[ad_1]

The US bond market, the world’s largest bond market,We will enter a week that will influence future development beyond the fierce battle to enter the White House.

With the president and the United States parliamentary elections approaching on November 3, there is no guarantee that the presidential winner and the party that will control parliament will be revealed that night. The next morning there will be more events that worry traders. The US Treasury plans to announce its quarterly bidding plan on the 4th and there is a risk of sudden performance fluctuations. There is disagreement among Wall Street traders on whether bond issuance will hit record levels or remain at current levels. The Federal Public Market Commission (FOMC) will decide the policy on the 5th. However, the policy is expected to remain unchanged and investor interest is low. The employment statistics for October will be released on the 6th.

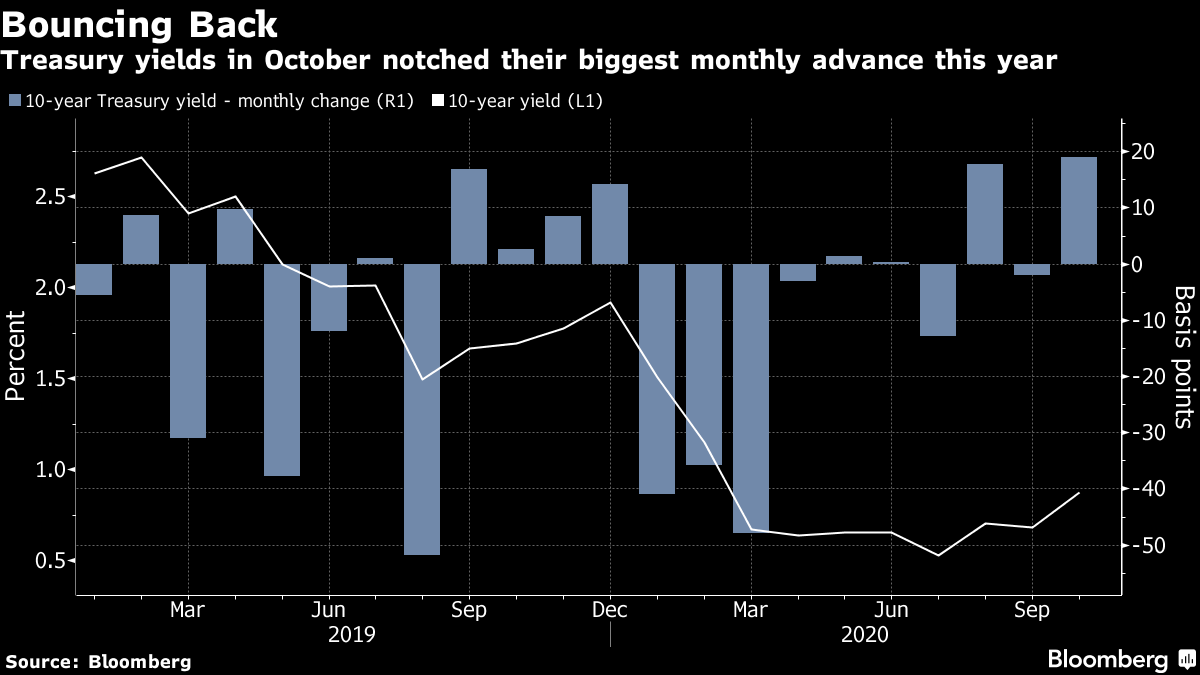

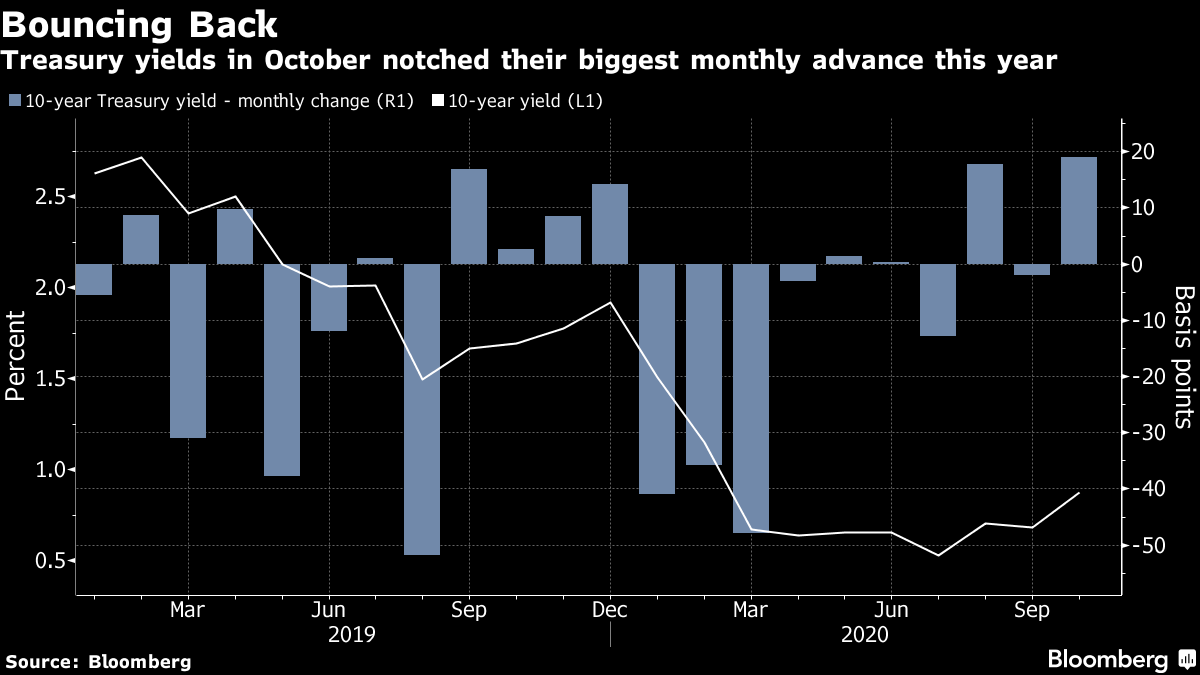

For the US bond market, which has had the best pace of performance since 2011We have an important period. Speculators who use leverage, such as hedge funds, to boost yields have raised the stakes that they anticipate a drop in bond futures to record levels, which could increase volatility. If expectations of large-scale economic measures wane in response to the election results, those bets will be forced to contract, likely to support the rise of the US bond market.

Wells Fargo interest rate strategist The Carrie Griffith said: “In addition to how much conflict the elections have created in the novel coronavirus pandemic, the government has issued a staggering number of bonds. Given that it has already been published, it is This week is likely to be the one with the greatest impact in recent years. ” “You can concentrate many things at the same time,” he added.

Election night

Former Vice President Byden, a Democratic candidate, becomes President Trump, polls showLeading, but if the Democratic Party will regain a majority seat in the SenateThe situation is unpredictable. According to Predequitit, the Democratic Party’s chances of winning the White House and the House of Representatives were 62% in early October, but more recently 52%.

Investors expect the Democratic Party’s overwhelming victory to pave the way for higher financial spending, with a 10-year bond yield reaching 0.87%, the highest level in four months, due to increased issuance. of government bonds.

Sustainable increases in long-term bond yields are likely to turn around some of the highest yields in the US bond market in the last decade. According to data from the Bloomberg Berkeleys index, the yield on US bonds in 2020 will increase by 7.9%.

Matthew Hornback, Global Head of Macro Strategy at Morgan Stanley, said: “Public opinion suggests that Mr. Byden is likely to win the presidential election, but is unsure of the whereabouts of the Senate election. Noted. If the winners of The presidential and parliamentary elections coincide, the US interest rate will be under the strongest upward pressure, and the 10-year bond yield is expected to reach 0.95% by the end of 2020.

Wildcard

Bond traders are paying close attention to the regular quarterly bidding plan announced by the Ministry of Finance at 8:30 am ET on the 4th (10:30 pm Japan time). If TD Securities, Citigroup, Natwest Markets, etc., which are expected to increase the size of the offerings, are as expected, it will be another opportunity for the long-term bond yields to increase. The Bank of Germany and Amherst Pierpont Securities expect a further significant increase.

On the other hand, the yield curve can flatten if there are no changes as expected, such as Berkeley’s, Jeffreys and Society General.

This week full of major events, the least stressful is the FOMC’s decision on the 5th, and most economists expect policy to remain unchanged. However, the Chairman of the Federal Reserve Board (FRB), Powell, may mention in an afternoon press conference what financial authorities could do to support the US economy in the wake of the pandemic. , and traders are calling for a bond buying program. We are paying the utmost attention to the authorities’ plans.

“If there is a surprise on the FOMC, it is a more lenient comment or action, but authorities are likely still waiting until December,” said Tony Rodriguez, director of bond strategy at Nubean Asset Management. Was.

Original title:

Bond traders face a dizzying week that is decisive for 2020 (抜 粋)

(We will update adding the forecast of each company regarding the quarterly regular tenders)