[ad_1]

On the crude oil futures market on 5, North Sea Brent, which is listed on ICE Futures Europe, added $ 30 a barrel since April 15.

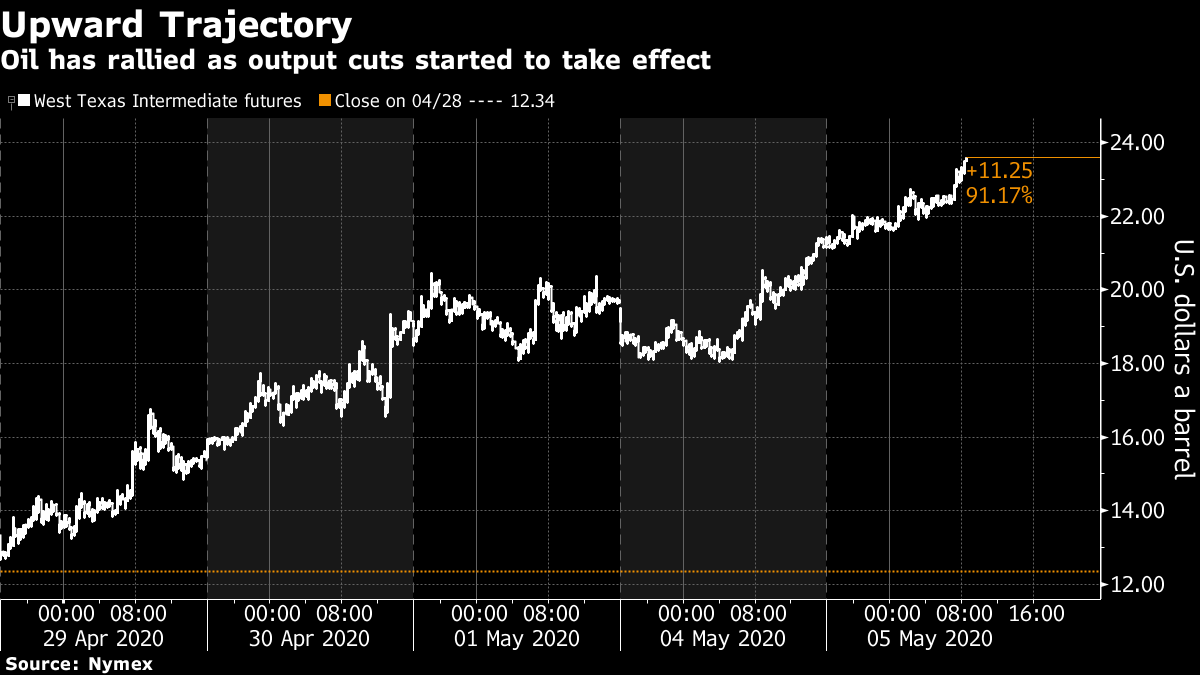

Contract The June futures contract for the New York Stock Exchange (NYMEX) West Texas Intermediate (WTI) temporarily increased by more than 20% from the previous day. Genscape reported on April 4 that weekly crude inventories in Cushing, Oklahoma, the WTI crude delivery site, increased to 1.8 million barrels per week. If official statistics confirm this on the 6th, it will be the smallest increase after mid-March.

Short-term WTI crude oil product traded at around $ 10 last week, but the price has more than doubled as production restrictions have been in place. While the Organization of the Petroleum Exporting Countries (OPEC) and the major oil-producing countries that maintain it, promise total cuts of 9.7 million barrels per day, US oil giants ExxonMobil, Chevron and ConocoPhillips will produce daily by the end of June. He plans to reduce production by 660,000 barrels.

Oil consumption has declined due to the spread of the new coronavirus infection, but there are also early signs that it has bottomed in some markets. The President of the United States, Trump, who saw this, tweeted yesterday that demand has started to move again and that crude prices have risen brilliantly.

Demand is still far below supply, and while it looks like it will take some time before supply declines are eliminated, Norwegian bank DNB believes the rebalancing is near. “A reduction in production other than OPEC Plus is currently accelerating,” said Helge Andre Martinsen, an analyst at the bank. We hope this changes. “

At 9:42 am New York time, on June 5, WTI crude oil was 18% higher at $ 24 in June. Brent’s contract in June was 12% higher at $ 30.46.

Original title:

Brent Crude Tops $ 30 a barrel for the first time since April 15 (extract)