[ad_1]

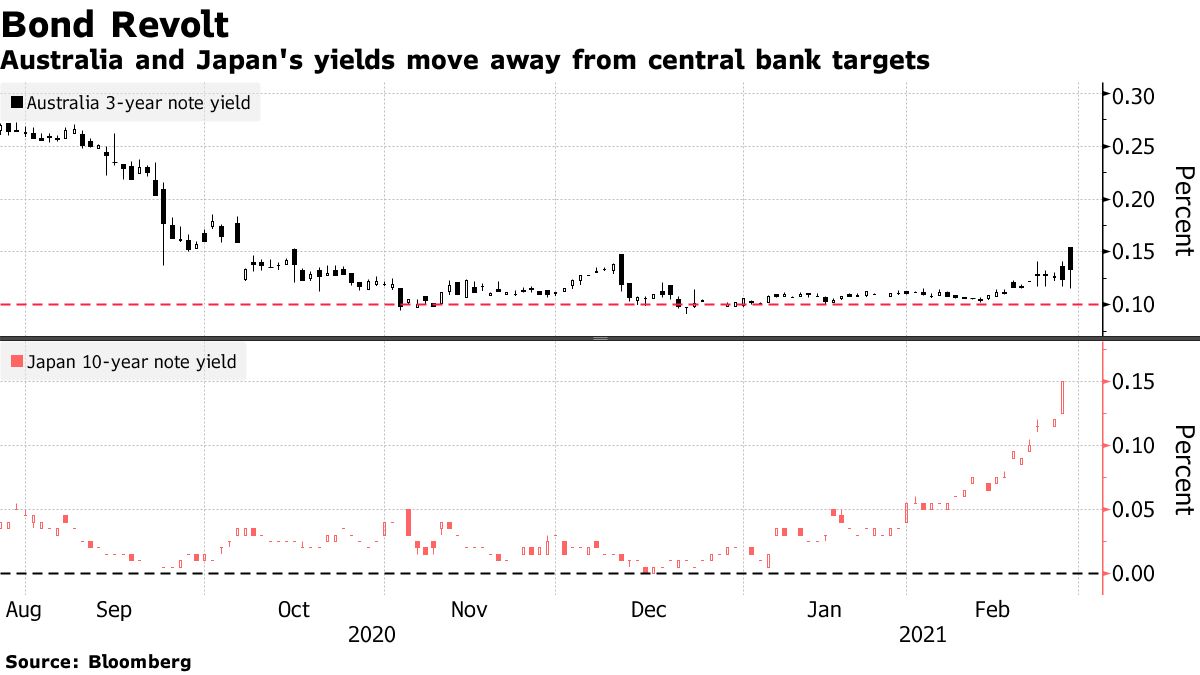

After the highest yields on US Treasuries in a year, central banks in Asia and Europe have moved to calm market turmoil.

The Reserve Bank of Australia (Central Bank) announced that it will buy 3-year government bonds worth A $ 3 billion (about 250 billion yen) in an unscheduled operation on the 26th. South Korea has announced a purchase plan for the next few months. Schnabel, director of the European Central Bank (ECB), said additional steps might be necessary if higher yields impede growth.

ECB Needs Further Action If Higher Yields Hurt Growth: Mr Schnabel

Bank of Japan Governor Haruhiko Kuroda said that long-term interest rates would not rise from the guidance target of around 0%, and that it was important to stabilize the entire yield curve at a low level.

Governor of the BOJ, long-term interest rates will not rise above 0%; low stability is important

The central bank’s response appears to have calmed bond investors, but the gap between traders and the central bank on the pace of economic recovery is unlikely to close. Officials are concerned that reflationary operations across the market will hamper the economic recovery from the coronavirus crisis.

Mizuho Bank’s Chief Economic and Strategic Officer Vishnu Barasan (Singapore) said: “Now we have to slow down the reflation. The central bank is fighting a sharp rise in yields. The central bank’s credibility is also at stake. Policies, you have to act when the market seems to be out of control. “

The yield on Australian 3-year bonds, which the central bank has decided to buy, has stabilized and the yield on US 10-year bonds, which had reached 1.61% on the 25th of US time, has also fallen . After Schnabel said, the yield on German 30-year bonds fell 6 basis points (bps, 1 bps = 0.01%) to 0.19%.

Bond Market Snapshot

- 10-year Treasury bonds fall 4 bp to 1.48%

- Australian 3-year bonds, 1bp minus 0.12%

- 30-year German government bond, 6bps down 0.19%

Original title:

Central banks fight bond failure, calming investors (抜 粋)