[ad_1]

Fintech startups are threatening central banks and traditional banking territories, and financial tensions are rising globally.The last minute wait by local authorities for Ant Group’s largest public offering (IPO) was the most dramatic example of this.

Ant IPO cancellation is peculiar to ChinaNot only is it a clue to the national situation, but it also reflects the fact that supervisors are not keeping pace with innovation around the world.Warning bells have been sounded, such as Facebook’s original “Libra” virtual currency project and the collapse of German e-cards, and the need for a response is increasing.

Ant Group Headquarters in Hangzhou, Zhejiang Province

Photograph: Qilai Shen / Bloomberg

Karstens, CEO of the International Settlement Bank (BIS), mentioned these challenges this week. “The industrial revolution took a century to produce structural changes in the economy, but technological advances have made this happen in just a few years,” he said.

At the “Hong Kong Fintech Week” forum held on the 2nd, Mr. Karstens said: “Big technology was too small to be bothered, but a few years later it was too big to be ignored. Now it is too big.” I’ve reached a point where I can’t crush it. “

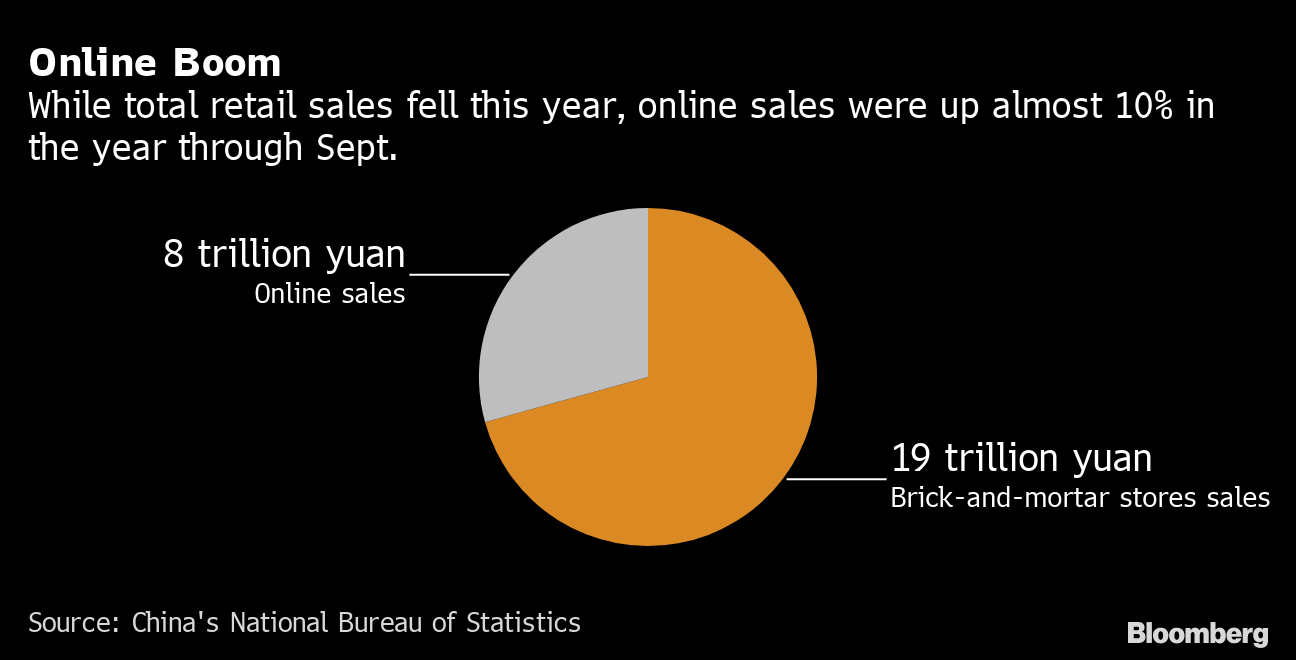

Boom online

While total retail sales fell this year, online sales were up nearly 10% in the year through September.

Source: National Bureau of Statistics of China

Digital payments and financial services are widespread in China and ubiquitous in everyday life. The office worker reads the QR code and pays for morning coffee and lunch. Approximately 30% of all retail purchases are now made online, and the “Red Pack” money distributed to family and friends during the Spring Festival (New Year’s holidays) is also settled digitally.

In fact, in China, the shift to cashless is making significant progress using private sector-led technologies such as Alipay (paid treasure) and Wechat Pay (paid with fine credit). Ant, which provides services from loans to payments using a huge digital user base, held the largest initial public offering in history at $ 35 billion this week, and China’s leadership in financial innovation. It was supposed to be an opportunity to show off.

Fintech’s expanding role has received high praise. The governor of the People’s Bank of China (Central Bank) mentioned the “efficiency” that fintech companies brought to the financial system. Meanwhile, BIS announcedResearch papers show how fintech companies can finance smaller businesses in times of economic pressure.

Governor of the People’s Bank of China

Photograph: Qilai Shen / Bloomberg

However, there are also challenges and risks that arise from independent payment providers and digital currency creators. The point is that it is beyond the control of the authorities, and not only China, but also countries are working together to respond.

Ultimately, clarifying regulations will not hamper Fintech’s expansion and may have a positive effect. “Regulations provide a certain degree of confidence,” said Knott, chairman of the Dutch Central Bank, a member of the Financial Stability Board (FSB).

But until regulators can keep pace with innovation, things like Ant’s IPO suspension and e-card misconduct are likely to happen again.

David Robbinger, a former Chinese US Treasury expert and now an analyst at TCW Group, said: “The lesson for investors is that financial regulators promote innovation and evade regulation. Finding the right balance with management is still a struggle. higher risk. ” “If it swings excessively in one direction, it will eventually come back,” he said.

Original title:

Ant’s canceled IPO in China highlights global fintech challenge (抜 粋)