[ad_1]

Every morning we deliver world news that you want to keep track of before you start your day. Click here to subscribe to the Bloomberg newsletter.

The US stock market fell on the 12th. US bonds have risen. With the re-expansion of the new coronavirus infection, there is a growing sense of caution that strict behavioral restrictions will be introduced. Although no additional economic measures are taken, the delay in economic recovery is being noticed.

|

The S&P 500 stock index temporarily fell 1.5%. New York City is bracing for the possibility of school closings under the new Crown, and Chicago has advised residents to refrain from going out on non-essential duties such as work. Under these circumstances, the administration TrumpThe company is walking away from negotiations on additional economic measures, people familiar with the matter said. He is said to have entrusted the resumption of discussions with the Speaker of the House of Representatives Peroshi to parliament. All major indices in the S&P 500 industry have fallen. The declines in energy companies, product-related stocks, and bank stocks were notable.

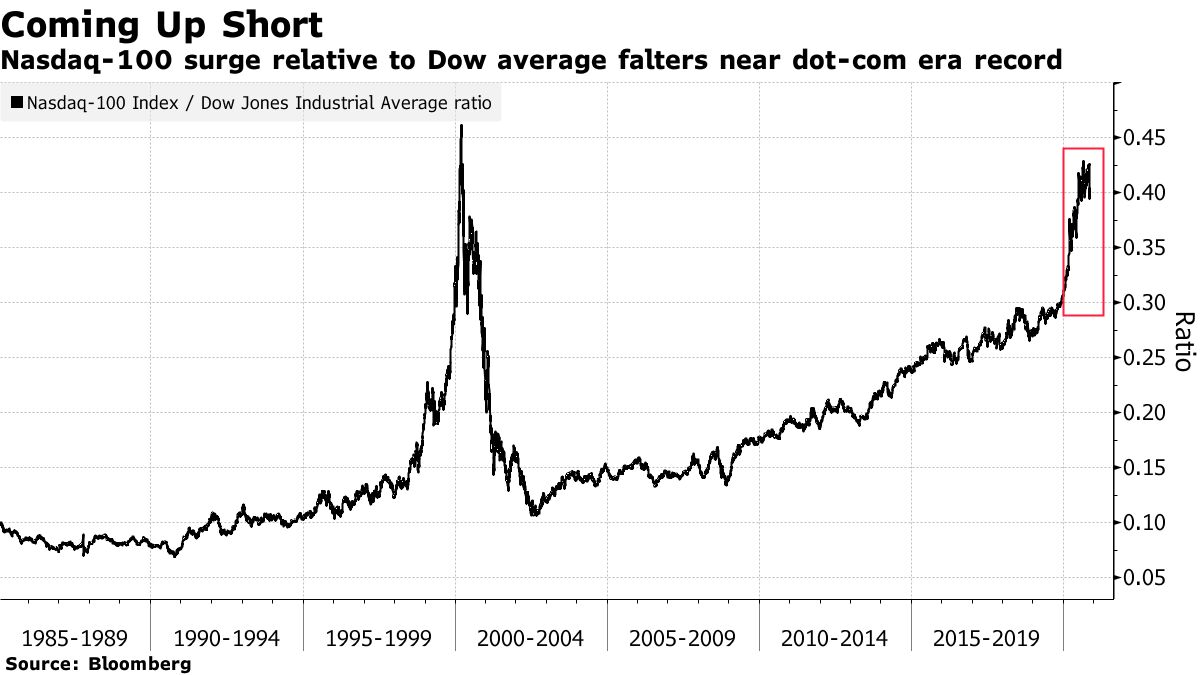

S&P 500 species are 3537.01, 1% less than the day before. The 30-share average of Dow Industrial fell $ 317.46 (1.1%) to $ 29,080.17. The Nasdak Comprehensive Index fell 0.7%. At 4:59 pm New York time, US 10-year bond yields fell 9 basis points (bp, 1 bp = 0.01%) to 0.88%.

The main central banks of the worldThe first three warned that the recent development of a new corona vaccine was not enough to solve the financial problems posed by the crown. According to data from the COVID Tracking Project, the number of patients infected and hospitalized with the new Corona has increased in 49 states in the United States compared to a week ago. The death toll is increasing in 35 states.

“The market is getting a bit tired as we focus on Corona’s unsettling short-term trends and the potential for severe conditions down the road,” said Youssef Abbasi, Stone X’s global market strategist.

In the currency market, the dollar rises with the yen and the Swiss franc. The record number of krone infections in the United States and the introduction of new restrictions in some areas supported the currency in flight. The Bloomberg Dollar Spot Index, which shows the movement of the dollar against the top 10 currencies, rose 0.1%. The dollar is down 0.3% against the yen, and $ 1 = 105.13 yen. The euro is up 0.3% against the dollar to 1 euro = $ 1.1806.

The New York crude oil futures market is down. He was fed up with the unexpected increase in rice inventory.Powell, chairman of the Federal Reserve Board (FRB), said the economy would be in a tough spot for months to come, citing positive news about vaccines. The rate of increase, which had expanded to 1.8% at one point, was lost.

The December contract for West Texas Intermediate (WTI) futures on the New York Commercial Exchange (NYMEX) ends at $ 41.12 per barrel, which is 33 cents (0.8%) cheaper. London ICE’s January North Sea Brent contract is down 27 cents to $ 43.53.

New York gold futures rebound. Pending the results of new vaccine trials for the new coronavirus, the dollar has been volatile due to the record spread of infections and increased deaths in the United States.

The December gold futures contract on the New York Commodity Exchange (COMEX) ended at $ 1,873.30, an increase of $ 11.70 (0.6%). Gold was up 0.6% at $ 1,877.52 at 2:03 pm New York time.

Original title:Stocks plummet from lockdown angst amid stimulus limbo: markets close (抜 粋)

Shelters Rise As Virus Rises, US Stimulus Stops: Within G-10 (抜 粋)

Oil falls after US stocks rise, Fed warns of Covid risk (抜 粋)

Gold gains as record cases of Covid in the US lift Haven Metal’s appeal (抜 粋)

(Update the market price and add comments, etc.)