[ad_1]

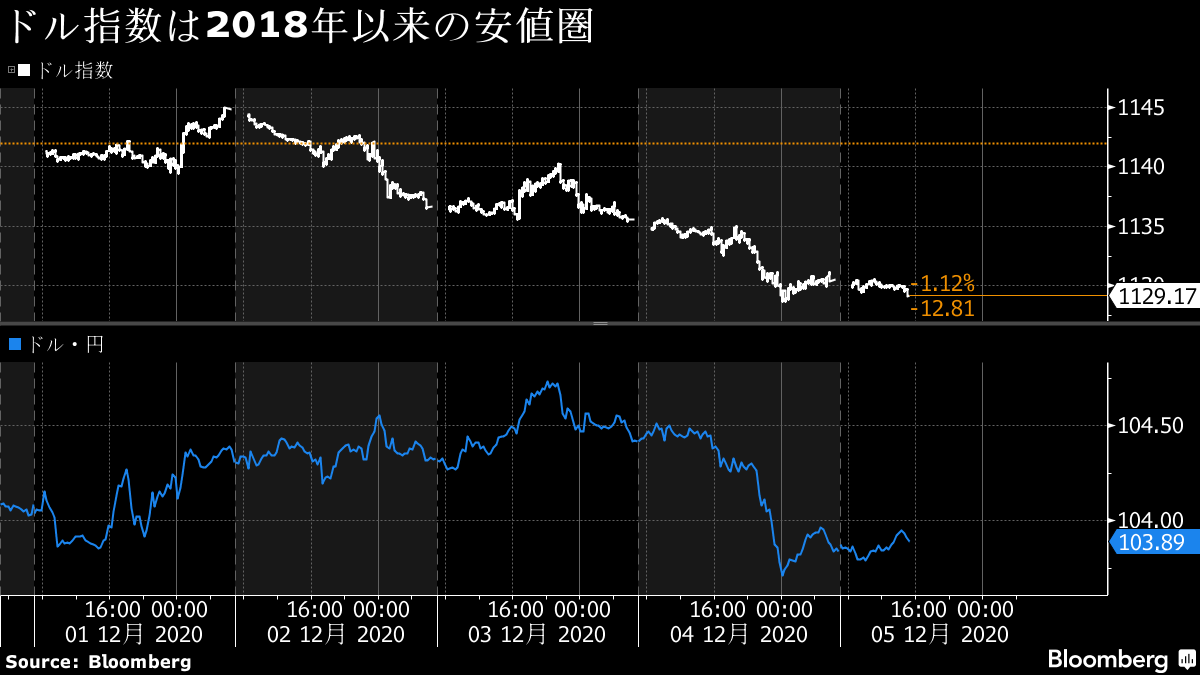

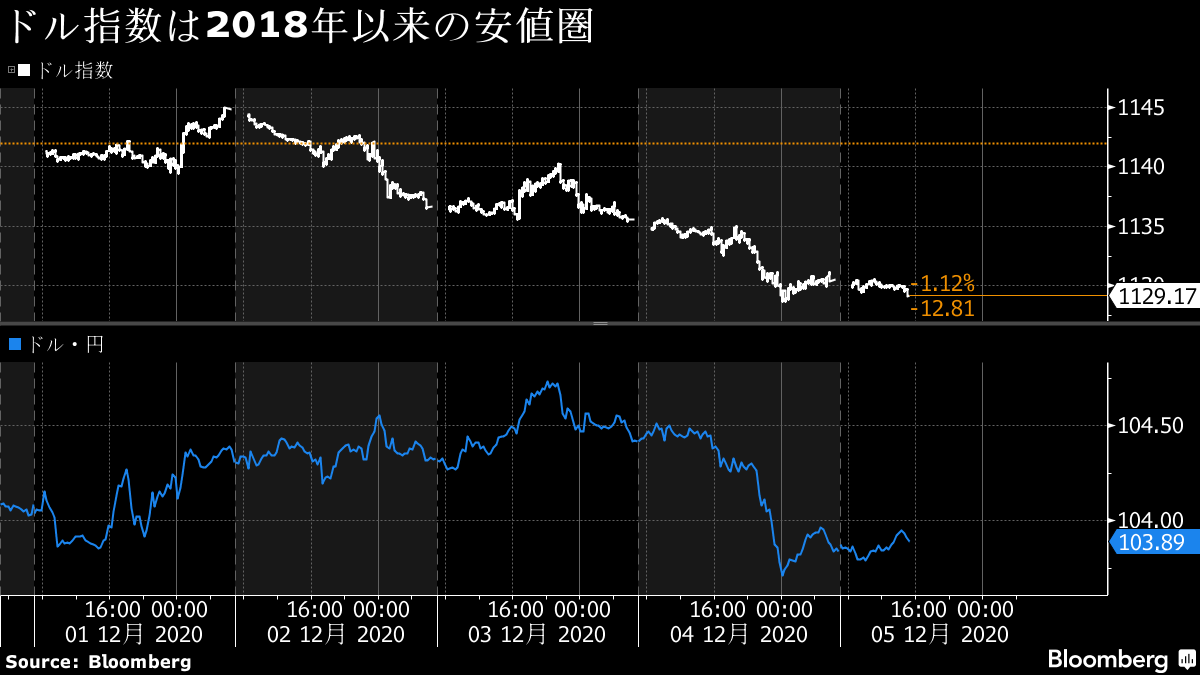

The dollar / yen exchange rate on the Tokyo foreign exchange market is small in the second half of 103 yen per dollar. Risk appetite against the backdrop of expectations of additional US economic measures and the depreciation of the dollar due to falling US interest rates slowed. As Japanese stocks, which had been in a downtrend, rallied in the afternoon, sales of the yen rose slightly, centered on the cross yen (the exchange rate of non-dollar currencies against the yen), but on Overall, the wait-and-see attitude was strong ahead of the US employment statistics.

|

View of market participants

Kyosuke Suzuki, General Manager, Foreign Exchange Fund Sales Department, Society General Bank

- I feel like I am waiting for the employment statistics because there are no clues. However, it is a sore point if the employment statistics will be a moving event.

- Although it will be slow next week, it seems that the dollar will continue to weaken, but on the other hand, with the euro chasing a high price, it seems that the authorities will react to the strength of the euro or the ECB meeting will be on alert.

- It is easy to make adjustments like buying back the dollar and correcting the appreciation of the euro, but even if that happens, it is difficult for the dollar and the yen to move, and there is a high possibility that development will continue at 104 yen.

Junichi Ishikawa, Senior Currency Strategist, IG Securities

- The US employment statistics are ISM (American Supply Management Association)The services index employment index was strong, so it is likely to exceed market expectations.

- In that case, the stock price rises, the US interest rate rises, and the typical risk-friendly market is likely to occur.

- If it falls below market expectations, it is simply a factor that reduces US interest rates, so the dollar / yen is likely to try to fall by increasing pressure on the dollar to weaken. It becomes a double whammy of adjusting share prices and lowering interest rates, the falling rate of the dollar and the yen will expand due to the appreciation of the yen and the depreciation of the dollar.

Hiroshi Kurihara, Chief US Economist, Office of Economic Research, Mitsubishi UFJ Bank (based in New York)

- The issue of US financial measures has the aspect of risk of dollar depreciation and dollar sale due to financial expansion, which tends to lead to dollar depreciation, however, it does not appear that the dollar is depreciating steadily before US employment statistics.

- Overall, the US employment statistics are expected to decline due to the spread of corona infection, so a stronger result will be more responsive.

background

- According to US employment statistics in November, the number of non-farm payrolls is expected to increase by 475,000 from the previous month, slowing the increase of 638,000 in October.

- US stock index futures for Asian time on day 4 remained positive. Japanese stocks are expanding to reduce the rate of decline in the afternoon, the average Nikkei share price is 58 yen lower than the previous day, TOPIX ends almost unchanged

- American RepublicanSenator McConnell said it was “reassuring” that the Democratic Party had opted for a smaller-scale economic plan than previously claimed. On the other hand, he does not suggest a compromise to reach an agreement.

- Modelna announced on day 3 that the new Corona vaccine candidate has the potential to provide sustained immunity. on the other hand,US Pfizer lowered its year-end vaccine shipment target due to sourcing issues