two decades, according to the investigative report. In some cases, the stock market was disgusted by this and expanded the rate of decline.

“There may be concerns about a new wave of lockdowns and political risks in America are increasing,” said Jeffrey Kleintop, chief global investment strategist at Charles Schwab. “There is concern that new fines will be imposed on financial services institutions,” he said, adding that earnings forecasts could worsen.

In the currency market, the dollar index has risen sharply for the first time in three months. The fall in US stocks has strengthened demand for escape.

The Bloomberg Dollar Spot Index, which shows the movement of the dollar against the top 10 currencies, rose 0.6%. The dollar is up 0.1% against the yen to $ 1 = 104.69 yen. 1 euro = 1.1768 dollars, 0.6% more against the euro.

The New York crude oil futures market has fallen sharply for the first time in about two weeks. The fall in US stocks weighed on him. Concerns about increased supply have increased as Libya’s crude oil exports are expected to resume.

The October contract for West Texas Intermediate (WTI) futures on the New York Stock Exchange (NYMEX) fell $ 1.80 (4.4%) to $ 39.31 per barrel. The London ICE North Sea Brent contract in November fell $ 1.71 (4%) to $ 41.44.

Spot gold prices have fallen. At one point, it fell 3.5% to 1 ounce = $ 1,882.51 and $ 1,900, the steepest drop in about five weeks. The rise in the dollar index has reduced the demand for products in general. At 3:20 p.m. New York time, it is down 2.1% to $ 1,910.69. The New York gold futures market has also fallen. The December contract for gold futures on the New York Commodity Exchange (COMEX) fell $ 51.50 (2.6%) to $ 1,910.60 an ounce.

Original title:Stocks cut losses as tech rally infuriates bank defeat – markets close

The dollar rises the most in three months with Haven’s demand: within the G-10

Oil falls with wider market sell-off and signs of Libya reboot

Gold and silver join the liquidation of raw materials with the rebound of the dollar