[ad_1]

The Bank of England (Central Bank of England) clearly suggested on the 17th that it will consider interest rates negative. Respond to unusually uncertain times in the economy.

The Monetary Policy Commission (MPC), led by Governor Andrew Bailey, has unanimously decided to keep the policy interest rate at 0.1% and to keep the bond purchase program at £ 745bn. At the same time, it also announced that it will start a “systematic adjustment” with the British Strength Regulatory Organization (PRA) within the year on how to introduce negative interest rates.

According to the meeting’s agenda, “If the outlook for inflation and production at some point in this period of low neutral interest rates shows the validity of negative interest rates, the Central and British Banks will consider how they can be introduced effectively.” MPC was briefed on the plan to do so. “

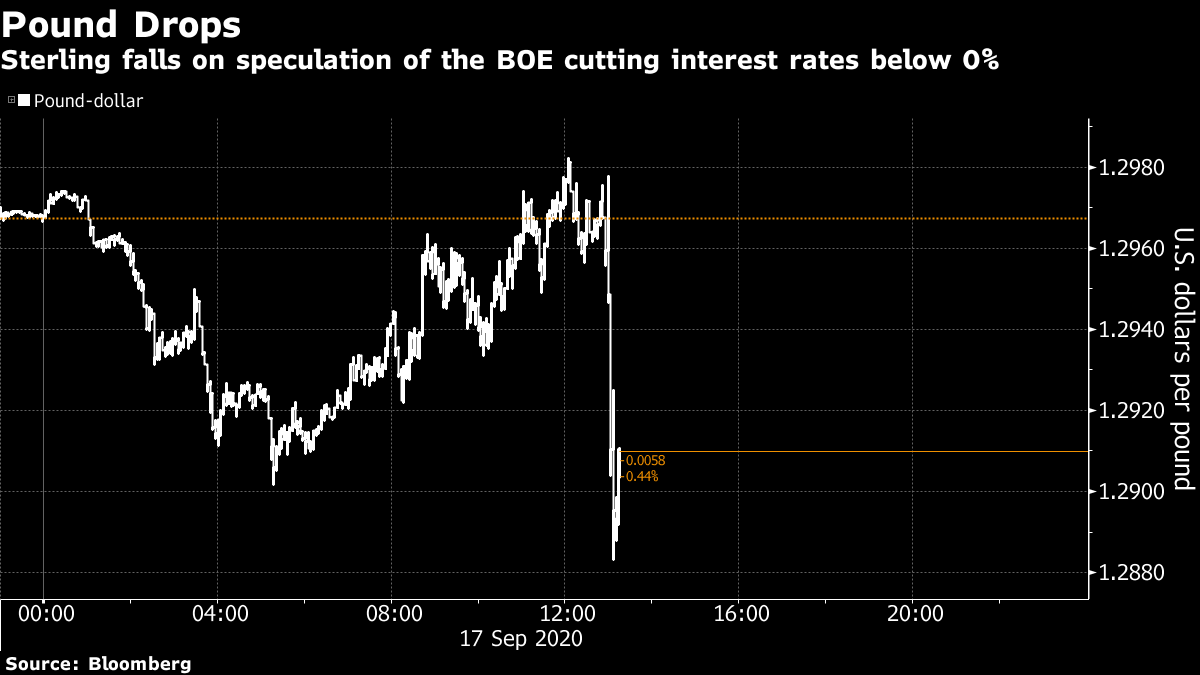

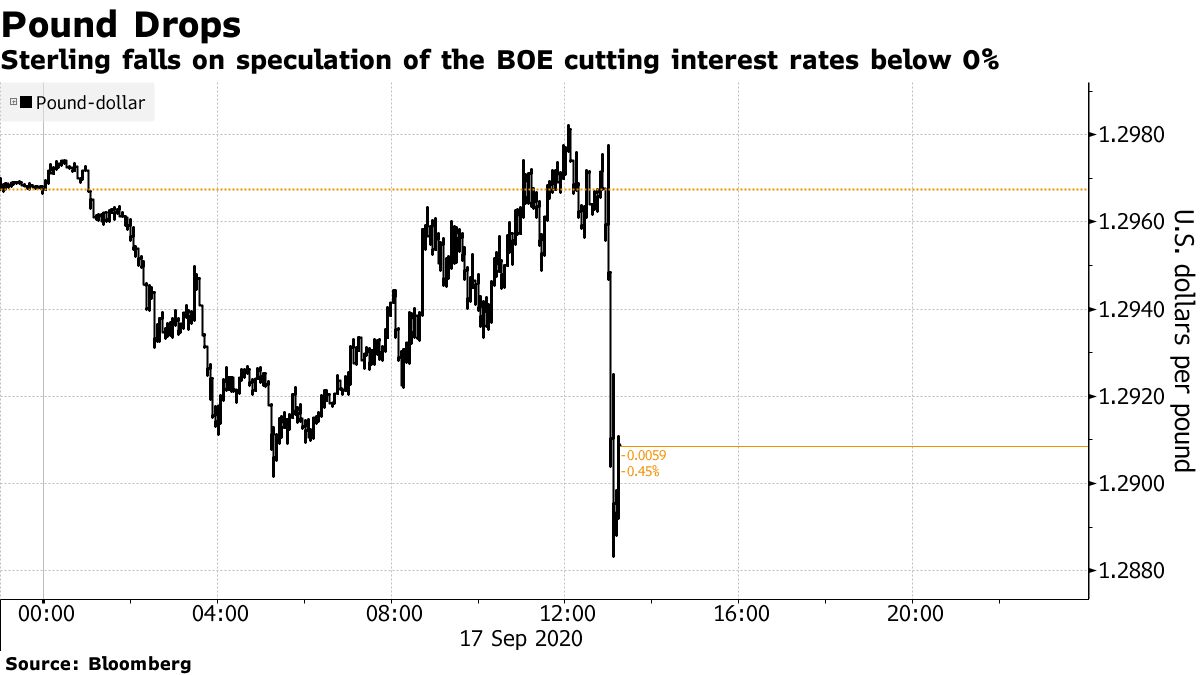

Officials have said they are verifying that negative interest rates are reasonable, but have indicated that they will prepare more for the introduction. The pound fell 0.5% to $ 1.2905 at 12:34 p.m. London time.

The agenda for the August meeting noted that negative interest rates could negatively affect the UK financial system, but the prospect of further relaxation has strengthened due to concerns about the re-expansion of the novel coronavirus infection and the rise of unemployment. .. The possibility of not being able to conclude a trade agreement before the end of the transition period to leave the European Union (EU) is also a worrying factor.

Officials noted that while recent data was a bit stronger than expected, there is a “risk that high levels of unemployment will last longer than expected.” However, total national production (GDP) for July-September (third quarter) is expected to decline 7% compared to the end of 2019, and the forecast has been revised up from the 8.6% decrease in August. .

“We are ready to monitor the situation and adjust our policies to meet our responsibilities,” the MPC said. Before the policy announcement, economists had expected asset purchases to rise by £ 50bn in November.

Original title:BOE steps up negative rate talks amid uncertain outlook (1) 、BOE increases negative rates work as threats to the economy multiply (抜 粋)