[ad_1]

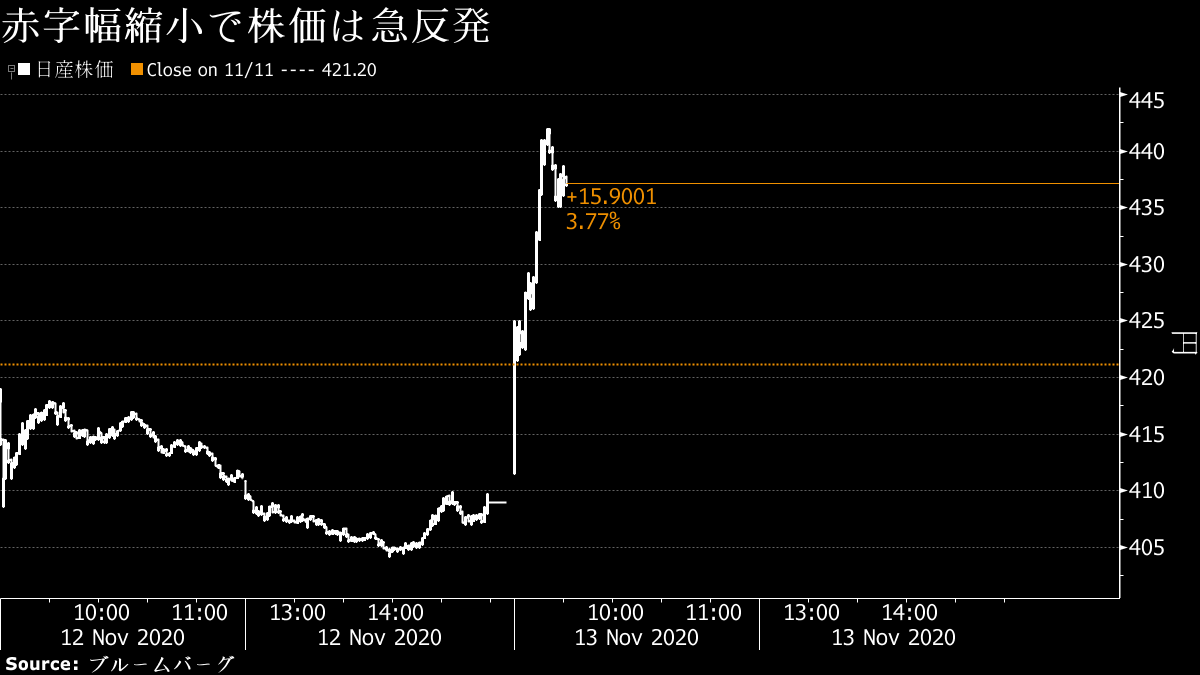

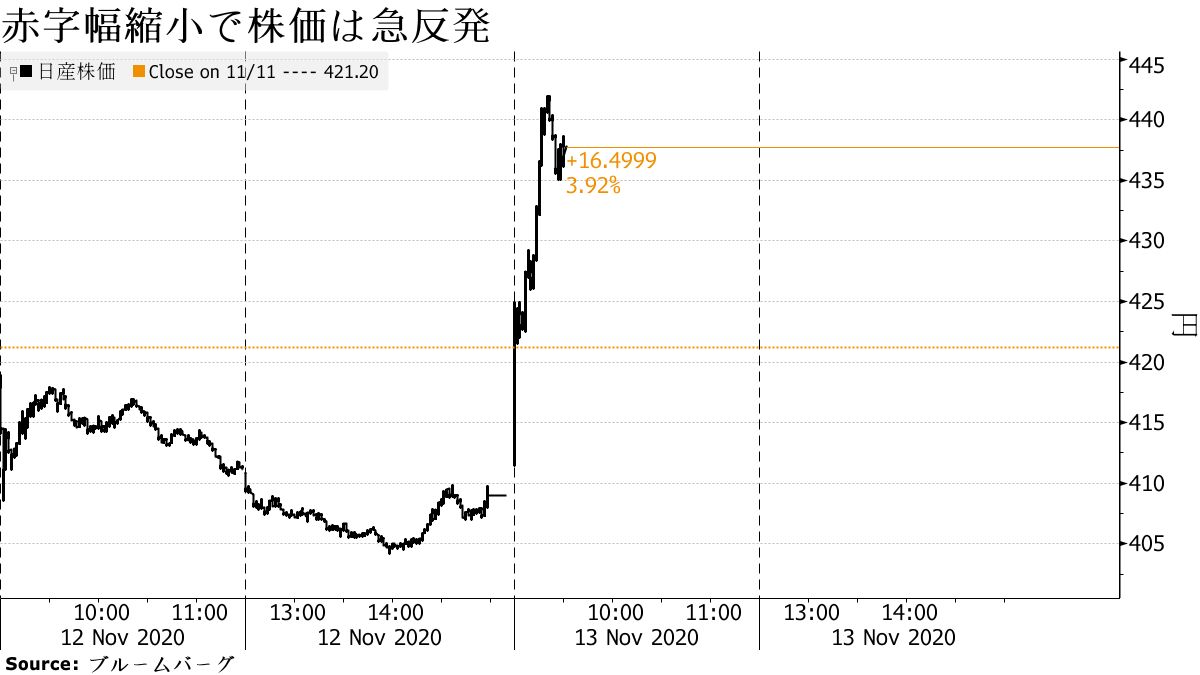

On the 13th, Nissan Motor’s share price rose 8.1% from the previous day to 442 yen, the highest rate of increase for the day since July 15. In the financial results for the July-September quarter announced by the company the previous day, it was welcomed that the operating loss had been significantly reduced from the previous quarter.

Yuji Yoshida, an analyst at Citi Group Securities, said in a report on the 12th that it was “good news for the company after a long time.”

From the January-March quarter onwards, the new “Rogue” sports-type multipurpose vehicle (SUV) (Japanese name: X-Trail), which was launched in North America in October, is expected to take effect, so the Earnings improvement before the launch of the new model is positive. He said he could “catch”. He noted that the forecast for operating loss of 181.2 billion yen in the second half (October-March period) is a “conservative impression” based on the second quarter results.

Makoto Uchida, Nissan president and CEO, said at an online press conference on the 12th that Rogue was “popular” and actively invested in advertising and other expenses in line with the introduction of new cars in the future. He showed his thoughts on the go.

Due to the increase in investment accompanying the introduction of new cars, the expected level of earnings in the second half “I think there is still a place where it seems a little conservative when viewed numerically,” he said.

Toshihide Kinoshita, an analyst at SMBC Nikko Securities, also reported that Nissan’s operating loss for the July-September period was “a positive surprise, even excluding the single factor of 19.9 billion yen.” He noted that in the second half of the year “there are doubts” about whether the marketing costs indicated by the company will be an important factor in the fall in profits.

Nissan’s operating loss for the July-September period was 4.8 billion yen, significantly higher than the deficit of 153.9 billion yen for the April-June period.Improvement. It exceeded the deficit of 148 billion yen, which is the average operating profit and loss forecast of seven analysts compiled by Bloomberg before the financial results announcement. It has announced that it will reduce the operating loss for the current fiscal year (ending March 2021) from the forecast of 340 billion yen and the previous forecast (deficit of 470 billion yen).