[ad_1]

Bitcoin, a virtual currency, has risen nearly 200% since the beginning of the year and topped $ 20,000 for the first time on the 16th, but an even more jaw-dropping event has appeared this week showing excitement for the virtual currency.

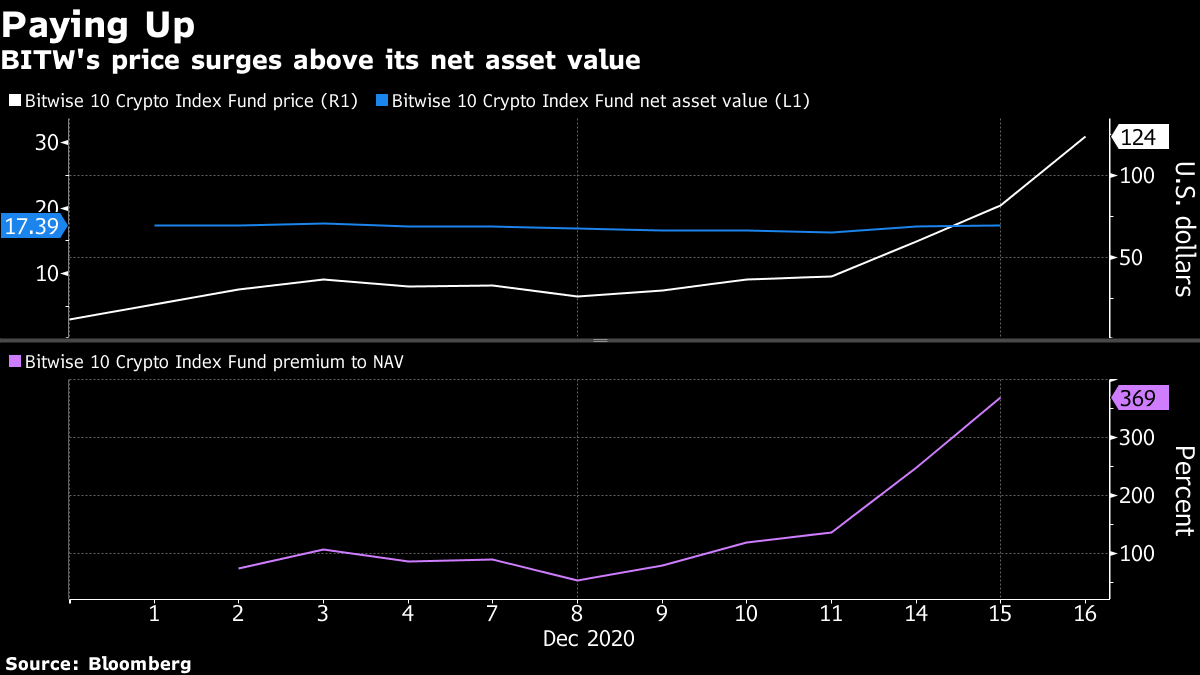

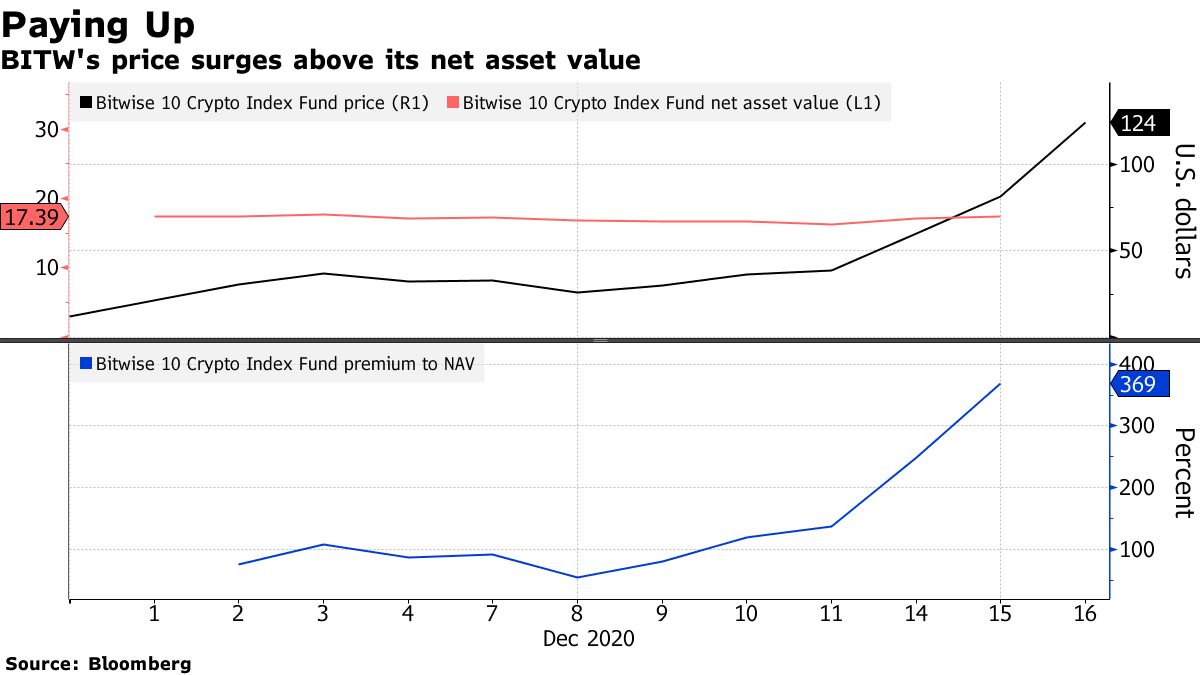

The price of the small virtual asset fund “Bitwise 10 Crypto Index Fund” exceeded the value of Bitcoin and Ether by 369%. Big investors like hedge funds and family offices, along with individual investors, rushed to the fund, which is cheaper than buying virtual currency, and pushed prices up.

As in previous developments in Bitcoin, this phenomenon is the result of investors who were afraid of missing the rise in prices and bought what they could call virtual currency. The new fund, which is pegged to the top 10 virtual currencies and can be easily traded by securities companies online, has terms that provide incredible premiums.

Kyle Samani, Co-Founder and Managing Partner of Multicoin Capital, said: “People who are starting to invest in cryptocurrencies do not know Bitcoin and want to invest in well designed indices. I do not think this premium is reasonable, I just do not understand what I am buying” .

Bitwise funds have risen 340% since they opened trading on the 9th. Since the price increase of Bitcoin and Ether greatly exceeded the rate of increase during the same period, the price of the fund and the value of the asset underlying diverged.

Since the virtual currency listed investment trust (ETF) is not approved by the regulator, there is no middleman to conduct arbitrage transactions. Repayment is not allowed and, as with fixed-equity investment trusts, the number of traded units is fixed, so the assets held can be significantly cheaper or more expensive.

“It doesn’t make sense because there’s only a certain number of enthusiasm,” said James Seifert of Bloomberg Intelligence. “There is no reason to pay such a premium.”

Original title:

Trading 369% premium, the new crypto fund amazes even bulls (1) (抜 粋)